Psychedelic stocks represent a rapidly emerging sector driven by increasing interest in mental health treatments and expanding legal frameworks, offering high-growth potential amid regulatory shifts. Financial stocks, rooted in traditional banking, insurance, and investment services, provide steady dividends and resilience during economic cycles, appealing to investors seeking stability. Explore the nuances between these divergent investment opportunities to optimize your portfolio strategy.

Why it is important

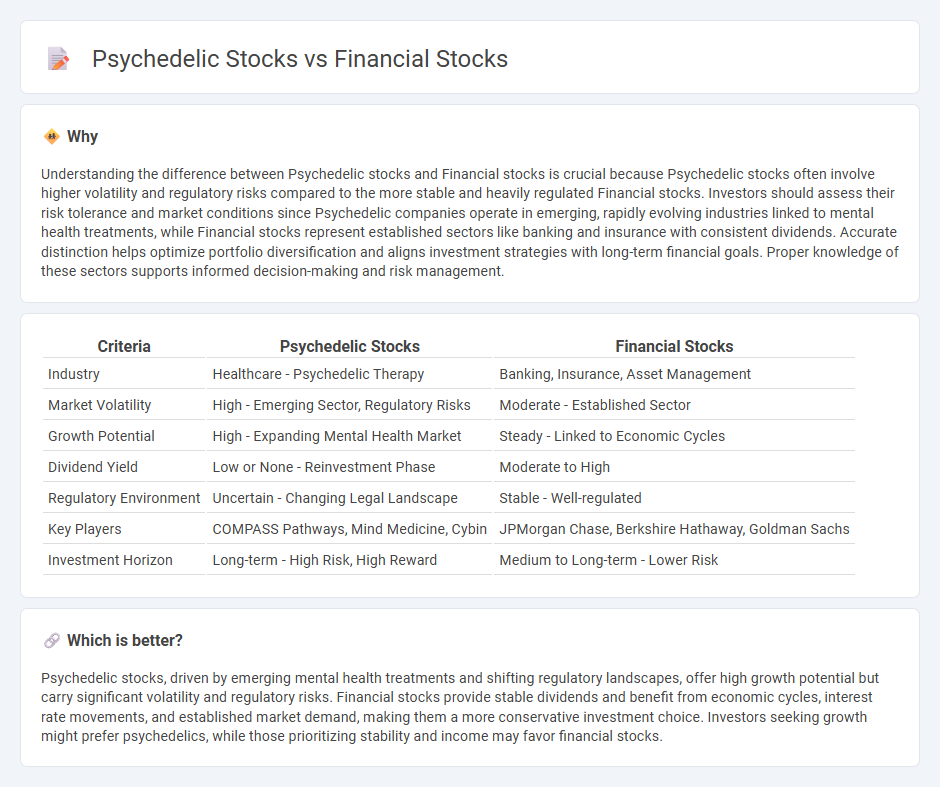

Understanding the difference between Psychedelic stocks and Financial stocks is crucial because Psychedelic stocks often involve higher volatility and regulatory risks compared to the more stable and heavily regulated Financial stocks. Investors should assess their risk tolerance and market conditions since Psychedelic companies operate in emerging, rapidly evolving industries linked to mental health treatments, while Financial stocks represent established sectors like banking and insurance with consistent dividends. Accurate distinction helps optimize portfolio diversification and aligns investment strategies with long-term financial goals. Proper knowledge of these sectors supports informed decision-making and risk management.

Comparison Table

| Criteria | Psychedelic Stocks | Financial Stocks |

|---|---|---|

| Industry | Healthcare - Psychedelic Therapy | Banking, Insurance, Asset Management |

| Market Volatility | High - Emerging Sector, Regulatory Risks | Moderate - Established Sector |

| Growth Potential | High - Expanding Mental Health Market | Steady - Linked to Economic Cycles |

| Dividend Yield | Low or None - Reinvestment Phase | Moderate to High |

| Regulatory Environment | Uncertain - Changing Legal Landscape | Stable - Well-regulated |

| Key Players | COMPASS Pathways, Mind Medicine, Cybin | JPMorgan Chase, Berkshire Hathaway, Goldman Sachs |

| Investment Horizon | Long-term - High Risk, High Reward | Medium to Long-term - Lower Risk |

Which is better?

Psychedelic stocks, driven by emerging mental health treatments and shifting regulatory landscapes, offer high growth potential but carry significant volatility and regulatory risks. Financial stocks provide stable dividends and benefit from economic cycles, interest rate movements, and established market demand, making them a more conservative investment choice. Investors seeking growth might prefer psychedelics, while those prioritizing stability and income may favor financial stocks.

Connection

Psychedelic stocks and financial stocks intersect through emerging market dynamics where investment firms increasingly allocate capital to biotech innovations, including psychedelic therapies. Financial stocks benefit from the growth of psychedelics as institutional investors and venture capital funds fuel expansion, driving market valuation and liquidity. This symbiotic relationship enhances portfolio diversification and highlights evolving investment trends in high-growth, speculative sectors.

Key Terms

Volatility

Financial stocks typically exhibit lower volatility, with daily price swings often ranging between 1% to 3%, reflecting their ties to established economic cycles and regulatory frameworks. Psychedelic stocks, by contrast, experience significantly higher volatility, sometimes exceeding 10% daily, driven by regulatory news, clinical trial results, and market speculation in this emerging industry. Explore the distinct risk profiles and market dynamics shaping these sectors to make informed investment decisions.

Regulation

Financial stocks are heavily influenced by strict regulatory frameworks set by agencies such as the SEC, ensuring compliance with capital requirements, disclosure norms, and risk management protocols. Psychedelic stocks face evolving regulatory landscapes, with increasing government interest in approving treatments for mental health conditions, yet still encountering significant legal uncertainties and classification challenges. Explore the dynamic regulatory environments shaping these sectors to understand their investment risks and opportunities.

Market Maturity

Financial stocks exhibit established market maturity characterized by steady growth, strong regulatory frameworks, and high liquidity, reflecting decades of investor confidence and market integration. Psychedelic stocks remain in early-stage market development, marked by regulatory uncertainties, volatile valuations, and emerging clinical breakthroughs that drive speculative interest. Explore the differences in market maturity and future potential between these two sectors for informed investment decisions.

Source and External Links

Top Financial Stocks to Watch in July 2025 | IG International - The largest global finance stocks by market capitalization in early 2025 include JPMorgan Chase, Visa, Mastercard, Bank of America, ICBC, Wells Fargo, Morgan Stanley, American Express, and China Construction Bank.

The Best Financial-Services Stocks to Buy - Morningstar - Morningstar highlights Western Union, Prudential, PayPal Holdings, Ally Financial, TransUnion, and T. Rowe Price as undervalued financial-services stocks with competitive moats as of June 2025.

A List of Stocks in the Financials Sector - Stock Analysis - The financials sector comprises 927 stocks globally, with a combined market cap of $12.7 trillion, $3.85 trillion in revenue, and an average PE ratio of 17.99 as of 2025.

dowidth.com

dowidth.com