Patent monetization generates revenue by licensing or selling intellectual property rights, leveraging innovations as tangible financial assets. Dividend investing focuses on acquiring stocks that provide regular income through profit-sharing distributions, offering steady cash flow and potential capital appreciation. Explore the distinct benefits and strategies of patent monetization versus dividend investing to optimize your financial growth.

Why it is important

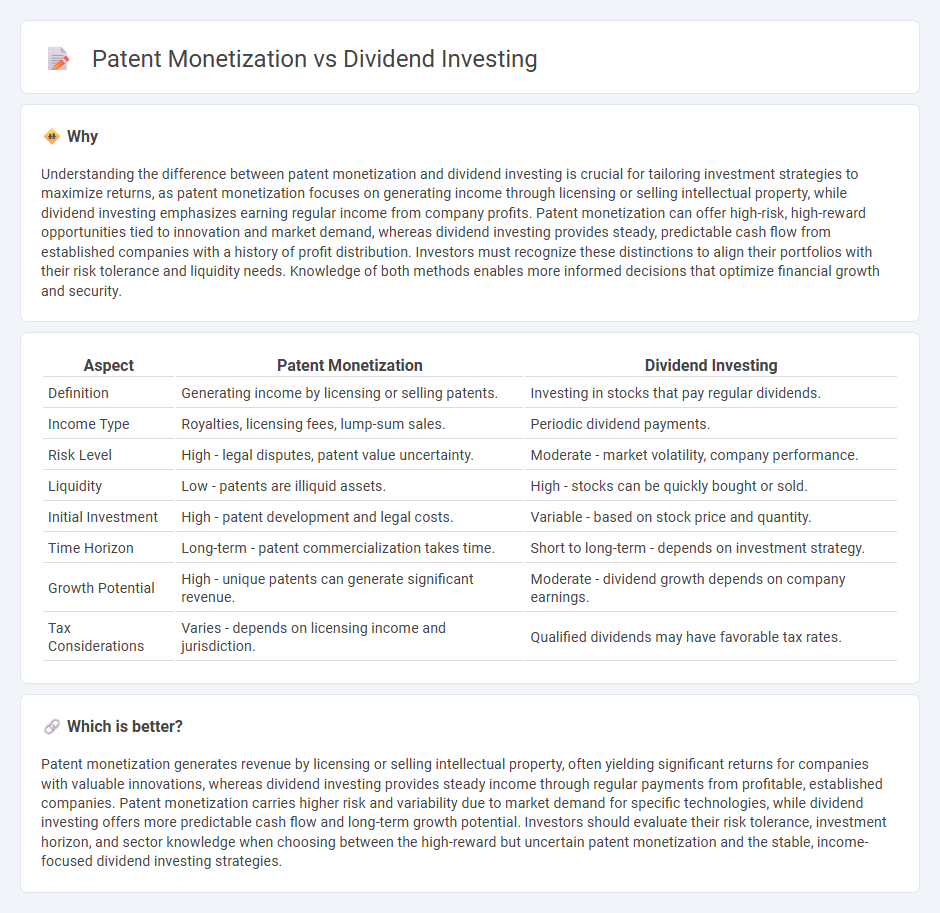

Understanding the difference between patent monetization and dividend investing is crucial for tailoring investment strategies to maximize returns, as patent monetization focuses on generating income through licensing or selling intellectual property, while dividend investing emphasizes earning regular income from company profits. Patent monetization can offer high-risk, high-reward opportunities tied to innovation and market demand, whereas dividend investing provides steady, predictable cash flow from established companies with a history of profit distribution. Investors must recognize these distinctions to align their portfolios with their risk tolerance and liquidity needs. Knowledge of both methods enables more informed decisions that optimize financial growth and security.

Comparison Table

| Aspect | Patent Monetization | Dividend Investing |

|---|---|---|

| Definition | Generating income by licensing or selling patents. | Investing in stocks that pay regular dividends. |

| Income Type | Royalties, licensing fees, lump-sum sales. | Periodic dividend payments. |

| Risk Level | High - legal disputes, patent value uncertainty. | Moderate - market volatility, company performance. |

| Liquidity | Low - patents are illiquid assets. | High - stocks can be quickly bought or sold. |

| Initial Investment | High - patent development and legal costs. | Variable - based on stock price and quantity. |

| Time Horizon | Long-term - patent commercialization takes time. | Short to long-term - depends on investment strategy. |

| Growth Potential | High - unique patents can generate significant revenue. | Moderate - dividend growth depends on company earnings. |

| Tax Considerations | Varies - depends on licensing income and jurisdiction. | Qualified dividends may have favorable tax rates. |

Which is better?

Patent monetization generates revenue by licensing or selling intellectual property, often yielding significant returns for companies with valuable innovations, whereas dividend investing provides steady income through regular payments from profitable, established companies. Patent monetization carries higher risk and variability due to market demand for specific technologies, while dividend investing offers more predictable cash flow and long-term growth potential. Investors should evaluate their risk tolerance, investment horizon, and sector knowledge when choosing between the high-reward but uncertain patent monetization and the stable, income-focused dividend investing strategies.

Connection

Patent monetization generates steady revenue streams through licensing fees and royalties, which can enhance a company's profitability and cash flow. Increased profitability often results in higher dividend payouts, making dividend investing an attractive strategy for shareholders seeking regular income. Investors combining patent monetization insights with dividend investing can identify companies with sustainable innovation-driven earnings and reliable dividend growth.

Key Terms

**Dividend investing:**

Dividend investing involves purchasing shares of companies that regularly distribute a portion of their profits as dividends, providing a steady income stream and potential for capital appreciation. Key sectors for dividend investing include utilities, consumer staples, and financials, known for stable cash flows and consistent payouts. Explore detailed strategies and benefits of dividend investing today.

Yield

Dividend investing offers consistent income streams through regular payouts from established companies, often yielding 2% to 5% annually based on stock performance. Patent monetization can potentially generate higher yields by licensing or selling intellectual property, but it carries greater risk and variability depending on innovation relevance and market demand. Explore the detailed comparison of yield potential and risk factors to optimize your investment strategy.

Payout Ratio

Dividend investing emphasizes companies with sustainable payout ratios, typically between 30% and 60%, ensuring reliable income without compromising growth potential. Patent monetization focuses on generating revenue through licensing and enforcement, with payout ratios varying widely based on litigation outcomes and licensing deals. Explore how payout ratios impact risk and returns in both strategies for smarter investment decisions.

Source and External Links

Is Dividend Investing Worth It? The Complete Guide - Dividend investing is a strategy focused on buying stocks from well-established companies that pay regular dividends, offering steady income streams along with potential capital gains, making it appealing for financial stability and growth.

How to Develop a Dividend Investing Strategy - Common dividend investing strategies include dividend growth, dividend value, and high-yield investing, with emphasis on assessing companies' financial health to avoid dividend traps and ensure long-term payout durability.

What is Dividend Investing & Qualified Dividends - Dividend investing involves buying stocks that pay regular dividends, providing returns from both capital appreciation and dividend income, with dividends being either qualified or ordinary for tax purposes.

dowidth.com

dowidth.com