Livestock investment platforms enable investors to gain returns by funding agricultural enterprises focused on cattle, sheep, or poultry, offering tangible asset-backed opportunities with potential for steady income streams. Wine investment platforms allow users to invest in fine wines, leveraging market appreciation driven by rarity, vintage quality, and global demand, often providing portfolio diversification and inflation hedging. Explore the distinct advantages and risks associated with these two alternative asset investment options.

Why it is important

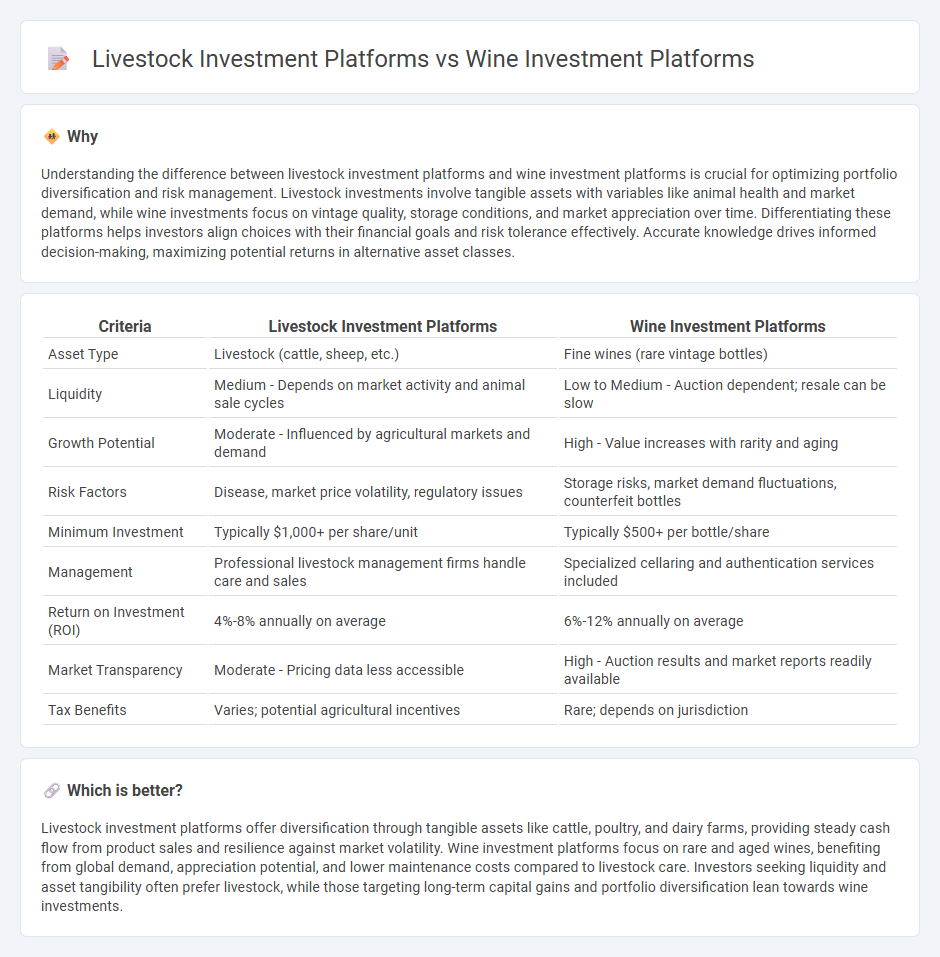

Understanding the difference between livestock investment platforms and wine investment platforms is crucial for optimizing portfolio diversification and risk management. Livestock investments involve tangible assets with variables like animal health and market demand, while wine investments focus on vintage quality, storage conditions, and market appreciation over time. Differentiating these platforms helps investors align choices with their financial goals and risk tolerance effectively. Accurate knowledge drives informed decision-making, maximizing potential returns in alternative asset classes.

Comparison Table

| Criteria | Livestock Investment Platforms | Wine Investment Platforms |

|---|---|---|

| Asset Type | Livestock (cattle, sheep, etc.) | Fine wines (rare vintage bottles) |

| Liquidity | Medium - Depends on market activity and animal sale cycles | Low to Medium - Auction dependent; resale can be slow |

| Growth Potential | Moderate - Influenced by agricultural markets and demand | High - Value increases with rarity and aging |

| Risk Factors | Disease, market price volatility, regulatory issues | Storage risks, market demand fluctuations, counterfeit bottles |

| Minimum Investment | Typically $1,000+ per share/unit | Typically $500+ per bottle/share |

| Management | Professional livestock management firms handle care and sales | Specialized cellaring and authentication services included |

| Return on Investment (ROI) | 4%-8% annually on average | 6%-12% annually on average |

| Market Transparency | Moderate - Pricing data less accessible | High - Auction results and market reports readily available |

| Tax Benefits | Varies; potential agricultural incentives | Rare; depends on jurisdiction |

Which is better?

Livestock investment platforms offer diversification through tangible assets like cattle, poultry, and dairy farms, providing steady cash flow from product sales and resilience against market volatility. Wine investment platforms focus on rare and aged wines, benefiting from global demand, appreciation potential, and lower maintenance costs compared to livestock care. Investors seeking liquidity and asset tangibility often prefer livestock, while those targeting long-term capital gains and portfolio diversification lean towards wine investments.

Connection

Livestock investment platforms and wine investment platforms both offer alternative asset classes that diversify traditional portfolios by providing tangible, appreciating commodities with intrinsic value. These platforms leverage market data and expert appraisals to estimate asset growth potential, appealing to investors seeking inflation-hedged, non-correlated investment opportunities. Shared characteristics include fractional ownership models, transparent valuation processes, and the use of digital technologies to facilitate access and liquidity in niche markets.

Key Terms

Asset Liquidity

Wine investment platforms typically offer moderate asset liquidity due to the niche market and aging process affecting resale timelines. Livestock investment platforms may provide higher liquidity through faster turnover cycles and more frequent trading opportunities in live animal markets. Explore further insights into asset liquidity differences between wine and livestock investment options.

Valuation Methods

Wine investment platforms primarily use expert appraisals and market-based pricing models that consider vintage, rarity, provenance, and storage conditions to establish accurate valuations. Livestock investment platforms rely on biological factors such as breed quality, age, health status, and growth potential alongside market demand to determine asset values. Explore more about how these valuation methods impact investment returns and risk profiles.

Storage & Maintenance

Wine investment platforms often provide climate-controlled storage facilities with strict humidity and temperature regulation to preserve wine quality and maximize resale value. Livestock investment platforms require specialized care including feeding, health monitoring, and biosecurity measures to ensure animal well-being and profitability. Explore detailed comparisons of storage and maintenance practices to make informed choices in alternative investments.

Source and External Links

Best Wine Investment Apps (2025): Features, Benefits - Vinovest - Vinovest, Vindome, and Cult Wine Investment are notable platforms offering various features including blockchain-secured trading, AI-driven portfolio advice, storage solutions, and different investment minimums--from low-entry options to high-tier exclusive plans.

Understanding Online Wine Investments And Investing Platforms - Platforms like Vinovest and Vindome provide seamless ways to buy, store, and sell wine with features like expert authentication, blockchain provenance, real-time markets, no minimum account balances, and insured bonded warehouses.

Top Wine Investing Platforms 2024 - Wine International Association - Cult Wine Investment emphasizes a combination of AI technology and traditional expertise with global reach and exclusive experiences, while Vindome leverages blockchain and mobile technology offering flexible buying options and secure storage in reputable warehouses.

dowidth.com

dowidth.com