Carbon credit trading involves buying and selling certificates representing the reduction of one metric ton of carbon dioxide emissions, offering companies a way to offset their carbon footprint through a market-driven mechanism. Nature-based solutions investing focuses on funding projects like reforestation and soil carbon sequestration that restore ecosystems while providing long-term carbon storage and biodiversity benefits. Explore the comparative financial and environmental impacts of carbon credit trading and nature-based solutions investing to make informed investment decisions.

Why it is important

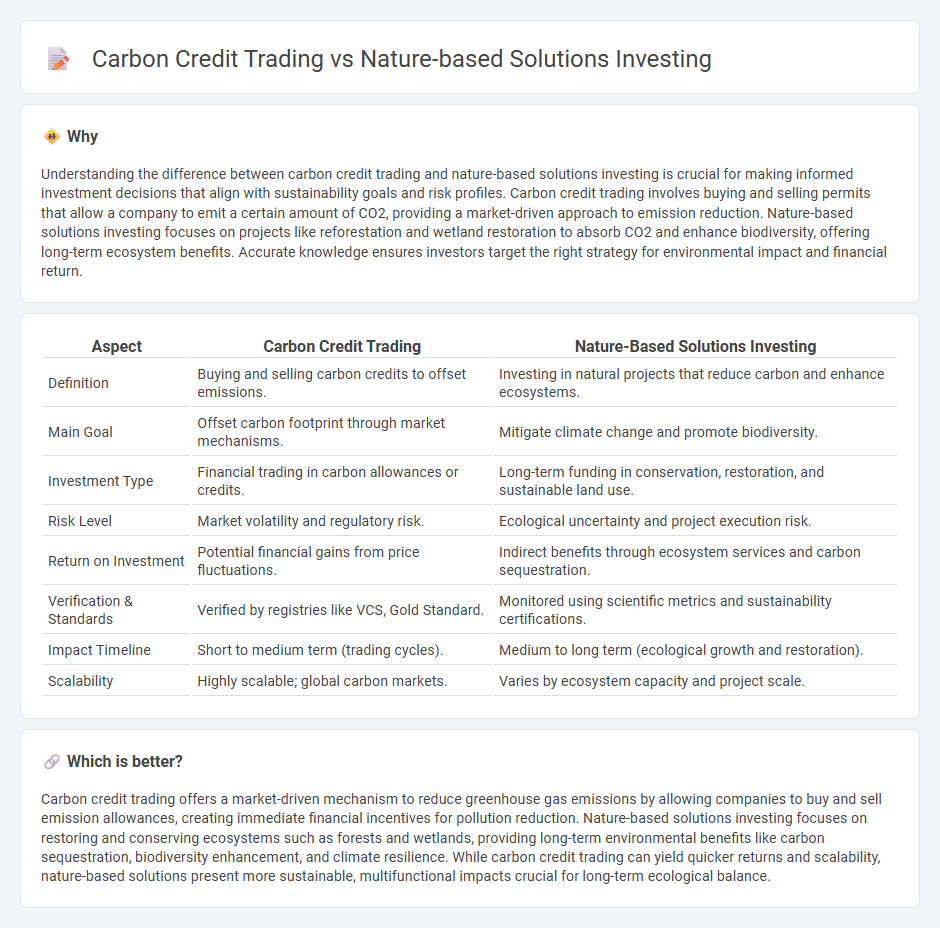

Understanding the difference between carbon credit trading and nature-based solutions investing is crucial for making informed investment decisions that align with sustainability goals and risk profiles. Carbon credit trading involves buying and selling permits that allow a company to emit a certain amount of CO2, providing a market-driven approach to emission reduction. Nature-based solutions investing focuses on projects like reforestation and wetland restoration to absorb CO2 and enhance biodiversity, offering long-term ecosystem benefits. Accurate knowledge ensures investors target the right strategy for environmental impact and financial return.

