Luxury handbag investment offers high liquidity and portability, attracting collectors and fashion enthusiasts seeking unique appreciation opportunities, whereas real estate investment provides long-term asset appreciation, rental income, and tangible property ownership. Both asset classes present distinct risk profiles, market dynamics, and potential returns crucial for diversifying investment portfolios. Explore the advantages and challenges of luxury handbag versus real estate investments to optimize your financial strategy.

Why it is important

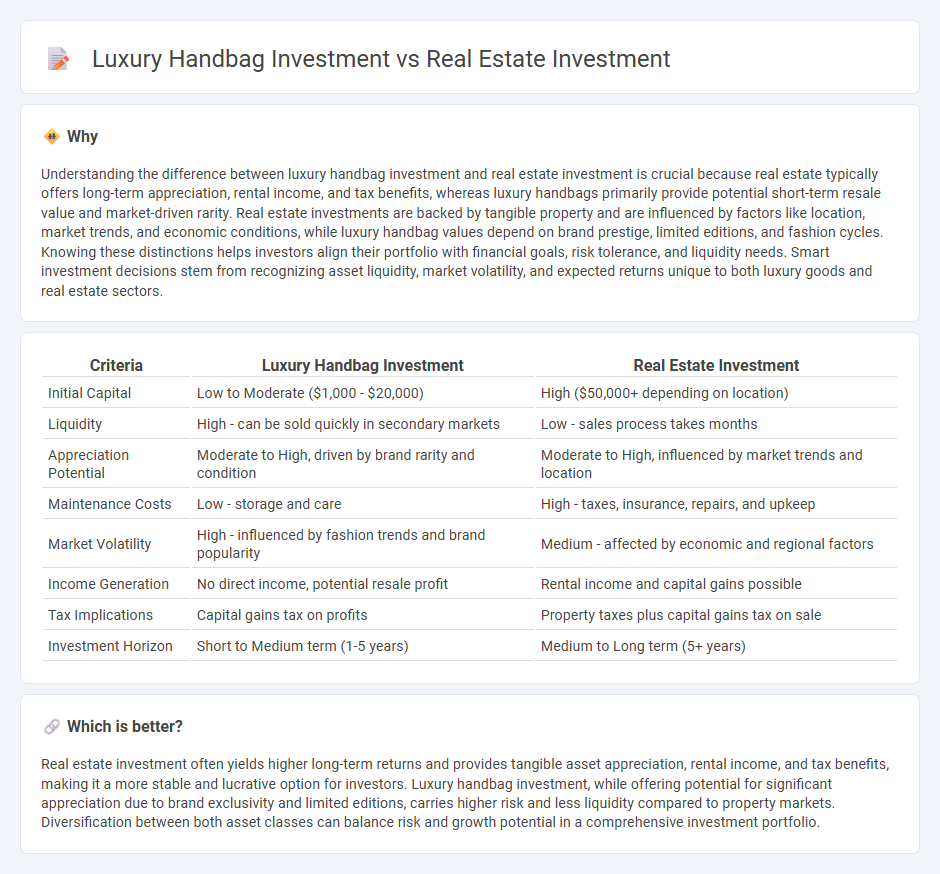

Understanding the difference between luxury handbag investment and real estate investment is crucial because real estate typically offers long-term appreciation, rental income, and tax benefits, whereas luxury handbags primarily provide potential short-term resale value and market-driven rarity. Real estate investments are backed by tangible property and are influenced by factors like location, market trends, and economic conditions, while luxury handbag values depend on brand prestige, limited editions, and fashion cycles. Knowing these distinctions helps investors align their portfolio with financial goals, risk tolerance, and liquidity needs. Smart investment decisions stem from recognizing asset liquidity, market volatility, and expected returns unique to both luxury goods and real estate sectors.

Comparison Table

| Criteria | Luxury Handbag Investment | Real Estate Investment |

|---|---|---|

| Initial Capital | Low to Moderate ($1,000 - $20,000) | High ($50,000+ depending on location) |

| Liquidity | High - can be sold quickly in secondary markets | Low - sales process takes months |

| Appreciation Potential | Moderate to High, driven by brand rarity and condition | Moderate to High, influenced by market trends and location |

| Maintenance Costs | Low - storage and care | High - taxes, insurance, repairs, and upkeep |

| Market Volatility | High - influenced by fashion trends and brand popularity | Medium - affected by economic and regional factors |

| Income Generation | No direct income, potential resale profit | Rental income and capital gains possible |

| Tax Implications | Capital gains tax on profits | Property taxes plus capital gains tax on sale |

| Investment Horizon | Short to Medium term (1-5 years) | Medium to Long term (5+ years) |

Which is better?

Real estate investment often yields higher long-term returns and provides tangible asset appreciation, rental income, and tax benefits, making it a more stable and lucrative option for investors. Luxury handbag investment, while offering potential for significant appreciation due to brand exclusivity and limited editions, carries higher risk and less liquidity compared to property markets. Diversification between both asset classes can balance risk and growth potential in a comprehensive investment portfolio.

Connection

Luxury handbag investment and real estate investment both serve as alternative asset classes that offer portfolio diversification and potential for appreciation over time. Both markets rely heavily on scarcity, brand reputation, and location or exclusivity factors to drive value growth. Investors leveraging these tangible assets benefit from the dual advantages of aesthetic or functional appeal alongside financial returns.

Key Terms

Appreciation

Real estate investment typically offers steady appreciation driven by market demand, location, and property improvements, often outpacing inflation over long periods. Luxury handbag investment appreciates based on brand prestige, rarity, and condition, with iconic models sometimes achieving significant value spikes in niche markets. Explore the dynamics of asset appreciation to determine which investment aligns with your financial goals.

Liquidity

Real estate investment typically offers lower liquidity due to lengthy transaction processes, including inspections, appraisals, and legal procedures, often taking months to convert assets into cash. In contrast, luxury handbag investment provides higher liquidity; prestigious brands like Hermes and Chanel have active secondary markets where items can be sold quickly and at competitive prices. Explore detailed comparisons of liquidity and market dynamics to make informed investment decisions.

Maintenance

Real estate investment requires regular maintenance such as property repairs, landscaping, and system updates to preserve value and attract tenants. Luxury handbag investment demands careful upkeep including proper storage, cleaning, and protection from wear to maintain condition and resale worth. Discover more about the essential maintenance strategies for maximizing returns in both markets.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - Real estate investment can be initiated through REITs, real estate investing platforms, rental properties, and flipping investment properties, with REITs being a popular option for income and diversification.

Real Estate Investment Trusts (REITs) - REITs are companies that own and operate income-producing real estate, offering investors access to real estate income without needing to manage properties directly, with options including publicly traded and non-traded REITs.

Arrived | Easily Invest in Real Estate - Arrived provides a platform to invest in pre-vetted rental properties starting at $100, enabling investors to earn passive income and benefit from property appreciation while Arrived manages the properties.

dowidth.com

dowidth.com