Rare whisky bottles trading offers a lucrative investment avenue characterized by limited supply, historical significance, and increasing global demand. First edition books hold value driven by rarity, author prominence, and condition, attracting collectors and literary enthusiasts. Explore the unique market dynamics and potential returns of both rare whisky and first edition book investments.

Why it is important

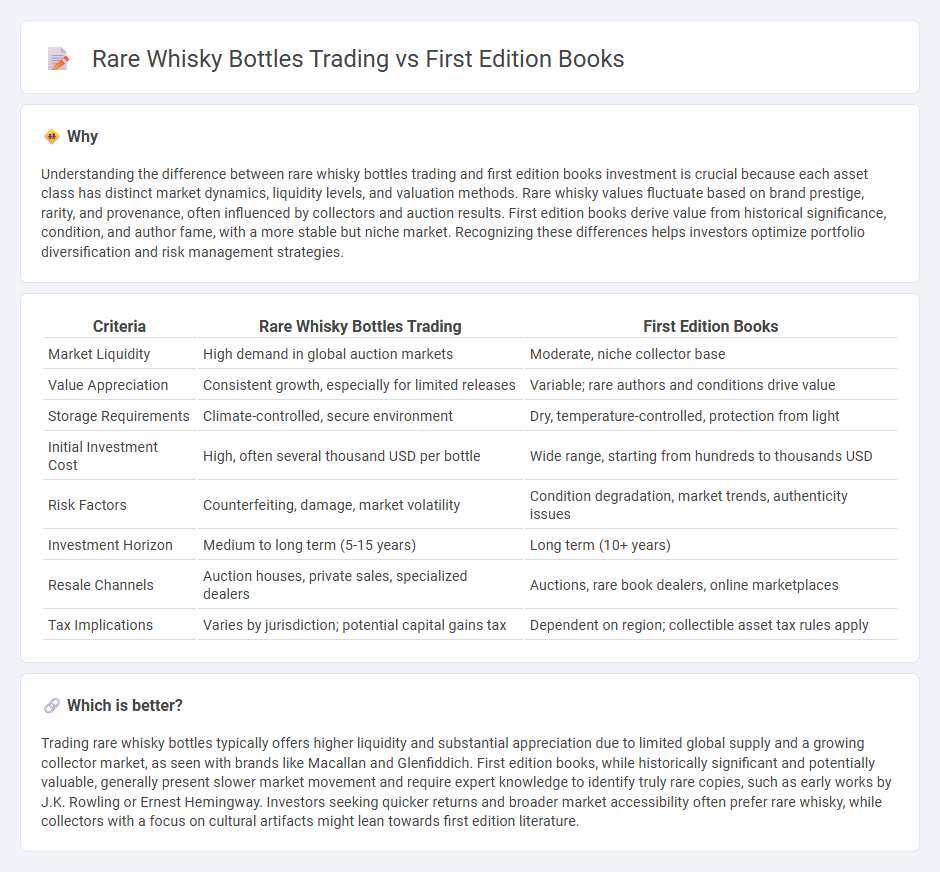

Understanding the difference between rare whisky bottles trading and first edition books investment is crucial because each asset class has distinct market dynamics, liquidity levels, and valuation methods. Rare whisky values fluctuate based on brand prestige, rarity, and provenance, often influenced by collectors and auction results. First edition books derive value from historical significance, condition, and author fame, with a more stable but niche market. Recognizing these differences helps investors optimize portfolio diversification and risk management strategies.

Comparison Table

| Criteria | Rare Whisky Bottles Trading | First Edition Books |

|---|---|---|

| Market Liquidity | High demand in global auction markets | Moderate, niche collector base |

| Value Appreciation | Consistent growth, especially for limited releases | Variable; rare authors and conditions drive value |

| Storage Requirements | Climate-controlled, secure environment | Dry, temperature-controlled, protection from light |

| Initial Investment Cost | High, often several thousand USD per bottle | Wide range, starting from hundreds to thousands USD |

| Risk Factors | Counterfeiting, damage, market volatility | Condition degradation, market trends, authenticity issues |

| Investment Horizon | Medium to long term (5-15 years) | Long term (10+ years) |

| Resale Channels | Auction houses, private sales, specialized dealers | Auctions, rare book dealers, online marketplaces |

| Tax Implications | Varies by jurisdiction; potential capital gains tax | Dependent on region; collectible asset tax rules apply |

Which is better?

Trading rare whisky bottles typically offers higher liquidity and substantial appreciation due to limited global supply and a growing collector market, as seen with brands like Macallan and Glenfiddich. First edition books, while historically significant and potentially valuable, generally present slower market movement and require expert knowledge to identify truly rare copies, such as early works by J.K. Rowling or Ernest Hemingway. Investors seeking quicker returns and broader market accessibility often prefer rare whisky, while collectors with a focus on cultural artifacts might lean towards first edition literature.

Connection

Rare whisky bottles and first edition books share a thriving investment market driven by scarcity, provenance, and cultural significance. Collectors seek these tangible assets for their potential to appreciate over time, with auction records demonstrating consistent value growth in both sectors. Both investment categories benefit from expert authentication and historical relevance, which enhance their desirability among niche collectors and investors.

Key Terms

Provenance

Provenance plays a crucial role in the trading of first edition books and rare whisky bottles, as it authenticates origin and ownership history, directly impacting value and desirability. Collectors prioritize documented lineage to ensure rarity and uniqueness, enhancing investment potential and prestige. Explore more about how provenance influences market dynamics and value differentiation in collectible trading.

Authenticity

Authenticity plays a crucial role in trading both first edition books and rare whisky bottles, ensuring provenance and condition align with collector standards. First edition books are verified through publisher marks, print runs, and historical documentation, while rare whisky bottles rely on sealed packaging, distillery records, and limited release verification. Explore detailed authentication methods to enhance your trading expertise.

Market Liquidity

Market liquidity in first edition books tends to be lower compared to rare whisky bottles due to narrower buyer pools and slower transaction velocities. Rare whisky bottles benefit from a growing global collector base and easier valuation through auction results, enhancing market fluidity. Explore our detailed analysis to understand liquidity dynamics and investment potential in these unique asset classes.

Source and External Links

First Edition Books - This webpage provides information on first edition books, including their definition and how to find them for collection.

Identifying First Editions - This article explains the difference between first editions and first printings, along with tips for identifying them.

First Edition Books at Sotheby's - Offers a selection of first edition books, including signed and notable modern first editions from famous authors.

dowidth.com

dowidth.com