Comparison Table

| Aspect | Carbon Credit Trading | Nature-Based Solutions Investing |

|---|---|---|

| Definition | Buying and selling carbon credits to offset emissions. | Investing in natural projects that reduce carbon and enhance ecosystems. |

| Main Goal | Offset carbon footprint through market mechanisms. | Mitigate climate change and promote biodiversity. |

| Investment Type | Financial trading in carbon allowances or credits. | Long-term funding in conservation, restoration, and sustainable land use. |

| Risk Level | Market volatility and regulatory risk. | Ecological uncertainty and project execution risk. |

| Return on Investment | Potential financial gains from price fluctuations. | Indirect benefits through ecosystem services and carbon sequestration. |

| Verification & Standards | Verified by registries like VCS, Gold Standard. | Monitored using scientific metrics and sustainability certifications. |

| Impact Timeline | Short to medium term (trading cycles). | Medium to long term (ecological growth and restoration). |

| Scalability | Highly scalable; global carbon markets. | Varies by ecosystem capacity and project scale. |

Which is better?

Carbon credit trading offers a market-driven mechanism to reduce greenhouse gas emissions by allowing companies to buy and sell emission allowances, creating immediate financial incentives for pollution reduction. Nature-based solutions investing focuses on restoring and conserving ecosystems such as forests and wetlands, providing long-term environmental benefits like carbon sequestration, biodiversity enhancement, and climate resilience. While carbon credit trading can yield quicker returns and scalability, nature-based solutions present more sustainable, multifunctional impacts crucial for long-term ecological balance.

Connection

Carbon credit trading directly supports Nature-based solutions investing by providing financial incentives for projects like reforestation, wetland restoration, and sustainable agriculture that capture or reduce greenhouse gas emissions. Investment in Nature-based solutions generates tradable carbon credits, creating a measurable impact market that attracts capital and drives scalable environmental benefits. This synergy enhances portfolio diversification while advancing global carbon neutrality targets through verified ecological interventions.

Key Terms

Ecosystem Services

Investing in nature-based solutions (NbS) enhances ecosystem services by restoring habitats, improving water quality, and sequestering carbon, providing long-term environmental and social benefits beyond carbon offsetting. Carbon credit trading primarily targets emission reductions through verified carbon sequestration, offering a market-driven mechanism for companies to meet climate goals but with limited impact on biodiversity or community resilience. Explore the differences and advantages of ecosystem-centric strategies to optimize sustainable investments.

Additionality

Nature-based solutions investing prioritizes true additionality by funding projects that deliver measurable environmental benefits beyond business-as-usual scenarios, such as reforestation or wetland restoration initiatives. Carbon credit trading relies on verified emission reductions to offset carbon footprints but faces challenges in ensuring that credited projects are genuinely additional and not subject to leakage or permanence issues. Explore deeper insights into the comparative effectiveness and mechanisms of additionality in these environmental finance strategies.

Market Mechanisms

Nature-based solutions investing channels capital into projects like reforestation and wetland restoration that enhance ecosystem services and sequester carbon, driving long-term environmental and social benefits. Carbon credit trading operates through market mechanisms where companies buy and sell emission allowances or offsets to meet regulatory compliance or voluntary targets, creating financial incentives for reducing greenhouse gas emissions. Explore how these market mechanisms shape sustainable finance and climate mitigation strategies in detail.

Source and External Links

Nature-Based Investing: Unlocking Long-Term Value - Nature-based investment strategies offer diversified cash flows through timber sales, carbon credits, and premium yields, while also mitigating real risks and generating competitive, long-term financial returns alongside environmental and social co-benefits.

Investing in Nature-Based Solutions in Least Developed Countries - Investing in nature-based solutions provides a cost-effective way to address climate change, biodiversity loss, and poverty by restoring ecosystems and supporting community livelihoods, particularly in regions facing significant environmental and economic challenges.

Investors Look to Nature to Shield Against Growing Financial Risks - While nature-based investing faces technical complexity, high transaction costs, and long time horizons, new frameworks and financial tools are emerging to help institutional investors integrate these solutions into mainstream portfolios for both risk mitigation and impact.

dowidth.com

dowidth.com