Art tokenization transforms physical artworks into digital tokens, enabling fractional ownership and enhanced liquidity in the art market. Derivatives are financial contracts whose value is derived from underlying assets, offering investors instruments for hedging or speculation across various markets. Explore how these innovative investment vehicles reshape portfolio diversification and risk management.

Why it is important

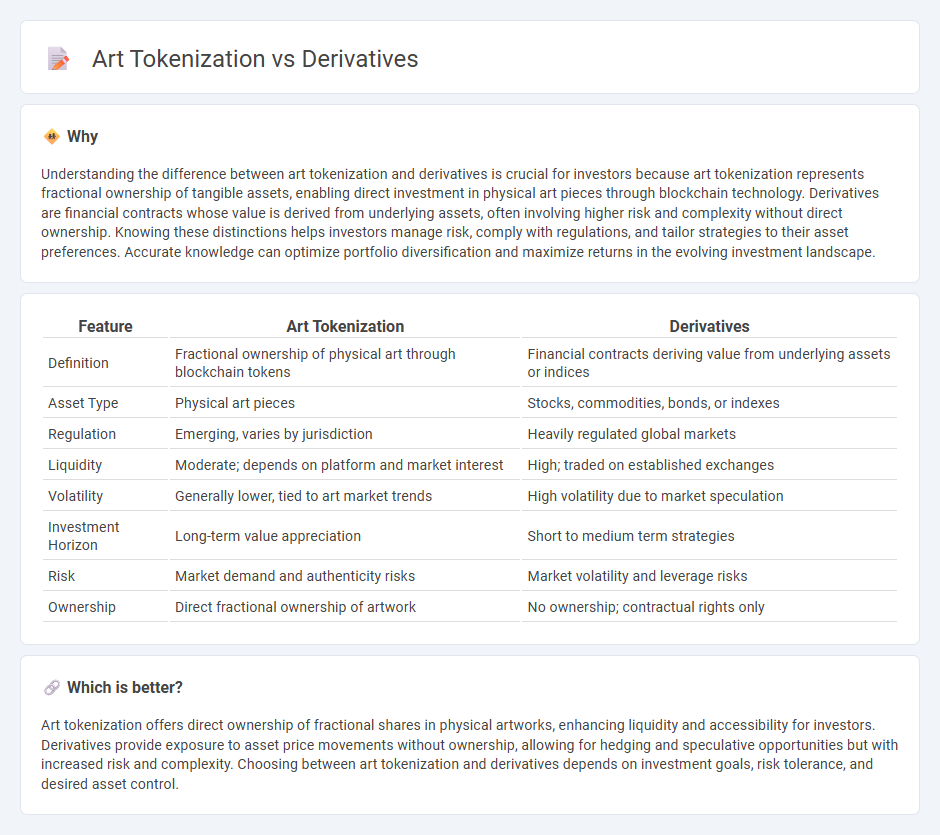

Understanding the difference between art tokenization and derivatives is crucial for investors because art tokenization represents fractional ownership of tangible assets, enabling direct investment in physical art pieces through blockchain technology. Derivatives are financial contracts whose value is derived from underlying assets, often involving higher risk and complexity without direct ownership. Knowing these distinctions helps investors manage risk, comply with regulations, and tailor strategies to their asset preferences. Accurate knowledge can optimize portfolio diversification and maximize returns in the evolving investment landscape.

Comparison Table

| Feature | Art Tokenization | Derivatives |

|---|---|---|

| Definition | Fractional ownership of physical art through blockchain tokens | Financial contracts deriving value from underlying assets or indices |

| Asset Type | Physical art pieces | Stocks, commodities, bonds, or indexes |

| Regulation | Emerging, varies by jurisdiction | Heavily regulated global markets |

| Liquidity | Moderate; depends on platform and market interest | High; traded on established exchanges |

| Volatility | Generally lower, tied to art market trends | High volatility due to market speculation |

| Investment Horizon | Long-term value appreciation | Short to medium term strategies |

| Risk | Market demand and authenticity risks | Market volatility and leverage risks |

| Ownership | Direct fractional ownership of artwork | No ownership; contractual rights only |

Which is better?

Art tokenization offers direct ownership of fractional shares in physical artworks, enhancing liquidity and accessibility for investors. Derivatives provide exposure to asset price movements without ownership, allowing for hedging and speculative opportunities but with increased risk and complexity. Choosing between art tokenization and derivatives depends on investment goals, risk tolerance, and desired asset control.

Connection

Art tokenization transforms physical artworks into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. Derivatives linked to these tokens allow investors to speculate on the future value of art assets or hedge risks without owning the underlying art piece directly. This connection creates a robust financial ecosystem that combines art investment with advanced trading strategies, enhancing market accessibility and capital efficiency.

Key Terms

Underlying Asset

Derivatives are financial contracts deriving value from an underlying asset such as stocks, commodities, or indices, allowing investors to hedge risk or speculate on price movements without owning the asset itself. Art tokenization involves converting ownership rights of physical artworks into digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity in the art market. Explore how these innovative financial instruments transform investment strategies and asset accessibility.

Liquidity

Derivatives markets offer high liquidity through standardized contracts and established exchanges, enabling rapid buying and selling with minimal price impact. Art tokenization provides liquidity by fractionalizing ownership of physical artworks into digital tokens, allowing broader investor access and easier transferability. Explore how these financial innovations reshape liquidity dynamics in art investment.

Valuation

Derivatives derive value from underlying assets, enabling traders to hedge risks or speculate on price movements without owning the asset itself. Art tokenization assigns blockchain-based tokens to fractional ownership in physical or digital artworks, allowing liquidity and market access previously unavailable to traditional collectors. Explore how these valuation methods transform investment strategies in the evolving financial and art markets.

Source and External Links

Derivative (mathematics) - The derivative measures how a function's output changes with respect to its input, with higher-order derivatives representing repeated differentiation useful in physics and other fields.

Derivative (finance) - In finance, a derivative is a contract between parties whose value depends on the performance of an underlying asset such as stocks, commodities, or currencies, allowing risk management and speculation.

Introduction to Derivatives - Derivatives can be found by calculating the slope of the function at a point through the limit of the difference quotient as the change in input approaches zero.

dowidth.com

dowidth.com