Royalty stream investing involves purchasing rights to receive a portion of revenue from intellectual property, natural resources, or other assets, providing consistent cash flow without ownership risks. Dividend investing focuses on acquiring shares in companies that distribute profits regularly, offering potential growth through capital appreciation alongside income. Explore the unique advantages and risks of these income-generating investment strategies to determine the best fit for your portfolio.

Why it is important

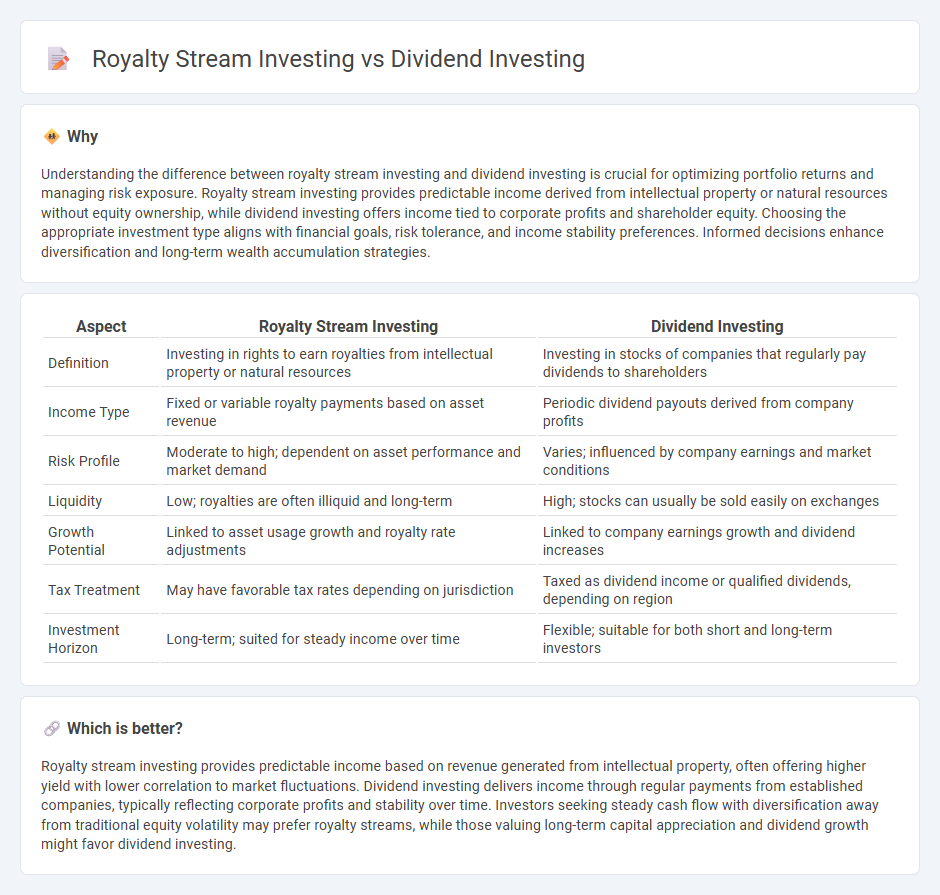

Understanding the difference between royalty stream investing and dividend investing is crucial for optimizing portfolio returns and managing risk exposure. Royalty stream investing provides predictable income derived from intellectual property or natural resources without equity ownership, while dividend investing offers income tied to corporate profits and shareholder equity. Choosing the appropriate investment type aligns with financial goals, risk tolerance, and income stability preferences. Informed decisions enhance diversification and long-term wealth accumulation strategies.

Comparison Table

| Aspect | Royalty Stream Investing | Dividend Investing |

|---|---|---|

| Definition | Investing in rights to earn royalties from intellectual property or natural resources | Investing in stocks of companies that regularly pay dividends to shareholders |

| Income Type | Fixed or variable royalty payments based on asset revenue | Periodic dividend payouts derived from company profits |

| Risk Profile | Moderate to high; dependent on asset performance and market demand | Varies; influenced by company earnings and market conditions |

| Liquidity | Low; royalties are often illiquid and long-term | High; stocks can usually be sold easily on exchanges |

| Growth Potential | Linked to asset usage growth and royalty rate adjustments | Linked to company earnings growth and dividend increases |

| Tax Treatment | May have favorable tax rates depending on jurisdiction | Taxed as dividend income or qualified dividends, depending on region |

| Investment Horizon | Long-term; suited for steady income over time | Flexible; suitable for both short and long-term investors |

Which is better?

Royalty stream investing provides predictable income based on revenue generated from intellectual property, often offering higher yield with lower correlation to market fluctuations. Dividend investing delivers income through regular payments from established companies, typically reflecting corporate profits and stability over time. Investors seeking steady cash flow with diversification away from traditional equity volatility may prefer royalty streams, while those valuing long-term capital appreciation and dividend growth might favor dividend investing.

Connection

Royalty stream investing and dividend investing are connected through their shared principle of generating passive income from ownership stakes in revenue-producing assets or companies. Both investment strategies provide investors with regular cash flows, royalty streams from intellectual property or natural resources, and dividends from corporate profits, respectively. This connection lies in their appeal to income-focused investors seeking consistent returns without actively managing the underlying business operations.

Key Terms

Yield

Dividend investing typically offers yields ranging from 2% to 6%, providing investors with steady income from company profits. Royalty stream investing can deliver higher yields, often between 8% and 15%, by receiving payments tied to asset revenue without operational control. Explore the nuances of yield generation in dividend and royalty stream investing to make informed decisions.

Passive income

Dividend investing generates passive income through regular payments from company profits, offering potential for capital appreciation and steady cash flow. Royalty stream investing provides passive income by earning a percentage of revenues from intellectual property or natural resource assets, often with lower market volatility. Explore deeper insights into both strategies to optimize your passive income portfolio.

Ownership rights

Dividend investing provides shareholders with partial ownership in a company, entitling them to a portion of the profits through dividends and potential voting rights. Royalty stream investing involves acquiring the rights to receive a percentage of revenue from a product, intellectual property, or natural resource without ownership in the underlying asset. Explore the nuances of ownership rights to determine which strategy aligns best with your investment goals.

Source and External Links

Is Dividend Investing Worth It? The Complete Guide - Dividend investing involves buying stocks that pay regular dividends, offering a steady income stream and potential capital gains, often favored for financial stability and growth through shares of well-established companies that distribute earnings regularly.

How to Develop a Dividend Investing Strategy - Common dividend strategies include dividend growth, value, and high-yield investing, focusing on companies with consistent dividend increases or high payout yields, combined with financial health assessments to ensure sustainable income streams.

A comprehensive guide to dividend investing - Saxo Bank - Dividend investing can provide steady income and long-term growth with a balanced, diversified portfolio emphasizing companies with solid financials and a reliable track record of dividend payments, often enhanced by dividend reinvestment plans (DRIPs) for compounding benefits.

dowidth.com

dowidth.com