Investment communities consist of individual and group investors who actively share insights and strategies to optimize portfolio returns, leveraging collective knowledge and diverse asset allocation. Endowment funds manage large capital pools for institutions, focusing on long-term growth through diversified investments including equities, bonds, and alternative assets while maintaining spending policies to support organizational goals. Discover the key differences and advantages each approach offers to elevate your investment strategy.

Why it is important

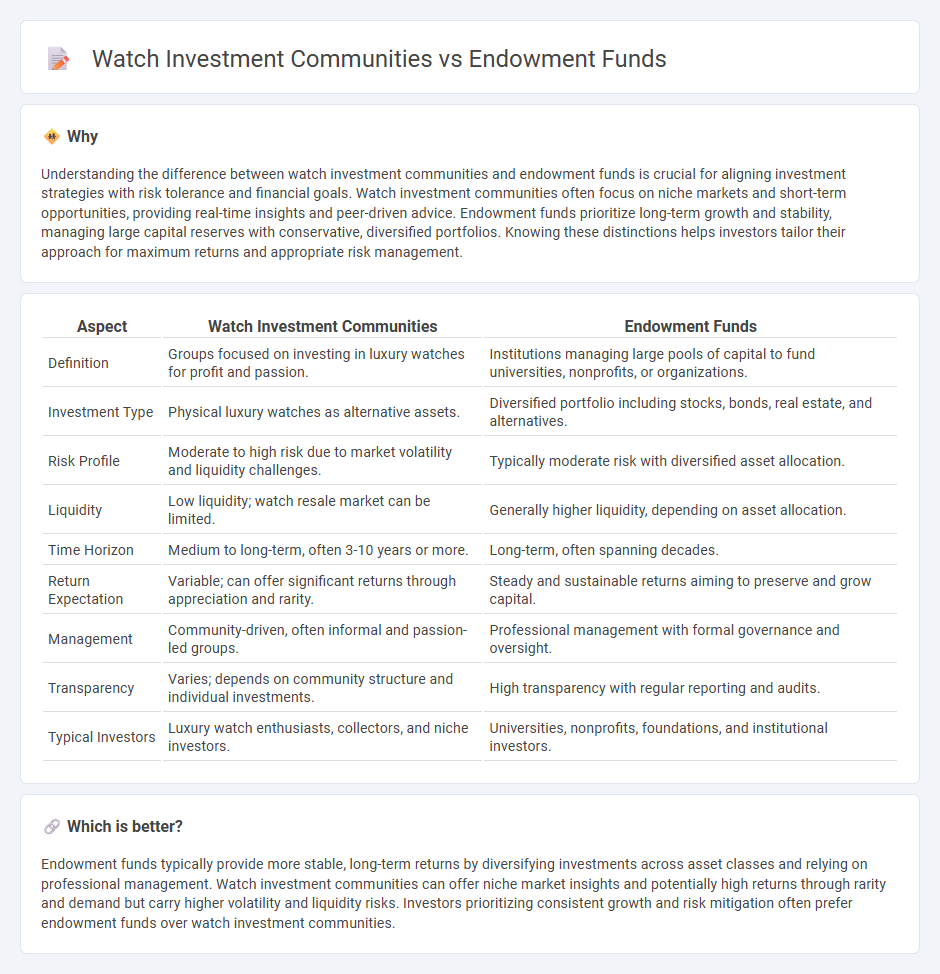

Understanding the difference between watch investment communities and endowment funds is crucial for aligning investment strategies with risk tolerance and financial goals. Watch investment communities often focus on niche markets and short-term opportunities, providing real-time insights and peer-driven advice. Endowment funds prioritize long-term growth and stability, managing large capital reserves with conservative, diversified portfolios. Knowing these distinctions helps investors tailor their approach for maximum returns and appropriate risk management.

Comparison Table

| Aspect | Watch Investment Communities | Endowment Funds |

|---|---|---|

| Definition | Groups focused on investing in luxury watches for profit and passion. | Institutions managing large pools of capital to fund universities, nonprofits, or organizations. |

| Investment Type | Physical luxury watches as alternative assets. | Diversified portfolio including stocks, bonds, real estate, and alternatives. |

| Risk Profile | Moderate to high risk due to market volatility and liquidity challenges. | Typically moderate risk with diversified asset allocation. |

| Liquidity | Low liquidity; watch resale market can be limited. | Generally higher liquidity, depending on asset allocation. |

| Time Horizon | Medium to long-term, often 3-10 years or more. | Long-term, often spanning decades. |

| Return Expectation | Variable; can offer significant returns through appreciation and rarity. | Steady and sustainable returns aiming to preserve and grow capital. |

| Management | Community-driven, often informal and passion-led groups. | Professional management with formal governance and oversight. |

| Transparency | Varies; depends on community structure and individual investments. | High transparency with regular reporting and audits. |

| Typical Investors | Luxury watch enthusiasts, collectors, and niche investors. | Universities, nonprofits, foundations, and institutional investors. |

Which is better?

Endowment funds typically provide more stable, long-term returns by diversifying investments across asset classes and relying on professional management. Watch investment communities can offer niche market insights and potentially high returns through rarity and demand but carry higher volatility and liquidity risks. Investors prioritizing consistent growth and risk mitigation often prefer endowment funds over watch investment communities.

Connection

Investment communities provide platforms where diverse investors, including endowment funds, exchange insights, strategies, and market trends to optimize portfolio performance. Endowment funds leverage these networks to access specialized knowledge, enhance asset allocation decisions, and identify long-term growth opportunities. Engagement within these communities fosters collaborative investment approaches that strengthen fund resilience and maximize returns.

Key Terms

Endowment funds:

Endowment funds are large pools of capital managed with a long-term growth strategy, typically supporting universities, hospitals, or nonprofit organizations by generating steady income through diversified investments in equities, bonds, and alternative assets. Their professional management emphasizes preservation of principal and consistent returns to fund operational needs and future projects. Explore the advantages and strategies behind endowment fund investments to understand their impact on financial sustainability.

Principal preservation

Endowment funds prioritize principal preservation through diversified, long-term investment strategies that balance growth and risk management. Watch investment communities often focus on shorter-term gains but may lack the rigorous risk controls found in institutional fund management. Explore the key differences and best practices for maintaining capital integrity in various investment approaches.

Spending policy

Endowment funds typically adopt a spending policy designed to ensure long-term sustainability, often targeting a fixed percentage of the fund's average market value, which balances current needs with future growth. Watch investment communities may emphasize more flexible spending strategies aligned with market opportunities and member priorities, focusing on maximizing returns for reinvestment rather than fixed payouts. Explore detailed comparisons of spending policies to understand the financial discipline and strategic implications for each investment approach.

Source and External Links

Endowment Fund - Overview, How It Works, Types - An endowment fund is an investment portfolio established with donations to fund charitable and nonprofit institutions; the principal is typically kept intact while the investment income supports specific purposes outlined by donors.

Financial endowment - A financial endowment is a legal structure that manages and perpetuates a pool of investments for specific purposes, often preserving inflation-adjusted principal while spending a portion of earnings annually for nonprofits like universities and hospitals.

What is an Endowment Fund? - Endowment funds generate revenue for charitable activities, with types including restricted endowments, term endowments, and quasi-endowments, where principal and earnings use are governed by donor restrictions or board discretion.

dowidth.com

dowidth.com