Carbon credits trading enables investors to buy and sell emission allowances to offset carbon footprints while stimulating green projects, offering potential financial returns linked to environmental impact. Energy efficiency funds focus capital on projects that reduce energy consumption and operational costs, promoting sustainable practices across industries with measurable savings. Explore the distinctions and benefits of carbon credits trading versus energy efficiency funds to optimize your sustainable investment portfolio.

Why it is important

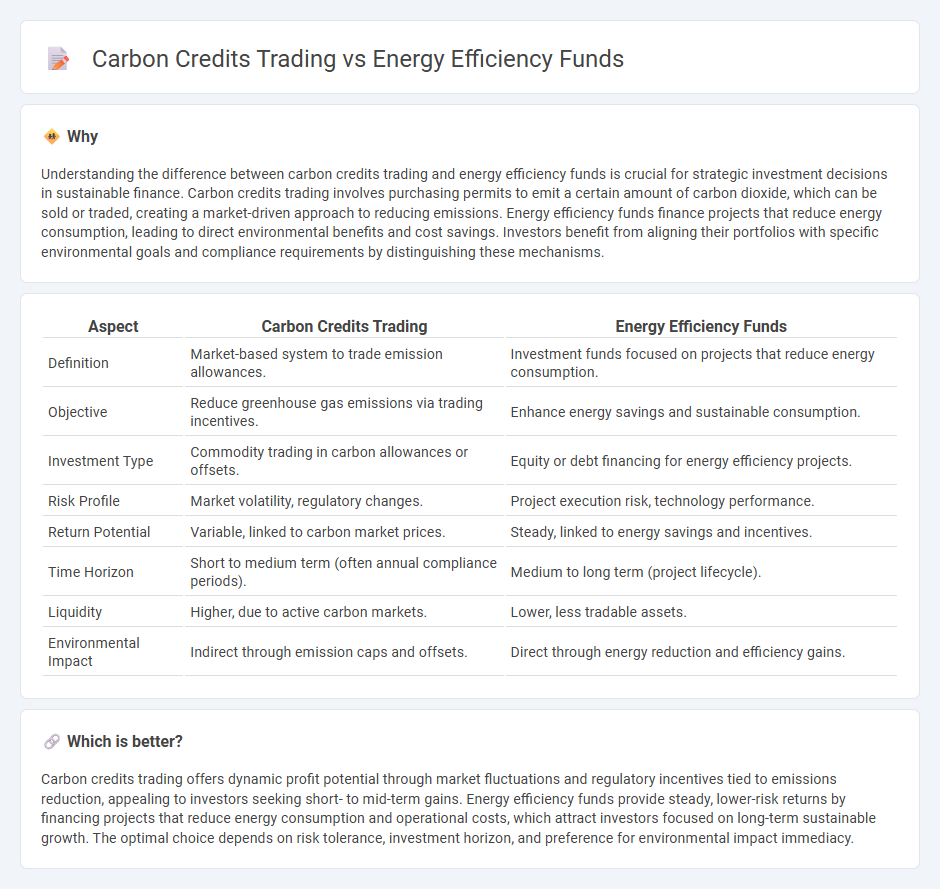

Understanding the difference between carbon credits trading and energy efficiency funds is crucial for strategic investment decisions in sustainable finance. Carbon credits trading involves purchasing permits to emit a certain amount of carbon dioxide, which can be sold or traded, creating a market-driven approach to reducing emissions. Energy efficiency funds finance projects that reduce energy consumption, leading to direct environmental benefits and cost savings. Investors benefit from aligning their portfolios with specific environmental goals and compliance requirements by distinguishing these mechanisms.

Comparison Table

| Aspect | Carbon Credits Trading | Energy Efficiency Funds |

|---|---|---|

| Definition | Market-based system to trade emission allowances. | Investment funds focused on projects that reduce energy consumption. |

| Objective | Reduce greenhouse gas emissions via trading incentives. | Enhance energy savings and sustainable consumption. |

| Investment Type | Commodity trading in carbon allowances or offsets. | Equity or debt financing for energy efficiency projects. |

| Risk Profile | Market volatility, regulatory changes. | Project execution risk, technology performance. |

| Return Potential | Variable, linked to carbon market prices. | Steady, linked to energy savings and incentives. |

| Time Horizon | Short to medium term (often annual compliance periods). | Medium to long term (project lifecycle). |

| Liquidity | Higher, due to active carbon markets. | Lower, less tradable assets. |

| Environmental Impact | Indirect through emission caps and offsets. | Direct through energy reduction and efficiency gains. |

Which is better?

Carbon credits trading offers dynamic profit potential through market fluctuations and regulatory incentives tied to emissions reduction, appealing to investors seeking short- to mid-term gains. Energy efficiency funds provide steady, lower-risk returns by financing projects that reduce energy consumption and operational costs, which attract investors focused on long-term sustainable growth. The optimal choice depends on risk tolerance, investment horizon, and preference for environmental impact immediacy.

Connection

Carbon credits trading incentivizes companies to reduce emissions by assigning a monetary value to carbon reductions, which aligns with the goals of energy efficiency funds that finance projects minimizing energy consumption. Investment in energy efficiency improves sustainability metrics, increasing the availability and value of carbon credits for participating entities. This synergy drives market demand for green technologies, fostering a cycle of reduced carbon footprints and enhanced investment returns in both sectors.

Key Terms

Return on Investment (ROI)

Energy efficiency funds channel capital into projects that reduce energy consumption, yielding measurable cost savings and a predictable ROI through lowered utility bills and operational costs. Carbon credits trading involves buying and selling emission allowances, where ROI depends on market price fluctuations and regulatory frameworks, often introducing higher financial volatility. Explore detailed comparisons to understand which approach aligns best with your financial goals and sustainability strategy.

Emissions Reduction

Energy efficiency funds allocate capital directly to projects that reduce energy consumption and lower greenhouse gas emissions, targeting measurable improvements in building performance, industrial processes, and transportation. Carbon credits trading operates as a market mechanism, allowing entities to buy and sell emission allowances to meet regulatory caps, incentivizing reductions where they are most cost-effective. Discover how these approaches complement each other in achieving comprehensive emissions reduction strategies.

Compliance Markets

Energy efficiency funds target reducing energy consumption through investments in sustainable technologies, directly lowering greenhouse gas emissions within compliance markets. Carbon credits trading enables companies to meet regulatory requirements by buying or selling emission allowances, creating financial incentives to stay within carbon limits. Explore the mechanisms and benefits of these compliance market tools to better understand their impact on emission reduction strategies.

Source and External Links

Energy Efficiency and Conservation Loan Program - Provides funds to expand energy efficiency and conservation efforts, including measures like energy audits, consumer education, and renewable energy systems, specifically supporting rural electric cooperatives to save money and reduce emissions.

Municipal & Federal Opportunities - Describes federal funding options like the Energy Efficiency and Conservation Block Formula Grant Program and Investment Tax Credits that local and tribal governments can use to reduce energy costs and support renewable energy projects, with potential credits up to 70% for eligible investments.

Finance Energy-Efficiency Projects - Summarizes various financing options for energy efficiency through grants, rebates, loans, and utility incentives available to commercial buildings and industrial plants to support project capital and energy performance upgrades.

dowidth.com

dowidth.com