Livestock investment platforms offer opportunities to invest in animals such as cattle, sheep, and poultry, providing diversification through tangible biological assets that generate income via breeding, milk, or meat production. Precious metals investment platforms focus on assets like gold, silver, and platinum, known for their liquidity, inflation hedging, and long-term value preservation. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

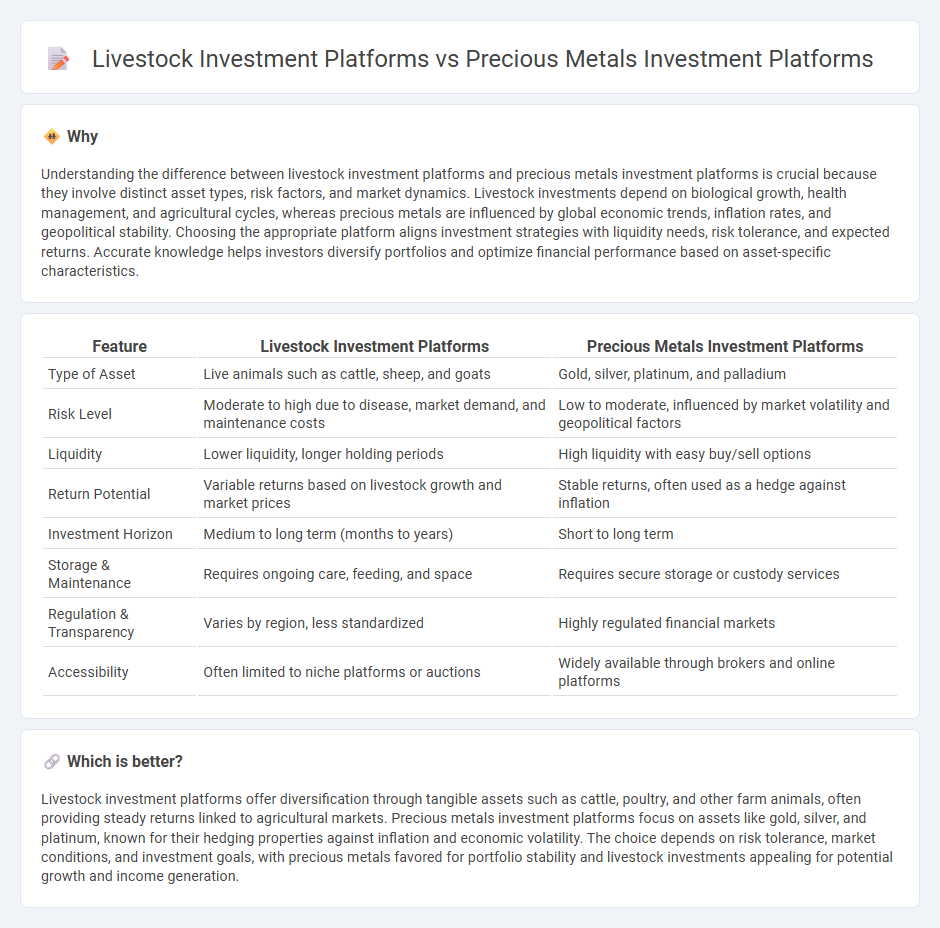

Understanding the difference between livestock investment platforms and precious metals investment platforms is crucial because they involve distinct asset types, risk factors, and market dynamics. Livestock investments depend on biological growth, health management, and agricultural cycles, whereas precious metals are influenced by global economic trends, inflation rates, and geopolitical stability. Choosing the appropriate platform aligns investment strategies with liquidity needs, risk tolerance, and expected returns. Accurate knowledge helps investors diversify portfolios and optimize financial performance based on asset-specific characteristics.

Comparison Table

| Feature | Livestock Investment Platforms | Precious Metals Investment Platforms |

|---|---|---|

| Type of Asset | Live animals such as cattle, sheep, and goats | Gold, silver, platinum, and palladium |

| Risk Level | Moderate to high due to disease, market demand, and maintenance costs | Low to moderate, influenced by market volatility and geopolitical factors |

| Liquidity | Lower liquidity, longer holding periods | High liquidity with easy buy/sell options |

| Return Potential | Variable returns based on livestock growth and market prices | Stable returns, often used as a hedge against inflation |

| Investment Horizon | Medium to long term (months to years) | Short to long term |

| Storage & Maintenance | Requires ongoing care, feeding, and space | Requires secure storage or custody services |

| Regulation & Transparency | Varies by region, less standardized | Highly regulated financial markets |

| Accessibility | Often limited to niche platforms or auctions | Widely available through brokers and online platforms |

Which is better?

Livestock investment platforms offer diversification through tangible assets such as cattle, poultry, and other farm animals, often providing steady returns linked to agricultural markets. Precious metals investment platforms focus on assets like gold, silver, and platinum, known for their hedging properties against inflation and economic volatility. The choice depends on risk tolerance, market conditions, and investment goals, with precious metals favored for portfolio stability and livestock investments appealing for potential growth and income generation.

Connection

Livestock investment platforms and precious metals investment platforms are connected through their roles as alternative asset classes that diversify investment portfolios and hedge against inflation. Both sectors provide tangible assets with intrinsic value, appealing to investors seeking stability in volatile markets. Integration of these platforms often enhances risk management and broadens market access for investors targeting real asset-based growth.

Key Terms

Precious metals investment platforms:

Precious metals investment platforms offer access to gold, silver, platinum, and palladium, providing investors with a hedge against inflation and currency fluctuations through physical bullion or digital tokens. These platforms often feature secure storage options, real-time market pricing, and easy liquidity, catering to both retail and institutional investors seeking to diversify portfolios with tangible assets. Explore how precious metals investment platforms can enhance your wealth strategy by learning more about their features and benefits.

Bullion

Precious metals investment platforms specializing in bullion offer direct ownership of physical gold, silver, platinum, and palladium, providing a tangible hedge against inflation and economic uncertainties. These platforms often feature secure storage options, market-linked pricing, and liquidity advantages compared to livestock investment platforms, which typically involve longer-term commitments and operational risks tied to animal health and market fluctuations. Explore the benefits and detailed comparisons of bullion investments to understand how they align with your financial goals.

Spot Price

Precious metals investment platforms provide real-time spot price data for gold, silver, platinum, and palladium, enabling investors to make informed decisions based on current market values and trends. Livestock investment platforms focus on the spot price of commodities like cattle and hogs, reflecting immediate market demand, feed costs, and seasonal trends affecting agricultural production. Explore more about how spot price fluctuations impact different investment strategies in precious metals and livestock markets.

Source and External Links

Best Gold and Silver App: Online Platforms for Precious Metal Investments - This article reviews top platforms like American Hartford Gold, Birch Gold Group, and Noble Gold Investments, highlighting their low minimum investments, quality customer service, flexible options, and strong buyback programs for investing in gold, silver, platinum, and palladium coins and bars.

BullionVault: Buy Gold, Silver and Platinum Bullion Online - BullionVault is a leading online platform providing access to professional bullion markets worldwide, with secure storage in major cities, low costs, and easy buying and selling for physical gold and silver investment.

GBI: Physical Precious Metals for Wealth Management - GBI offers real-time trading and secure storage of physical precious metals integrated with wealth management systems, targeting institutional clients and enabling portfolio diversification with metals like gold and silver.

dowidth.com

dowidth.com