Space debris cleanup startups focus on reducing orbital congestion by removing defunct satellites and debris, enhancing safety for active space assets. Communications satellite operators emphasize deploying and maintaining satellites to provide global connectivity and broadband services. Explore how investments shape the future of space technology and sustainability.

Why it is important

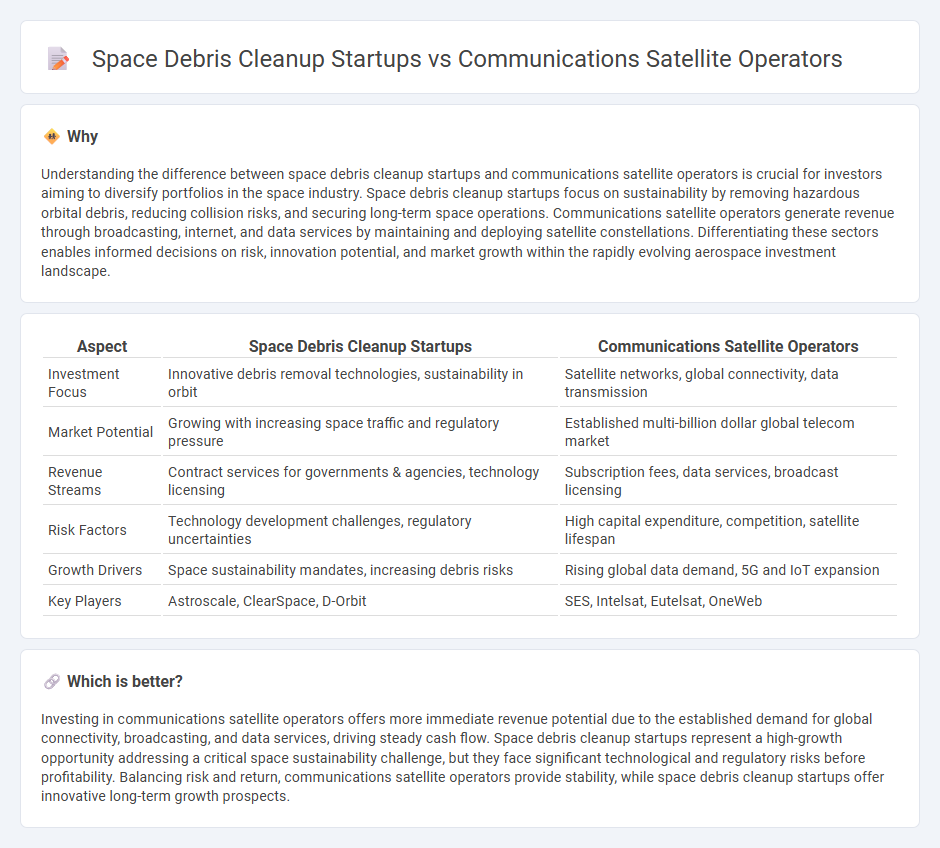

Understanding the difference between space debris cleanup startups and communications satellite operators is crucial for investors aiming to diversify portfolios in the space industry. Space debris cleanup startups focus on sustainability by removing hazardous orbital debris, reducing collision risks, and securing long-term space operations. Communications satellite operators generate revenue through broadcasting, internet, and data services by maintaining and deploying satellite constellations. Differentiating these sectors enables informed decisions on risk, innovation potential, and market growth within the rapidly evolving aerospace investment landscape.

Comparison Table

| Aspect | Space Debris Cleanup Startups | Communications Satellite Operators |

|---|---|---|

| Investment Focus | Innovative debris removal technologies, sustainability in orbit | Satellite networks, global connectivity, data transmission |

| Market Potential | Growing with increasing space traffic and regulatory pressure | Established multi-billion dollar global telecom market |

| Revenue Streams | Contract services for governments & agencies, technology licensing | Subscription fees, data services, broadcast licensing |

| Risk Factors | Technology development challenges, regulatory uncertainties | High capital expenditure, competition, satellite lifespan |

| Growth Drivers | Space sustainability mandates, increasing debris risks | Rising global data demand, 5G and IoT expansion |

| Key Players | Astroscale, ClearSpace, D-Orbit | SES, Intelsat, Eutelsat, OneWeb |

Which is better?

Investing in communications satellite operators offers more immediate revenue potential due to the established demand for global connectivity, broadcasting, and data services, driving steady cash flow. Space debris cleanup startups represent a high-growth opportunity addressing a critical space sustainability challenge, but they face significant technological and regulatory risks before profitability. Balancing risk and return, communications satellite operators provide stability, while space debris cleanup startups offer innovative long-term growth prospects.

Connection

Space debris cleanup startups play a crucial role in protecting the operations of communications satellite operators by reducing collision risks in Earth's orbit. Investment in these startups enhances the sustainability and longevity of satellite constellations used for global communications, directly impacting the reliability and efficiency of satellite services. Effective space debris management is becoming a vital factor for investors seeking long-term value in the rapidly expanding satellite communications industry.

Key Terms

Spectrum allocation

Communications satellite operators require prioritized spectrum allocation to maintain reliable data transmission and avoid signal interference, particularly as the number of active satellites increases. Space debris cleanup startups rely on specific frequency bands for remote sensing and control of debris removal technologies, necessitating careful coordination to prevent cross-spectrum conflicts. Explore how evolving spectrum policies impact both sectors and the future of space sustainability.

Orbital slots

Communications satellite operators rely heavily on securing and maintaining prime orbital slots to ensure optimal signal coverage and minimal interference for their satellites. Space debris cleanup startups actively develop technologies to clear congested orbital paths, aiming to preserve these valuable slots and prevent collisions that could disrupt satellite operations. Explore how the competition and cooperation between these sectors shape the future of orbital slot management.

Debris mitigation compliance

Communications satellite operators face increasing regulatory pressure to implement debris mitigation measures, including end-of-life disposal and collision avoidance protocols, to ensure operational sustainability in crowded orbits. Space debris cleanup startups leverage advanced technologies like robotic arms and nets to actively remove defunct satellites and debris fragments, complementing compliance efforts by directly reducing collision risks. Explore how compliance-driven innovations are shaping the future of orbital environment management.

Source and External Links

Top Companies in Satellite Communication - Intelsat (US) and ... - Key satellite communication operators include Intelsat (US), Viasat Inc. (US), Telesat (Canada), Starlink (US), and Globalstar Inc. (US), with services spanning broadcasting, broadband, and secure communications across various industries.

7 Influential Satellite Communication Service Providers To Keep an ... - Prominent satellite communication service providers include OneWeb, Eutelsat, and others offering GEO and LEO satellite services for global broadband, IoT connectivity, and coverage in remote areas.

List of communication satellite companies - Wikipedia - The global top 20 communication satellite companies include SES, Intelsat, EchoStar, Hughes Network Systems, Eutelsat, Telesat, and others from various countries, ranked by revenue and satellite fleet operations.

dowidth.com

dowidth.com