Investment in sports team ownership shares offers the potential for long-term value appreciation tied to franchise growth and media rights, while venture capital funds provide diversified exposure to early-stage companies with high growth prospects. Sports team shares typically attract passionate investors seeking tangible assets and exclusive experiences, whereas venture capital funding appeals to those targeting innovative startups and emerging technologies. Explore more about how these distinct investment avenues align with different risk profiles and return expectations.

Why it is important

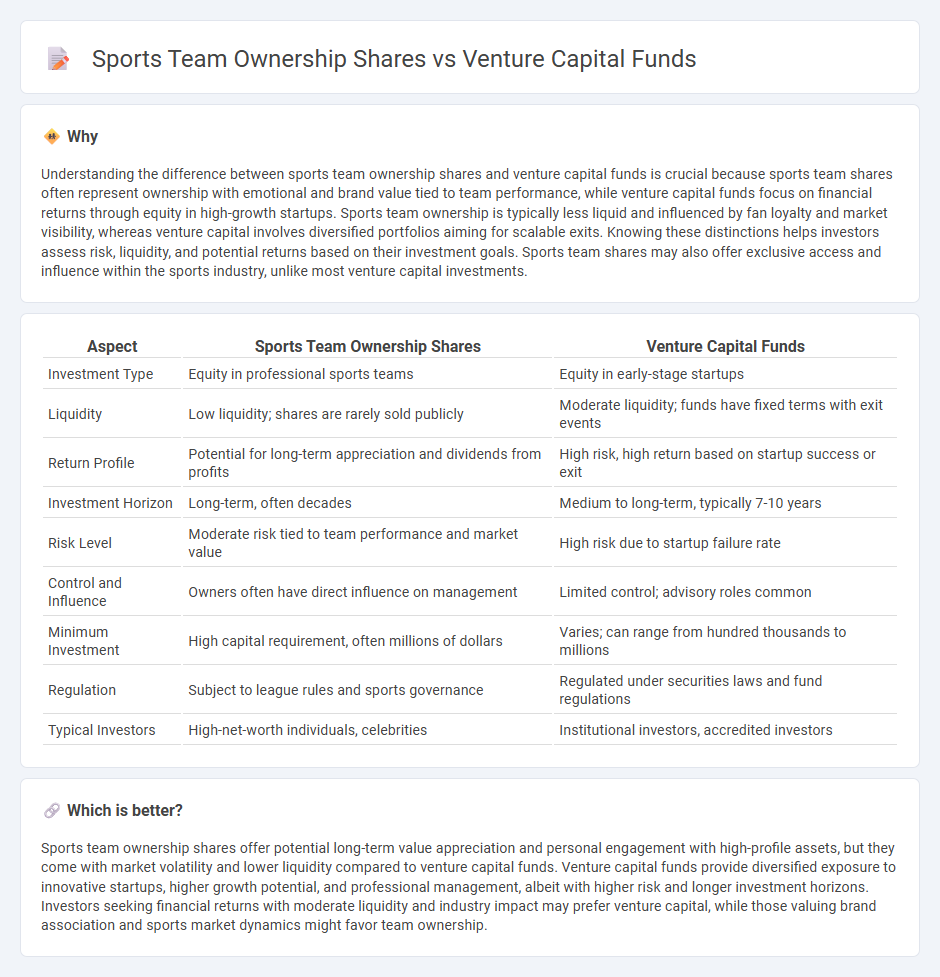

Understanding the difference between sports team ownership shares and venture capital funds is crucial because sports team shares often represent ownership with emotional and brand value tied to team performance, while venture capital funds focus on financial returns through equity in high-growth startups. Sports team ownership is typically less liquid and influenced by fan loyalty and market visibility, whereas venture capital involves diversified portfolios aiming for scalable exits. Knowing these distinctions helps investors assess risk, liquidity, and potential returns based on their investment goals. Sports team shares may also offer exclusive access and influence within the sports industry, unlike most venture capital investments.

Comparison Table

| Aspect | Sports Team Ownership Shares | Venture Capital Funds |

|---|---|---|

| Investment Type | Equity in professional sports teams | Equity in early-stage startups |

| Liquidity | Low liquidity; shares are rarely sold publicly | Moderate liquidity; funds have fixed terms with exit events |

| Return Profile | Potential for long-term appreciation and dividends from profits | High risk, high return based on startup success or exit |

| Investment Horizon | Long-term, often decades | Medium to long-term, typically 7-10 years |

| Risk Level | Moderate risk tied to team performance and market value | High risk due to startup failure rate |

| Control and Influence | Owners often have direct influence on management | Limited control; advisory roles common |

| Minimum Investment | High capital requirement, often millions of dollars | Varies; can range from hundred thousands to millions |

| Regulation | Subject to league rules and sports governance | Regulated under securities laws and fund regulations |

| Typical Investors | High-net-worth individuals, celebrities | Institutional investors, accredited investors |

Which is better?

Sports team ownership shares offer potential long-term value appreciation and personal engagement with high-profile assets, but they come with market volatility and lower liquidity compared to venture capital funds. Venture capital funds provide diversified exposure to innovative startups, higher growth potential, and professional management, albeit with higher risk and longer investment horizons. Investors seeking financial returns with moderate liquidity and industry impact may prefer venture capital, while those valuing brand association and sports market dynamics might favor team ownership.

Connection

Sports team ownership shares attract venture capital funds by offering high-growth investment opportunities with potential for substantial returns through media rights, merchandising, and brand value appreciation. Venture capital funds leverage sports franchises as strategic assets, integrating technology and fan engagement platforms to increase valuation and liquidity. This synergy drives innovation in sports management and monetization, aligning financial interests of investors with team performance and market expansion.

Key Terms

**Venture Capital Funds:**

Venture capital funds pool capital from investors to finance early-stage startups with high growth potential, typically aiming for significant returns within 5 to 10 years through equity stakes. These funds are managed by experienced professionals who conduct thorough due diligence and actively support portfolio companies to accelerate value creation. To explore the strategic benefits and risk profiles of venture capital funds, discover more insights here.

Limited Partners (LPs)

Limited Partners (LPs) in venture capital funds typically invest in diversified portfolios managed by General Partners (GPs), seeking high returns from early-stage startups with limited direct control. In contrast, LPs holding ownership shares in sports teams often have a stake in tangible assets tied to franchise value, enjoying potential income from team operations and appreciation but with varying degrees of governance influence. Explore the nuances and implications of LP involvement in these distinct investment vehicles to optimize your portfolio strategy.

Portfolio Companies

Venture capital funds diversify risk by investing in multiple portfolio companies across various industries, allowing potential for high returns through equity stakes in startups. Sports team ownership shares, however, represent direct stakes in a single asset, with value largely influenced by team performance, brand strength, and league economics. Discover deeper insights into portfolio management strategies and investment outcomes in these distinct asset classes.

Source and External Links

Venture Capital Funds: What they are & how to invest in them - Venture capital funds pool money from investors to finance early-stage startups with high growth potential, take an active role in guiding these companies, and aim to exit via IPO or acquisition to return capital to investors.

Top 100 Best Performing VC Funds from the US 2025 - Leading U.S. venture capital funds, such as Endeavor Catalyst and Everywhere Ventures, specialize in specific industries and company stages, backing high-growth startups and unicorns with strategic investments and a global outlook.

Venture capital - Venture capital is private equity financing provided to startups and early-stage companies, structured in rounds (pre-seed, seed, Series A/B/C), with exits typically through IPO, acquisition, or secondary sale, sometimes supplemented by venture debt.

dowidth.com

dowidth.com