Fine art micro-shares offer fractional ownership in valuable artworks, allowing investors to diversify portfolios with tangible cultural assets and potential appreciation in the luxury market. REITs (Real Estate Investment Trusts) provide exposure to commercial and residential properties, delivering regular income through dividends and liquidity unavailable in direct real estate ownership. Explore the benefits and risks of fine art micro-shares versus REITs to make informed investment decisions.

Why it is important

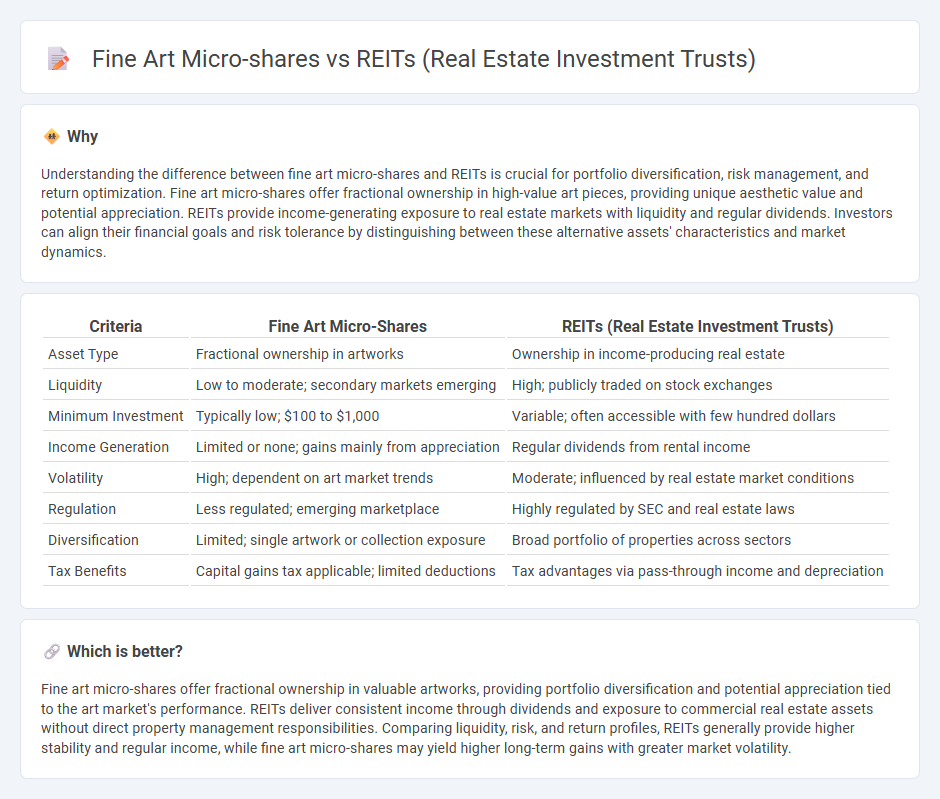

Understanding the difference between fine art micro-shares and REITs is crucial for portfolio diversification, risk management, and return optimization. Fine art micro-shares offer fractional ownership in high-value art pieces, providing unique aesthetic value and potential appreciation. REITs provide income-generating exposure to real estate markets with liquidity and regular dividends. Investors can align their financial goals and risk tolerance by distinguishing between these alternative assets' characteristics and market dynamics.

Comparison Table

| Criteria | Fine Art Micro-Shares | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Asset Type | Fractional ownership in artworks | Ownership in income-producing real estate |

| Liquidity | Low to moderate; secondary markets emerging | High; publicly traded on stock exchanges |

| Minimum Investment | Typically low; $100 to $1,000 | Variable; often accessible with few hundred dollars |

| Income Generation | Limited or none; gains mainly from appreciation | Regular dividends from rental income |

| Volatility | High; dependent on art market trends | Moderate; influenced by real estate market conditions |

| Regulation | Less regulated; emerging marketplace | Highly regulated by SEC and real estate laws |

| Diversification | Limited; single artwork or collection exposure | Broad portfolio of properties across sectors |

| Tax Benefits | Capital gains tax applicable; limited deductions | Tax advantages via pass-through income and depreciation |

Which is better?

Fine art micro-shares offer fractional ownership in valuable artworks, providing portfolio diversification and potential appreciation tied to the art market's performance. REITs deliver consistent income through dividends and exposure to commercial real estate assets without direct property management responsibilities. Comparing liquidity, risk, and return profiles, REITs generally provide higher stability and regular income, while fine art micro-shares may yield higher long-term gains with greater market volatility.

Connection

Fine art micro-shares and REITs (Real Estate Investment Trusts) both offer fractional ownership models, enabling investors to diversify portfolios without purchasing entire assets. These investment vehicles provide liquidity and access to traditionally illiquid markets such as high-value artworks and real estate properties. By leveraging blockchain technology and regulated platforms, both micro-shares and REITs facilitate transparent, accessible, and scalable investment opportunities.

Key Terms

Liquidity

REITs offer higher liquidity compared to fine art micro-shares due to their trading on major stock exchanges, enabling investors to buy or sell shares quickly. Fine art micro-shares, while providing fractional ownership in valuable artworks, often face limited secondary market activity and longer holding periods, reducing liquidity. Explore the distinct liquidity profiles of both investment types to optimize your portfolio strategy.

Diversification

REITs (Real Estate Investment Trusts) offer investors diversified exposure to income-generating real estate assets, including commercial properties, residential buildings, and industrial spaces, often providing steady dividends and liquidity. Fine art micro-shares allow investors to own fractional interests in valuable artworks, diversifying portfolios with non-traditional assets that are less correlated with financial markets but may lack regular income streams. Explore how combining REITs and fine art micro-shares can optimize portfolio diversification and risk management in alternative investments.

Regulation

REITs operate under stringent regulations governed by the SEC and must distribute at least 90% of taxable income as dividends, ensuring investor protection and consistent income. Fine art micro-shares, often traded on emerging platforms, face less standardized regulation, creating potential risks related to transparency and valuation. Explore the regulatory landscape further to understand the implications of investing in these alternative assets.

Source and External Links

Real estate investment trust - A REIT is a company that owns and typically operates income-producing real estate, including offices, apartments, hospitals, and more; they can be publicly traded or private, and are categorized mainly into equity and mortgage REITs with tax advantages under many countries' laws.

What's a REIT (Real Estate Investment Trust)? - REITs are companies that own, operate, or finance income-producing real estate, providing investors with regular income, diversification, and potential long-term capital appreciation, often trading on major stock exchanges.

Real Estate Investment Trusts (REITs) - REITs allow individuals to invest in large-scale income-producing real estate like shopping malls or apartments without directly buying properties; they can be publicly traded or non-traded with different risk profiles.

dowidth.com

dowidth.com