Crowdlending platforms enable investors to directly fund loans for businesses or individuals, often offering higher returns with increased risk compared to traditional assets. Exchange-traded funds (ETFs) provide diversified exposure to various markets by pooling investor capital into a portfolio of stocks or bonds, balancing risk and liquidity. Explore the unique benefits and considerations of these investment options to determine which aligns best with your financial goals.

Why it is important

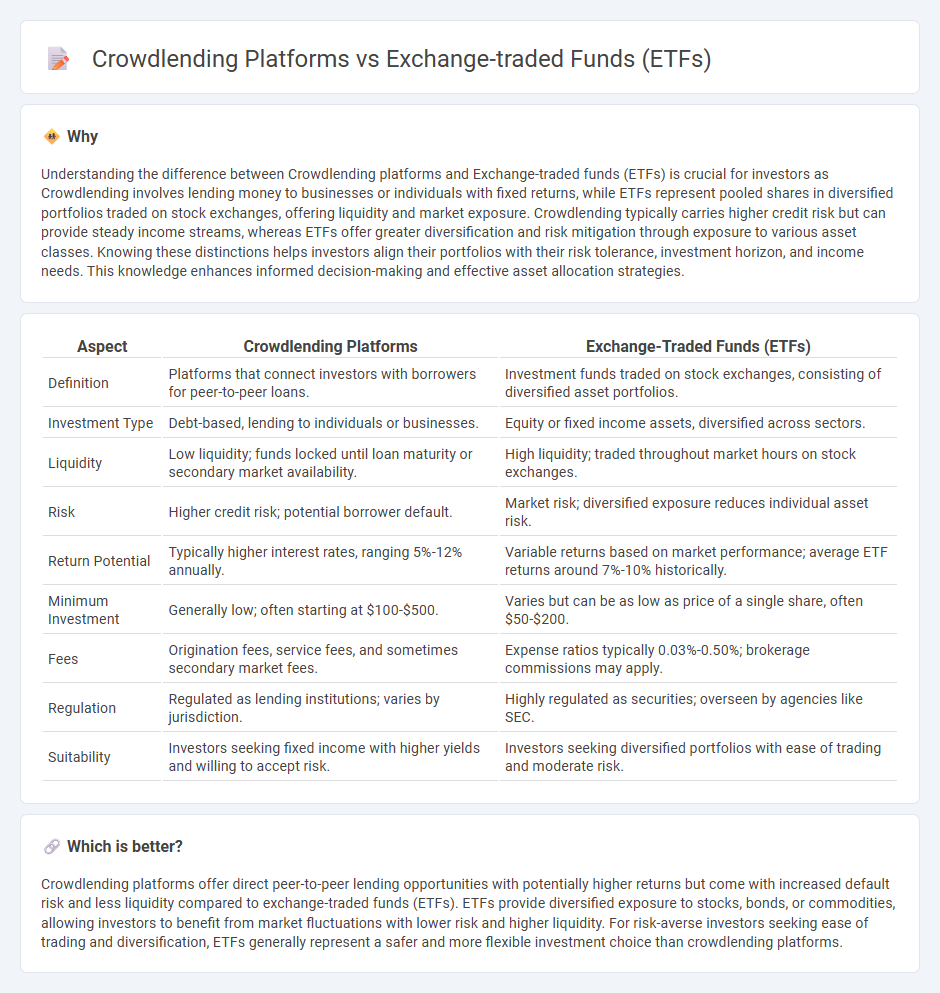

Understanding the difference between Crowdlending platforms and Exchange-traded funds (ETFs) is crucial for investors as Crowdlending involves lending money to businesses or individuals with fixed returns, while ETFs represent pooled shares in diversified portfolios traded on stock exchanges, offering liquidity and market exposure. Crowdlending typically carries higher credit risk but can provide steady income streams, whereas ETFs offer greater diversification and risk mitigation through exposure to various asset classes. Knowing these distinctions helps investors align their portfolios with their risk tolerance, investment horizon, and income needs. This knowledge enhances informed decision-making and effective asset allocation strategies.

