Royalty rights investing involves purchasing a percentage of a company's future revenue streams, offering potential long-term passive income without ownership dilution. Debt investing requires lending capital to entities in exchange for fixed interest payments and principal repayment, typically providing lower risk and predictable returns. Explore the differences between these investment strategies to determine which aligns best with your financial goals.

Why it is important

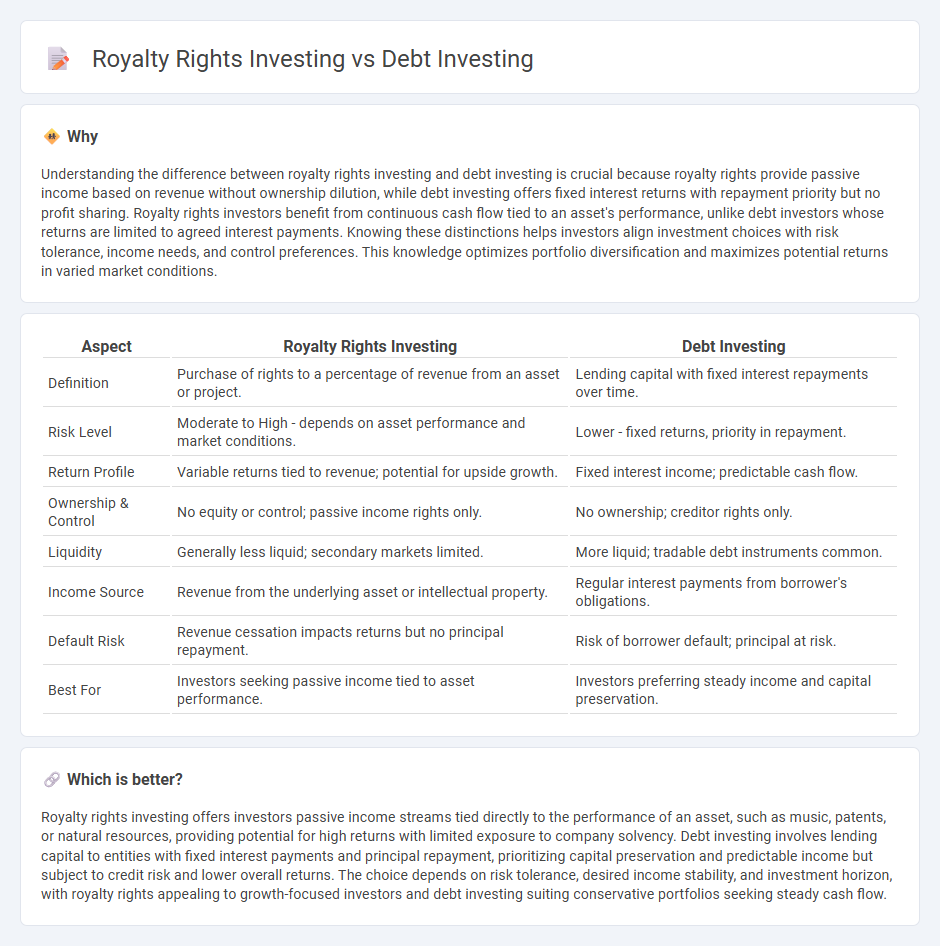

Understanding the difference between royalty rights investing and debt investing is crucial because royalty rights provide passive income based on revenue without ownership dilution, while debt investing offers fixed interest returns with repayment priority but no profit sharing. Royalty rights investors benefit from continuous cash flow tied to an asset's performance, unlike debt investors whose returns are limited to agreed interest payments. Knowing these distinctions helps investors align investment choices with risk tolerance, income needs, and control preferences. This knowledge optimizes portfolio diversification and maximizes potential returns in varied market conditions.

Comparison Table

| Aspect | Royalty Rights Investing | Debt Investing |

|---|---|---|

| Definition | Purchase of rights to a percentage of revenue from an asset or project. | Lending capital with fixed interest repayments over time. |

| Risk Level | Moderate to High - depends on asset performance and market conditions. | Lower - fixed returns, priority in repayment. |

| Return Profile | Variable returns tied to revenue; potential for upside growth. | Fixed interest income; predictable cash flow. |

| Ownership & Control | No equity or control; passive income rights only. | No ownership; creditor rights only. |

| Liquidity | Generally less liquid; secondary markets limited. | More liquid; tradable debt instruments common. |

| Income Source | Revenue from the underlying asset or intellectual property. | Regular interest payments from borrower's obligations. |

| Default Risk | Revenue cessation impacts returns but no principal repayment. | Risk of borrower default; principal at risk. |

| Best For | Investors seeking passive income tied to asset performance. | Investors preferring steady income and capital preservation. |

Which is better?

Royalty rights investing offers investors passive income streams tied directly to the performance of an asset, such as music, patents, or natural resources, providing potential for high returns with limited exposure to company solvency. Debt investing involves lending capital to entities with fixed interest payments and principal repayment, prioritizing capital preservation and predictable income but subject to credit risk and lower overall returns. The choice depends on risk tolerance, desired income stability, and investment horizon, with royalty rights appealing to growth-focused investors and debt investing suiting conservative portfolios seeking steady cash flow.

Connection

Royalty rights investing and debt investing are connected through their fixed-income characteristics, providing investors with predictable cash flows derived from revenue or principal repayments. Both strategies involve contractual agreements that ensure investors receive payments based on the borrower's or asset's financial performance. This linkage enables diversification within income-focused portfolios by combining the steady returns of debt instruments with the revenue-based earnings from royalty rights.

Key Terms

Principal (Debt)

Debt investing involves lending capital to borrowers with a contractual obligation to repay the principal plus interest, providing predictable income streams and principal protection. Royalty rights investing entitles investors to a percentage of revenue or production without principal repayment, creating variable returns based on asset performance. Explore how principal security impacts investment risk and yield profiles to make informed decisions.

Interest Rate (Debt)

Debt investing typically offers a fixed interest rate that provides predictable returns and lower risk, making it appealing for conservative investors seeking steady income. Royalty rights investing, in contrast, does not pay interest but generates variable income based on revenue performance, introducing higher risk and reward potential. Discover more about how interest rates impact debt investments compared to royalty rights for optimized portfolio strategies.

Revenue Share Percentage (Royalty Rights)

Revenue share percentage in royalty rights investing directly correlates to the investor's portion of a company's or product's gross revenues, providing a continuous income stream as long as the revenue is generated. In contrast, debt investing typically involves fixed interest payments independent of business performance, emphasizing principal repayment over revenue participation. Explore detailed comparisons of revenue share impacts on investment returns to optimize your portfolio strategy.

Source and External Links

Debt Investment (Supervest) - Debt investment involves lending money to companies or projects with the expectation of repayment plus interest, and common instruments include bonds, tax liens, and private loans, offering fixed-income returns with legal repayment obligations.

Investing in private debt (Mercer) - Private debt investing provides portfolio diversification and a yield premium over traditional fixed income, often with floating-rate loans that can offer some inflation protection and shorter investment cycles compared to private equity.

Distressed Debt Investing Basics - CAIS - Distressed debt investing targets companies in financial or operational distress, allowing investors to buy debt at significant discounts, with the strategy focused on restructuring and recovery, but carrying higher risk due to the borrower's potential for default or bankruptcy.

dowidth.com

dowidth.com