Fractionalized art investment allows investors to own a share of valuable artwork, making high-end art assets accessible without the need for full ownership, while timberland investment involves purchasing forested land for sustainable timber production and long-term value appreciation. Both offer diversification with unique risk and return profiles tied to tangible assets, emphasizing physical value and market liquidity. Explore deeper insights to determine which asset class aligns best with your investment strategy.

Why it is important

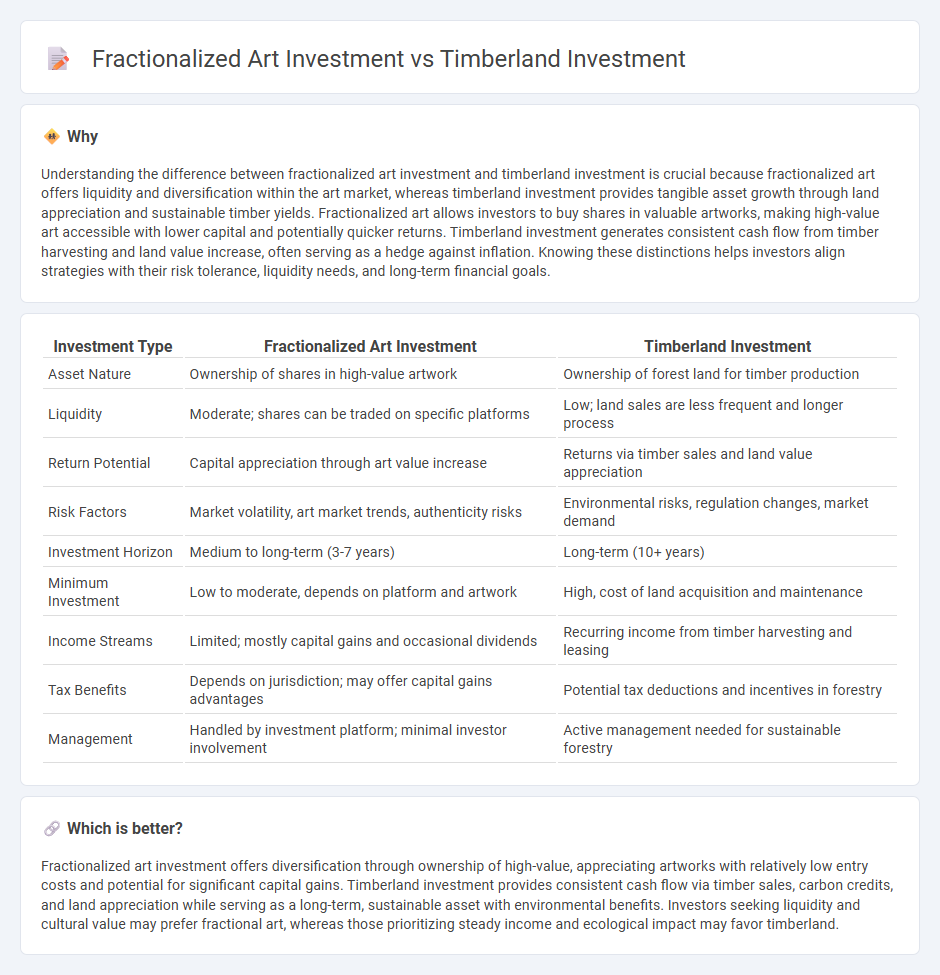

Understanding the difference between fractionalized art investment and timberland investment is crucial because fractionalized art offers liquidity and diversification within the art market, whereas timberland investment provides tangible asset growth through land appreciation and sustainable timber yields. Fractionalized art allows investors to buy shares in valuable artworks, making high-value art accessible with lower capital and potentially quicker returns. Timberland investment generates consistent cash flow from timber harvesting and land value increase, often serving as a hedge against inflation. Knowing these distinctions helps investors align strategies with their risk tolerance, liquidity needs, and long-term financial goals.

Comparison Table

| Investment Type | Fractionalized Art Investment | Timberland Investment |

|---|---|---|

| Asset Nature | Ownership of shares in high-value artwork | Ownership of forest land for timber production |

| Liquidity | Moderate; shares can be traded on specific platforms | Low; land sales are less frequent and longer process |

| Return Potential | Capital appreciation through art value increase | Returns via timber sales and land value appreciation |

| Risk Factors | Market volatility, art market trends, authenticity risks | Environmental risks, regulation changes, market demand |

| Investment Horizon | Medium to long-term (3-7 years) | Long-term (10+ years) |

| Minimum Investment | Low to moderate, depends on platform and artwork | High, cost of land acquisition and maintenance |

| Income Streams | Limited; mostly capital gains and occasional dividends | Recurring income from timber harvesting and leasing |

| Tax Benefits | Depends on jurisdiction; may offer capital gains advantages | Potential tax deductions and incentives in forestry |

| Management | Handled by investment platform; minimal investor involvement | Active management needed for sustainable forestry |

Which is better?

Fractionalized art investment offers diversification through ownership of high-value, appreciating artworks with relatively low entry costs and potential for significant capital gains. Timberland investment provides consistent cash flow via timber sales, carbon credits, and land appreciation while serving as a long-term, sustainable asset with environmental benefits. Investors seeking liquidity and cultural value may prefer fractional art, whereas those prioritizing steady income and ecological impact may favor timberland.

Connection

Fractionalized art investment and timberland investment both offer accessible entry points into traditionally high-value asset classes by allowing investors to purchase smaller shares, enhancing portfolio diversification and liquidity. Both asset types provide potential for capital appreciation along with alternative income streams--art through value appreciation and timberland through sustainable timber harvesting and land leases. Their connection lies in leveraging fractional ownership technology to democratize investment opportunities while managing risk in tangible, appreciating assets.

Key Terms

**Timberland investment:**

Timberland investment offers consistent returns through timber growth, land appreciation, and potential land-use diversification, appealing to investors seeking long-term asset stability. Timber markets respond favorably to increasing demand for sustainable wood products, enhancing timberland's value and offering inflation hedging benefits. Explore more about timberland investment strategies and market trends to maximize portfolio performance.

Land appreciation

Timberland investment offers significant potential for land appreciation due to increasing timber values and rising demand for sustainable forest products. Fractionalized art investment, while driven by market trends and artist reputation, does not directly benefit from land value increases, focusing instead on the asset's cultural and aesthetic appeal. Explore deeper insights into the comparative benefits of timberland versus fractionalized art investments in terms of land appreciation and portfolio diversity.

Timber yield

Timberland investment generates consistent timber yield through sustainable forest management, providing investors with periodic income from timber sales and potential capital appreciation as trees mature. Fractionalized art investment, in contrast, lacks physical yield generation, relying solely on art value appreciation and market liquidity for returns. Explore the nuances of timber yield and its impact on investment performance to understand which option aligns with your financial goals.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Timberland investments provide strong financial returns, portfolio diversification, inflation protection, and positive environmental and social impacts through sustainable management and carbon credit generation.

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investing involves purchasing managed tree plantations or natural forests, offering predictable biological growth and portfolio diversification, widely used by institutional investors like pension funds and endowments.

Timberland - J.P. Morgan Asset Management - Timberland investments help manage inflation risk, provide income through timber sales, and diversify portfolios due to low correlation with traditional assets, emphasizing sustainability and carbon sequestration benefits.

dowidth.com

dowidth.com