Music royalties provide investors with a steady income stream derived from the continuous use of songs in media, streaming platforms, and public performances, often offering high liquidity compared to traditional assets. Fine art investments, on the other hand, focus on acquiring physical pieces valued for their rarity, historical significance, and aesthetic appeal, typically appreciating over time but with less market transparency and liquidity. Explore the unique benefits and risks of music royalties versus fine art to determine the best fit for your investment portfolio.

Why it is important

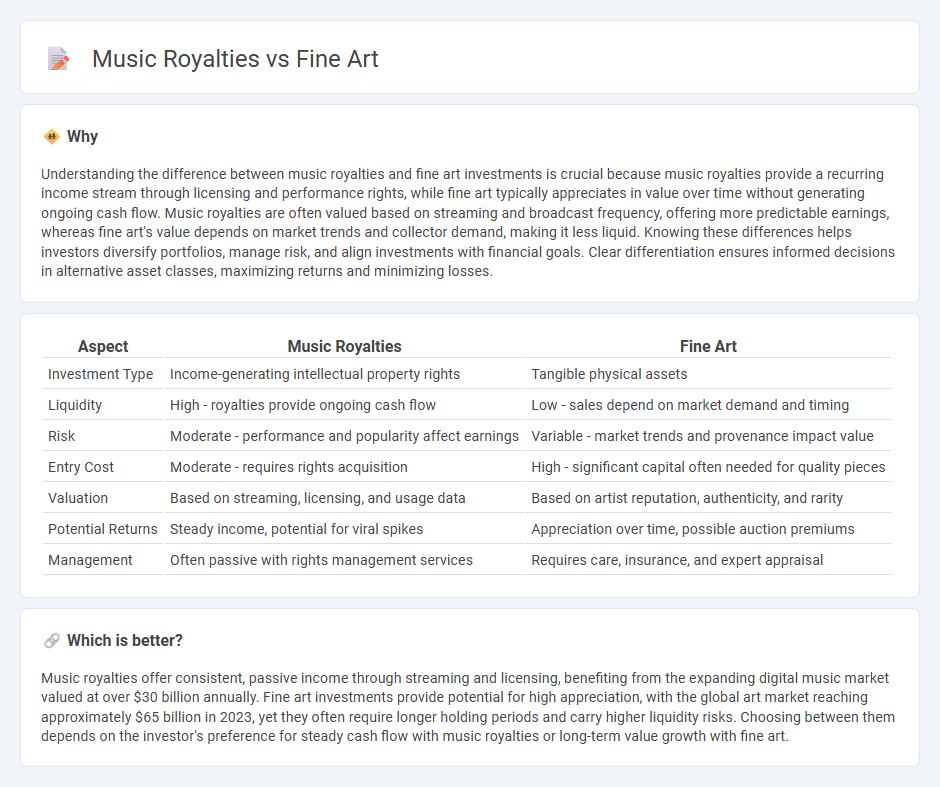

Understanding the difference between music royalties and fine art investments is crucial because music royalties provide a recurring income stream through licensing and performance rights, while fine art typically appreciates in value over time without generating ongoing cash flow. Music royalties are often valued based on streaming and broadcast frequency, offering more predictable earnings, whereas fine art's value depends on market trends and collector demand, making it less liquid. Knowing these differences helps investors diversify portfolios, manage risk, and align investments with financial goals. Clear differentiation ensures informed decisions in alternative asset classes, maximizing returns and minimizing losses.

Comparison Table

| Aspect | Music Royalties | Fine Art |

|---|---|---|

| Investment Type | Income-generating intellectual property rights | Tangible physical assets |

| Liquidity | High - royalties provide ongoing cash flow | Low - sales depend on market demand and timing |

| Risk | Moderate - performance and popularity affect earnings | Variable - market trends and provenance impact value |

| Entry Cost | Moderate - requires rights acquisition | High - significant capital often needed for quality pieces |

| Valuation | Based on streaming, licensing, and usage data | Based on artist reputation, authenticity, and rarity |

| Potential Returns | Steady income, potential for viral spikes | Appreciation over time, possible auction premiums |

| Management | Often passive with rights management services | Requires care, insurance, and expert appraisal |

Which is better?

Music royalties offer consistent, passive income through streaming and licensing, benefiting from the expanding digital music market valued at over $30 billion annually. Fine art investments provide potential for high appreciation, with the global art market reaching approximately $65 billion in 2023, yet they often require longer holding periods and carry higher liquidity risks. Choosing between them depends on the investor's preference for steady cash flow with music royalties or long-term value growth with fine art.

Connection

Music royalties and fine art intersect as alternative investment assets that generate passive income through intellectual property rights. Both markets offer diversification benefits, with music royalties providing recurring cash flow from licensing and streaming, while fine art appreciates in value over time and can be sold or loaned for exhibitions. Investors leverage digital platforms and blockchain technology to enhance transparency and liquidity, making these creative assets increasingly accessible and attractive for portfolio growth.

Key Terms

Provenance

Provenance plays a critical role in fine art royalties by establishing the artwork's origin, ownership history, and authenticity, thereby impacting its value and royalty distribution. In music royalties, provenance is linked to the documented creation process and rights ownership, ensuring accurate royalty payments to composers, performers, and producers. Discover more about how provenance influences royalty management in fine art and music industries.

Copyright

Fine art royalties primarily arise from copyright licensing agreements that protect original visual works, including paintings, sculptures, and digital art, ensuring artists receive financial benefits from reproductions, exhibitions, and derivative works. Music royalties are generated through various channels such as mechanical royalties, performance royalties, and synchronization fees, governed by copyright laws that cover sound recordings and compositions. Explore the distinct copyright frameworks and royalty management strategies that maximize earnings for creators in both fine art and music industries.

Liquidity

Fine art royalties often provide limited liquidity due to infrequent sales and longer holding periods, whereas music royalties typically offer more consistent cash flow through streaming and licensing revenues. Music royalties benefit from digital platforms that facilitate easier trading and revenue tracking, enhancing investor liquidity. Explore more to understand how liquidity dynamics shape investment strategies in these creative asset classes.

Source and External Links

Original Fine Art Paintings For Sale - Saatchi Art - Saatchi Art offers a wide range of original fine art paintings by emerging artists worldwide, emphasizing unique craftsmanship and authentic creative expression in various styles and subjects.

Fine Art America | Curated Wall Art from Independent Artists and ... - Fine Art America is the world's largest community and marketplace for independent artists to sell wall art, home decor, and apparel, featuring millions of images from hundreds of thousands of creators globally.

Fine Art Connoisseur: Home - Fine Art Connoisseur provides expert insights, artist profiles, exhibition news, and curated articles focusing on diverse aspects of fine art, including contemporary and traditional works.

dowidth.com

dowidth.com