Whisky cask investment offers a unique blend of tangible asset growth and market appreciation driven by scarcity and aging quality, while gold investment provides time-tested stability and liquidity in global markets. Both assets serve as hedges against inflation, with whisky casks appealing to collectors and connoisseurs seeking alternative asset diversification and gold favored for its universal acceptance and historical value retention. Explore the comparative advantages and risks of whisky cask and gold investment to optimize your portfolio strategy.

Why it is important

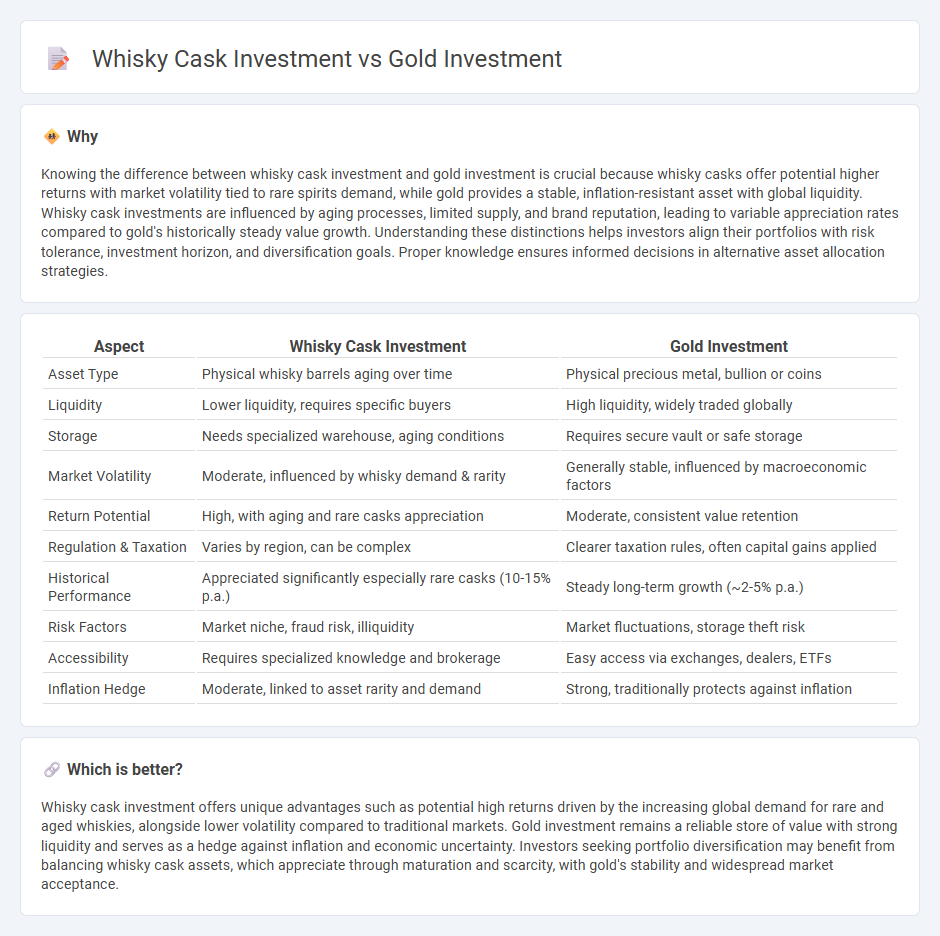

Knowing the difference between whisky cask investment and gold investment is crucial because whisky casks offer potential higher returns with market volatility tied to rare spirits demand, while gold provides a stable, inflation-resistant asset with global liquidity. Whisky cask investments are influenced by aging processes, limited supply, and brand reputation, leading to variable appreciation rates compared to gold's historically steady value growth. Understanding these distinctions helps investors align their portfolios with risk tolerance, investment horizon, and diversification goals. Proper knowledge ensures informed decisions in alternative asset allocation strategies.

Comparison Table

| Aspect | Whisky Cask Investment | Gold Investment |

|---|---|---|

| Asset Type | Physical whisky barrels aging over time | Physical precious metal, bullion or coins |

| Liquidity | Lower liquidity, requires specific buyers | High liquidity, widely traded globally |

| Storage | Needs specialized warehouse, aging conditions | Requires secure vault or safe storage |

| Market Volatility | Moderate, influenced by whisky demand & rarity | Generally stable, influenced by macroeconomic factors |

| Return Potential | High, with aging and rare casks appreciation | Moderate, consistent value retention |

| Regulation & Taxation | Varies by region, can be complex | Clearer taxation rules, often capital gains applied |

| Historical Performance | Appreciated significantly especially rare casks (10-15% p.a.) | Steady long-term growth (~2-5% p.a.) |

| Risk Factors | Market niche, fraud risk, illiquidity | Market fluctuations, storage theft risk |

| Accessibility | Requires specialized knowledge and brokerage | Easy access via exchanges, dealers, ETFs |

| Inflation Hedge | Moderate, linked to asset rarity and demand | Strong, traditionally protects against inflation |

Which is better?

Whisky cask investment offers unique advantages such as potential high returns driven by the increasing global demand for rare and aged whiskies, alongside lower volatility compared to traditional markets. Gold investment remains a reliable store of value with strong liquidity and serves as a hedge against inflation and economic uncertainty. Investors seeking portfolio diversification may benefit from balancing whisky cask assets, which appreciate through maturation and scarcity, with gold's stability and widespread market acceptance.

Connection

Whisky cask investment and gold investment both serve as alternative assets that hedge against inflation and economic uncertainty by preserving value over time. Investors seeking portfolio diversification often allocate funds to whisky casks, which appreciate through aging and limited supply, similar to gold's status as a tangible, scarce commodity. Both markets exhibit strong ties to rarity and tangible asset backing, attracting investors looking for stable, long-term growth beyond traditional stocks and bonds.

Key Terms

Liquidity

Gold investment offers high liquidity due to its widespread market acceptance, allowing quick conversion to cash with minimal price fluctuation. Whisky cask investment, while potentially lucrative, typically involves longer holding periods and limited marketbuyers, making it less liquid than gold. Explore detailed comparisons to understand the liquidity differences and identify the best fit for your investment strategy.

Storage/security

Gold investment offers unparalleled security due to its physical durability and ease of storage in bank vaults or secure facilities, minimizing theft risks. Whisky cask investment requires specialized storage conditions, including temperature and humidity control, along with the need for bonded warehouses to comply with legal regulations, which can add complexity and cost. Explore more about the storage and security considerations of gold and whisky cask investments to make informed decisions.

Market valuation

Gold investment remains a globally recognized store of value, with market valuations driven by safe-haven demand, geopolitical tensions, and central bank reserves, currently trading around $2,000 per ounce. Whisky cask investment, by contrast, is emerging as an alternative asset, with valuations influenced by vintage scarcity, brand prestige, and maturation quality, often yielding higher returns in luxury niche markets. Explore the evolving market dynamics and valuation factors shaping these two distinct investment avenues.

Source and External Links

How to Buy Gold to Diversify Your Portfolio - Gold can be bought as physical bars or coins, through stocks of gold mining companies, or gold ETFs, serving as a portfolio diversifier with low correlation to traditional assets like stocks and bonds.

How To Invest In Different Gold Assets - Gold investments play key roles such as portfolio diversification, providing long-term returns, liquidity with no credit risk, and potentially enhancing overall portfolio performance with allocations between 4% and 15% recommended.

How to buy gold: 2 ways to invest in gold - Investors can acquire gold either as physical gold (bars, coins) or via financial gold investments like ETFs, mutual funds, futures, and stocks, each with distinct risks and complexities.

dowidth.com

dowidth.com