Fine art micro-shares offer investors fractional ownership in high-value artworks, allowing diversification with lower capital compared to traditional acquisitions. Wine investment platforms provide access to rare and aged vintages, leveraging the historical appreciation and market demand of premium wines. Explore these innovative avenues to understand their unique benefits and risks in the investment landscape.

Why it is important

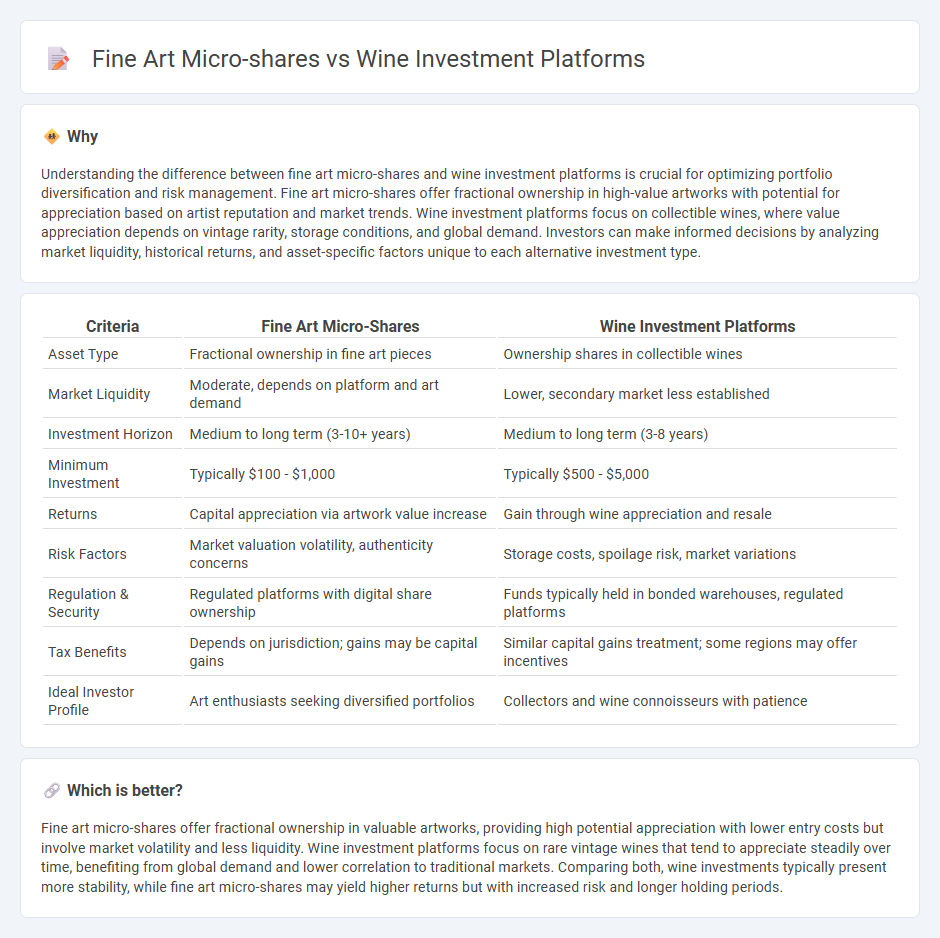

Understanding the difference between fine art micro-shares and wine investment platforms is crucial for optimizing portfolio diversification and risk management. Fine art micro-shares offer fractional ownership in high-value artworks with potential for appreciation based on artist reputation and market trends. Wine investment platforms focus on collectible wines, where value appreciation depends on vintage rarity, storage conditions, and global demand. Investors can make informed decisions by analyzing market liquidity, historical returns, and asset-specific factors unique to each alternative investment type.

Comparison Table

| Criteria | Fine Art Micro-Shares | Wine Investment Platforms |

|---|---|---|

| Asset Type | Fractional ownership in fine art pieces | Ownership shares in collectible wines |

| Market Liquidity | Moderate, depends on platform and art demand | Lower, secondary market less established |

| Investment Horizon | Medium to long term (3-10+ years) | Medium to long term (3-8 years) |

| Minimum Investment | Typically $100 - $1,000 | Typically $500 - $5,000 |

| Returns | Capital appreciation via artwork value increase | Gain through wine appreciation and resale |

| Risk Factors | Market valuation volatility, authenticity concerns | Storage costs, spoilage risk, market variations |

| Regulation & Security | Regulated platforms with digital share ownership | Funds typically held in bonded warehouses, regulated platforms |

| Tax Benefits | Depends on jurisdiction; gains may be capital gains | Similar capital gains treatment; some regions may offer incentives |

| Ideal Investor Profile | Art enthusiasts seeking diversified portfolios | Collectors and wine connoisseurs with patience |

Which is better?

Fine art micro-shares offer fractional ownership in valuable artworks, providing high potential appreciation with lower entry costs but involve market volatility and less liquidity. Wine investment platforms focus on rare vintage wines that tend to appreciate steadily over time, benefiting from global demand and lower correlation to traditional markets. Comparing both, wine investments typically present more stability, while fine art micro-shares may yield higher returns but with increased risk and longer holding periods.

Connection

Fine art micro-shares and wine investment platforms are connected through their shared approach to fractional ownership, allowing investors to diversify portfolios with tangible assets traditionally reserved for high-net-worth individuals. Both platforms leverage blockchain technology and digital trading systems to provide transparency, liquidity, and accessibility in markets often characterized by illiquidity. By democratizing access to fine art and collectible wines, these investment avenues attract a broad range of investors seeking alternative asset classes with potential long-term appreciation.

Key Terms

**Wine investment platforms:**

Wine investment platforms offer fractional ownership in high-value wine collections, providing investors with access to a traditionally exclusive market through curated portfolios and expert valuation. These platforms leverage blockchain technology and secure storage solutions to ensure provenance and liquidity, often outperforming traditional asset classes in stability. Discover how wine investment platforms can diversify your portfolio and unlock unique financial opportunities.

Provenance

Wine investment platforms leverage blockchain technology and expert verification to ensure accurate provenance tracking, enhancing transparency and investor confidence. Fine art micro-shares also utilize digital certification and edge AI to authenticate ownership history, but often face challenges with subjective valuation and market liquidity. Explore detailed comparisons to understand how provenance influences investment security and potential returns.

Liquidity

Wine investment platforms offer relatively higher liquidity by enabling fractional ownership with secondary markets facilitating quicker trades, appealing to investors seeking flexible exit options. Fine art micro-shares, while providing access to high-value artworks, often face longer holding periods and less developed secondary markets, limiting liquidity compared to wine investments. Explore detailed comparisons to understand which asset class suits your liquidity needs best.

Source and External Links

Best Wine Investment Apps (2025): Features, Benefits - Vinovest, Vindome, and Cult Wine Investment are notable wine investment platforms offering diverse entry points, storage, portfolio management, and trading options; Vindome uses blockchain and offers flexible buying/selling, while Cult Wine Investment provides AI-driven portfolio advice starting from $35,000 investment with fees including storage and management.

Understanding Online Wine Investments And Investing Platforms - Vinovest offers a reputable and transparent platform with no minimum investment and expert authentication, while Vindome caters to investors with no minimum buy-in, blockchain-secured provenance, NFC-tagged cases, and real-time market access through a mobile app.

Top Wine Investing Platforms 2024 - Leading platforms include Cult Wine Investment, known for AI-driven portfolio creation and exclusive experiences, Vindome which combines blockchain technology with traditional wine storage, and Vinovest offering a seamless blend of technology and expertise for global fine wine investing.

dowidth.com

dowidth.com