Spice trading involves the direct exchange of commodities like cinnamon, pepper, and cardamom, capitalizing on global demand and supply fluctuations to generate profits. Private equity focuses on investing in private companies through capital infusion, aiming to enhance business growth and achieve high returns upon exit. Explore the distinct advantages and risks of spice trading versus private equity to determine which investment aligns with your financial goals.

Why it is important

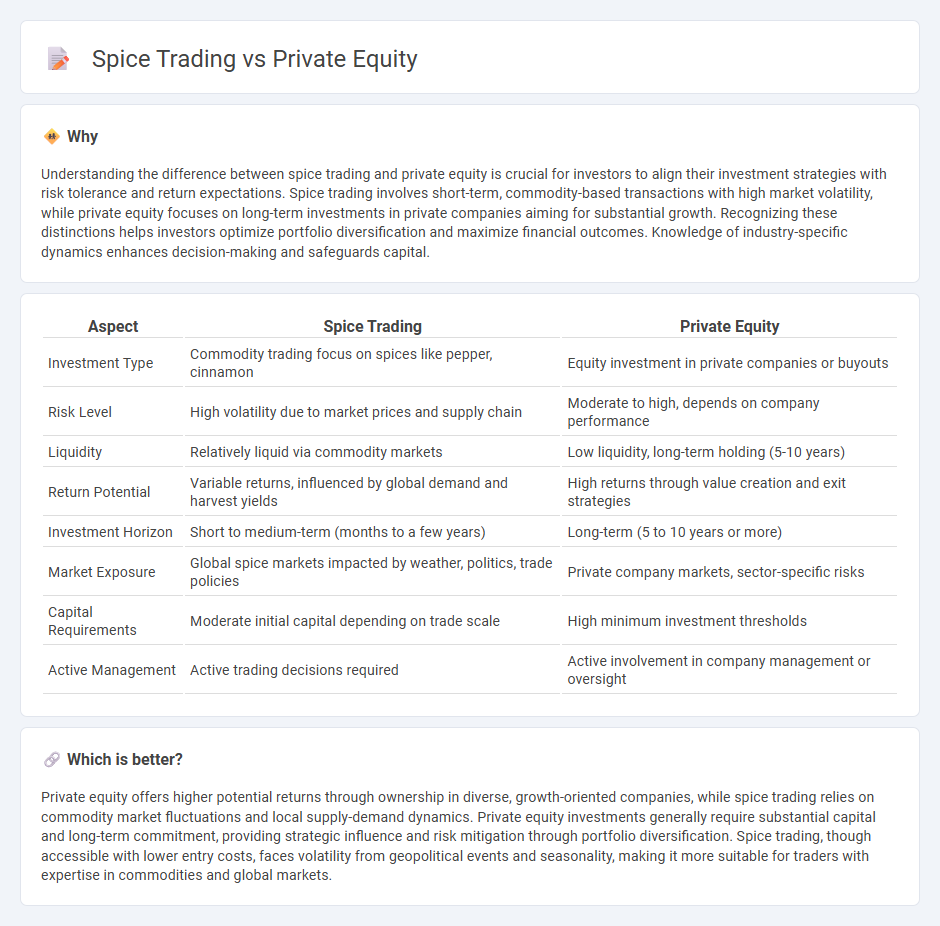

Understanding the difference between spice trading and private equity is crucial for investors to align their investment strategies with risk tolerance and return expectations. Spice trading involves short-term, commodity-based transactions with high market volatility, while private equity focuses on long-term investments in private companies aiming for substantial growth. Recognizing these distinctions helps investors optimize portfolio diversification and maximize financial outcomes. Knowledge of industry-specific dynamics enhances decision-making and safeguards capital.

Comparison Table

| Aspect | Spice Trading | Private Equity |

|---|---|---|

| Investment Type | Commodity trading focus on spices like pepper, cinnamon | Equity investment in private companies or buyouts |

| Risk Level | High volatility due to market prices and supply chain | Moderate to high, depends on company performance |

| Liquidity | Relatively liquid via commodity markets | Low liquidity, long-term holding (5-10 years) |

| Return Potential | Variable returns, influenced by global demand and harvest yields | High returns through value creation and exit strategies |

| Investment Horizon | Short to medium-term (months to a few years) | Long-term (5 to 10 years or more) |

| Market Exposure | Global spice markets impacted by weather, politics, trade policies | Private company markets, sector-specific risks |

| Capital Requirements | Moderate initial capital depending on trade scale | High minimum investment thresholds |

| Active Management | Active trading decisions required | Active involvement in company management or oversight |

Which is better?

Private equity offers higher potential returns through ownership in diverse, growth-oriented companies, while spice trading relies on commodity market fluctuations and local supply-demand dynamics. Private equity investments generally require substantial capital and long-term commitment, providing strategic influence and risk mitigation through portfolio diversification. Spice trading, though accessible with lower entry costs, faces volatility from geopolitical events and seasonality, making it more suitable for traders with expertise in commodities and global markets.

Connection

Spice trading historically laid the foundation for global commerce by establishing trade routes and financial networks that early investors leveraged for capital growth. Private equity firms often analyze such commodity markets, including spice trading, to identify investment opportunities in supply chains and emerging markets. The strategic insights from spice trade dynamics enhance private equity decisions by revealing patterns in demand, risk management, and international market trends.

Key Terms

Deal Sourcing

Deal sourcing in private equity relies heavily on extensive networks, proprietary databases, and relationships with investment bankers, aiming to identify undervalued companies with strong growth potential. In spice trading, deal sourcing focuses on cultivating connections with farmers, exporters, and commodity brokers to secure quality products at competitive prices amidst volatile market conditions. Explore deeper strategies and case studies in deal sourcing for both industries to enhance your market approach.

Risk Management

Private equity investments demand rigorous risk management frameworks to mitigate market volatility, liquidity constraints, and regulatory uncertainties. Spice trading involves dynamic risk controls centered on commodity price fluctuations, supply chain interruptions, and geopolitical factors influencing trade routes. Explore comprehensive strategies to optimize risk management in both private equity and spice trading markets.

Exit Strategy

Private equity exit strategies primarily involve initial public offerings (IPOs), strategic sales, or secondary buyouts, targeting liquidity events that maximize investor returns within a 5-10 year horizon. In contrast, spice trading exit strategies depend on market demand fluctuations, inventory liquidation, and long-term contracts to optimize profit margins in commodity markets. Explore detailed comparisons to understand how these strategies shape investment decisions and risk management practices.

Source and External Links

Private Equity - Wikipedia - Private equity involves investing in non-publicly traded companies through specialized funds, aiming to enhance their value over time.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance in exchange for equity stakes in potentially high-growth private companies, often supporting business growth through active management.

Private Equity: What You Need to Know - KKR - Private equity strategies focus on enhancing the performance of portfolio companies by strengthening management, acquiring new businesses, and optimizing operations.

dowidth.com

dowidth.com