Comparison Table

| Aspect | Crowdlending Platforms | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Platforms that connect investors with borrowers for peer-to-peer loans. | Investment funds traded on stock exchanges, consisting of diversified asset portfolios. |

| Investment Type | Debt-based, lending to individuals or businesses. | Equity or fixed income assets, diversified across sectors. |

| Liquidity | Low liquidity; funds locked until loan maturity or secondary market availability. | High liquidity; traded throughout market hours on stock exchanges. |

| Risk | Higher credit risk; potential borrower default. | Market risk; diversified exposure reduces individual asset risk. |

| Return Potential | Typically higher interest rates, ranging 5%-12% annually. | Variable returns based on market performance; average ETF returns around 7%-10% historically. |

| Minimum Investment | Generally low; often starting at $100-$500. | Varies but can be as low as price of a single share, often $50-$200. |

| Fees | Origination fees, service fees, and sometimes secondary market fees. | Expense ratios typically 0.03%-0.50%; brokerage commissions may apply. |

| Regulation | Regulated as lending institutions; varies by jurisdiction. | Highly regulated as securities; overseen by agencies like SEC. |

| Suitability | Investors seeking fixed income with higher yields and willing to accept risk. | Investors seeking diversified portfolios with ease of trading and moderate risk. |

Which is better?

Crowdlending platforms offer direct peer-to-peer lending opportunities with potentially higher returns but come with increased default risk and less liquidity compared to exchange-traded funds (ETFs). ETFs provide diversified exposure to stocks, bonds, or commodities, allowing investors to benefit from market fluctuations with lower risk and higher liquidity. For risk-averse investors seeking ease of trading and diversification, ETFs generally represent a safer and more flexible investment choice than crowdlending platforms.

Connection

Crowdlending platforms and Exchange-traded funds (ETFs) are connected through their role in diversifying investment portfolios and providing access to alternative asset classes. Crowdlending offers direct peer-to-peer lending opportunities, while ETFs can include diversified holdings in crowdlending or other fixed-income assets, enhancing liquidity and risk management. Investors leverage this connection to optimize returns by balancing high-yield lending risks with the traded liquidity of ETFs.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity by allowing investors to buy and sell shares on stock exchanges throughout the trading day, providing immediate access to funds. Crowdlending platforms, by contrast, typically involve longer lock-in periods as loan repayments are scheduled over months or years, limiting the ability to quickly liquidate investments. Explore deeper insights on liquidity differences to optimize your investment strategy.

Diversification

Exchange-traded funds (ETFs) offer broad market diversification by pooling assets across various sectors and geographies, reducing investment risk through extensive portfolio spread. Crowdlending platforms diversify risk by spreading loans among multiple borrowers, though their exposure remains more sector and credit quality specific compared to ETFs. Explore deeper insights on how diversification strategies differ between ETFs and crowdlending to optimize your investment portfolio.

Risk profile

Exchange-traded funds (ETFs) typically offer diversified exposure to a range of assets, reducing individual investment risk through broad market participation. Crowdlending platforms, on the other hand, carry higher default risk due to direct lending to individual borrowers or small businesses, often without collateral. Explore detailed comparisons of risk profiles and investor protection mechanisms to better understand these investment options.

Source and External Links

Exchange-Traded Funds (ETFs) - Investor.gov - ETFs are exchange-traded investment products registered with the SEC that pool investors' money to invest in diversified portfolios of stocks, bonds or other securities, offering benefits like professional management, diversification, liquidity, low minimum investment, and tax advantages.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the flexibility of stocks with the diversification of mutual funds, allowing investors to buy and sell baskets of assets on exchanges during market hours, often with lower costs and higher tax efficiency than mutual funds.

Exchange-traded fund - Wikipedia - ETFs are investment funds traded on stock exchanges that differ from mutual funds by trading like stocks throughout the day with generally lower fees, greater tax efficiency, and more transparency in holdings.

dowidth.com

dowidth.com