Wine cask aging and farmland investments offer distinct value propositions, with wine casks appreciating through maturation and rarity, while farmland provides tangible assets with crop yield and land appreciation potential. Wine cask aging capitalizes on the controlled environment and time-driven quality enhancement, impacting market prices significantly. Explore the dynamics of these investment avenues to optimize your portfolio strategies.

Why it is important

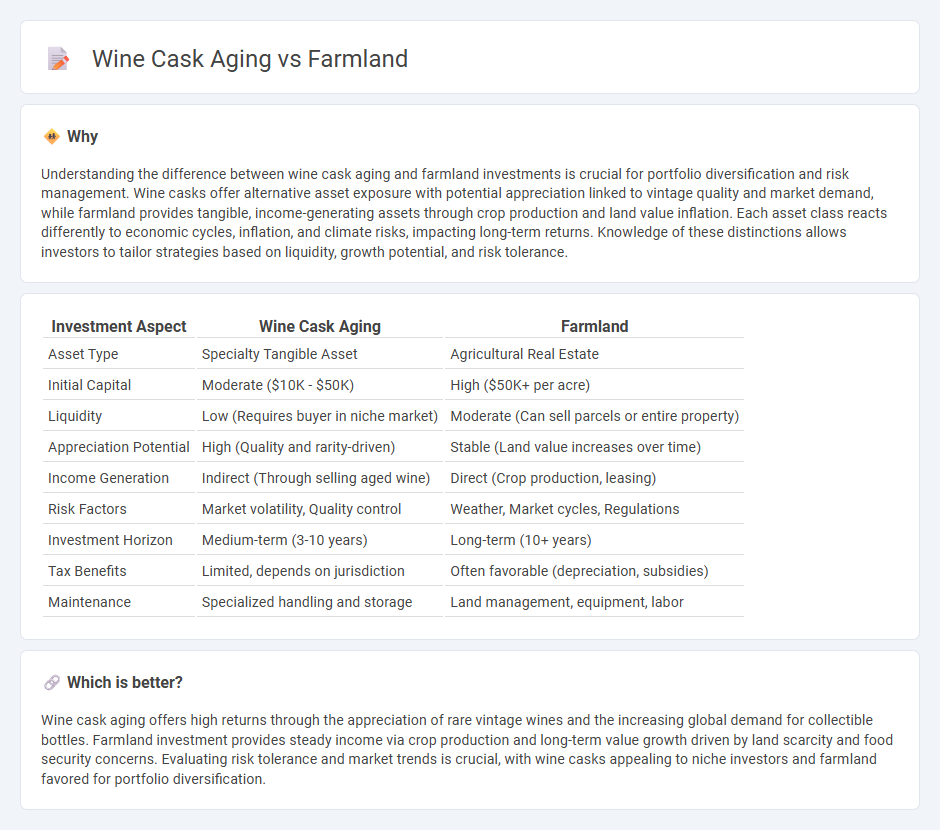

Understanding the difference between wine cask aging and farmland investments is crucial for portfolio diversification and risk management. Wine casks offer alternative asset exposure with potential appreciation linked to vintage quality and market demand, while farmland provides tangible, income-generating assets through crop production and land value inflation. Each asset class reacts differently to economic cycles, inflation, and climate risks, impacting long-term returns. Knowledge of these distinctions allows investors to tailor strategies based on liquidity, growth potential, and risk tolerance.

Comparison Table

| Investment Aspect | Wine Cask Aging | Farmland |

|---|---|---|

| Asset Type | Specialty Tangible Asset | Agricultural Real Estate |

| Initial Capital | Moderate ($10K - $50K) | High ($50K+ per acre) |

| Liquidity | Low (Requires buyer in niche market) | Moderate (Can sell parcels or entire property) |

| Appreciation Potential | High (Quality and rarity-driven) | Stable (Land value increases over time) |

| Income Generation | Indirect (Through selling aged wine) | Direct (Crop production, leasing) |

| Risk Factors | Market volatility, Quality control | Weather, Market cycles, Regulations |

| Investment Horizon | Medium-term (3-10 years) | Long-term (10+ years) |

| Tax Benefits | Limited, depends on jurisdiction | Often favorable (depreciation, subsidies) |

| Maintenance | Specialized handling and storage | Land management, equipment, labor |

Which is better?

Wine cask aging offers high returns through the appreciation of rare vintage wines and the increasing global demand for collectible bottles. Farmland investment provides steady income via crop production and long-term value growth driven by land scarcity and food security concerns. Evaluating risk tolerance and market trends is crucial, with wine casks appealing to niche investors and farmland favored for portfolio diversification.

Connection

Investment in wine cask aging and farmland intersects through the appreciation of tangible assets that benefit from natural growth cycles and exclusive production processes. Farmland serves as a critical resource for cultivating vineyards, directly impacting the quality and quantity of grapes used in wine production, while wine cask aging enhances the value of the final product by improving its flavor profile and market price. Both assets offer investors diversification, protection against inflation, and potential long-term returns rooted in agricultural productivity and artisanal craftsmanship.

Key Terms

Asset Appreciation

Farmland investment offers tangible asset appreciation through land value increases driven by agricultural productivity and demand for arable land, providing steady, long-term growth. Wine cask aging enhances value by developing unique vintage characteristics that attract collectors and connoisseurs, often leading to significant appreciation based on rarity and quality. Explore the comparative benefits of farmland and wine cask aging to optimize your asset appreciation strategy.

Liquidity

Farmland investment generally offers lower liquidity compared to wine cask aging, as real estate transactions can take weeks or months to complete while wine casks may be bought and sold more quickly in niche markets. Wine cask aging benefits from shorter holding periods and auction platforms that enhance liquidity, allowing investors to convert assets to cash with less delay. Explore the nuances of these asset classes to determine the best fit for your liquidity needs.

Yield Potential

Yield potential in farmland directly impacts grape production volumes, influencing the quantity of wine that can be aged in wine casks. Optimizing soil fertility, irrigation, and vineyard management enhances grape yield, thereby ensuring consistent supply for barrel aging processes that develop wine complexity. Explore how maximizing yield potential ties into superior wine maturation techniques by learning more about vineyard-to-cask strategies.

Source and External Links

Land Use, Land Value & Tenure - Farmland Ownership and Tenure - A majority of U.S. farmland is owner-operated (over 60%), with trends in ownership and tenure influencing farm decisions, production, and conservation, based on USDA's 2022 data and surveys.

Agricultural land - Agricultural land represents 38.4% of the world's land area, including arable land, permanent pastures, and permanent crops, with a global reduction noted in recent years from 4.79 to 4.78 billion hectares by 2022.

American Farmland Trust - An organization dedicated to protecting and sustaining farmland in the U.S., promoting sound farming practices, and supporting farmers to maintain agricultural land for future generations.

dowidth.com

dowidth.com