Rare whisky bottles trading offers a unique investment opportunity characterized by increasing global demand, limited supply, and a strong secondary market with high appreciation potential. Fine art investments provide diversification through tangible assets, historical significance, and the possibility of long-term value growth driven by artist reputation and market trends. Explore the distinct advantages and risks of these alternative investment assets to enhance your portfolio strategy.

Why it is important

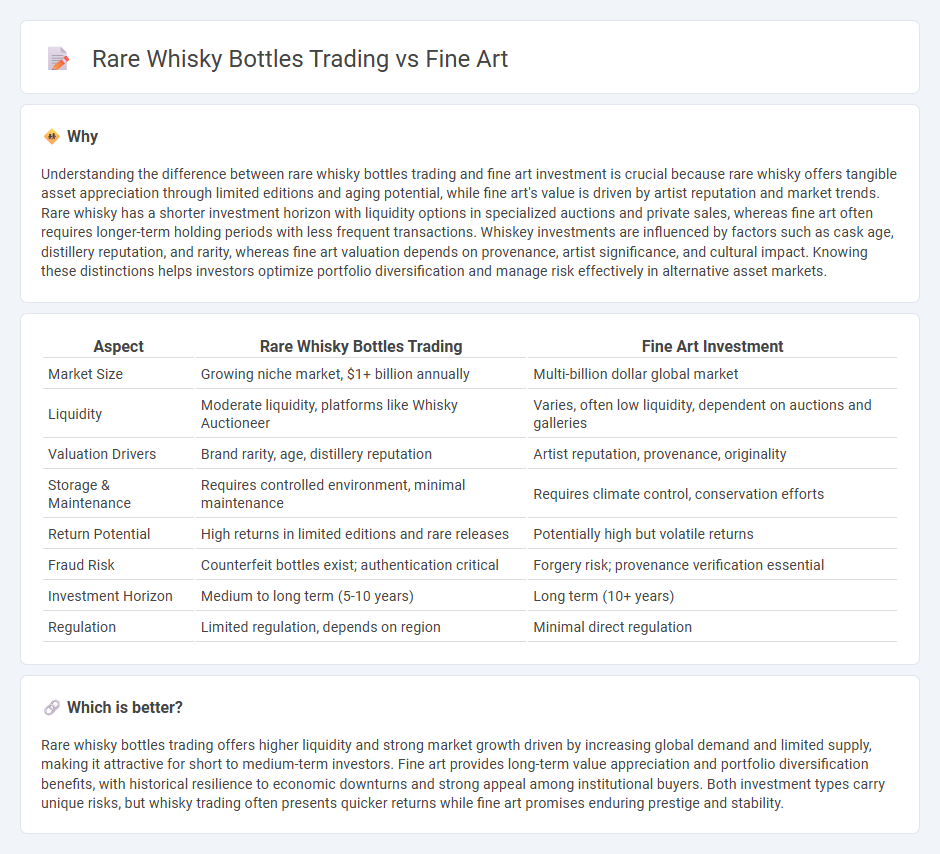

Understanding the difference between rare whisky bottles trading and fine art investment is crucial because rare whisky offers tangible asset appreciation through limited editions and aging potential, while fine art's value is driven by artist reputation and market trends. Rare whisky has a shorter investment horizon with liquidity options in specialized auctions and private sales, whereas fine art often requires longer-term holding periods with less frequent transactions. Whiskey investments are influenced by factors such as cask age, distillery reputation, and rarity, whereas fine art valuation depends on provenance, artist significance, and cultural impact. Knowing these distinctions helps investors optimize portfolio diversification and manage risk effectively in alternative asset markets.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | Fine Art Investment |

|---|---|---|

| Market Size | Growing niche market, $1+ billion annually | Multi-billion dollar global market |

| Liquidity | Moderate liquidity, platforms like Whisky Auctioneer | Varies, often low liquidity, dependent on auctions and galleries |

| Valuation Drivers | Brand rarity, age, distillery reputation | Artist reputation, provenance, originality |

| Storage & Maintenance | Requires controlled environment, minimal maintenance | Requires climate control, conservation efforts |

| Return Potential | High returns in limited editions and rare releases | Potentially high but volatile returns |

| Fraud Risk | Counterfeit bottles exist; authentication critical | Forgery risk; provenance verification essential |

| Investment Horizon | Medium to long term (5-10 years) | Long term (10+ years) |

| Regulation | Limited regulation, depends on region | Minimal direct regulation |

Which is better?

Rare whisky bottles trading offers higher liquidity and strong market growth driven by increasing global demand and limited supply, making it attractive for short to medium-term investors. Fine art provides long-term value appreciation and portfolio diversification benefits, with historical resilience to economic downturns and strong appeal among institutional buyers. Both investment types carry unique risks, but whisky trading often presents quicker returns while fine art promises enduring prestige and stability.

Connection

Rare whisky bottles and fine art share a strong correlation in the alternative investment market due to their high appreciation potential and limited supply. Both asset classes attract collectors seeking tangible, culturally significant items that retain value independent of traditional financial markets. Their trading platforms often emphasize provenance, rarity, and historical significance, driving competitive demand and premium pricing.

Key Terms

Provenance

Provenance plays a crucial role in both fine art and rare whisky bottles trading, serving as a verified history that ensures authenticity and increases market value. In fine art, detailed provenance can trace an artwork's ownership, exhibition history, and condition reports, significantly enhancing buyer confidence and price. Discover how provenance shapes investment decisions and market trends in fine art and rare whisky trading.

Liquidity

Fine art trading generally offers lower liquidity due to the unique nature and longer sales cycles of artworks, often requiring specialized auction houses and private sales. Rare whisky bottles trading benefits from higher liquidity with established online marketplaces and increasing global demand, allowing quicker transactions and better price discovery. Explore the nuances of liquidity in these markets to enhance your investment decisions.

Authenticity

Authenticity in fine art trading is ensured through provenance documentation, expert evaluations, and certification by recognized authorities, establishing the artwork's originality and historical significance. Rare whisky bottles trading relies on tamper-proof packaging, official distillery seals, and detailed batch information to verify genuineness and prevent counterfeit sales. Explore more about the critical methods used to validate authenticity in both markets and protect investments.

Source and External Links

Fine art - Wikipedia - Fine art is visual art created primarily for aesthetic and intellectual purposes, traditionally including painting, sculpture, drawing, watercolor, graphics, and architecture, valued for its beauty and meaningfulness.

Fine Art America | Curated Wall Art from Independent Artists - Fine Art America is a large online marketplace where independent artists sell wall art and decor, supporting living artists globally.

Fine Art Connoisseur: Home - Fine Art Connoisseur offers expert analysis, artist profiles, and curated insights into the world of fine art, including exhibitions and auctions.

dowidth.com

dowidth.com