Wine funds and forestry funds offer unique investment opportunities by capitalizing on the growth potential of tangible, appreciating assets in agriculture and natural resources. Wine funds focus on acquiring and managing valuable vineyards and wine inventories, benefiting from the global demand for premium wines, while forestry funds invest in timberland and forest management, leveraging carbon credits and sustainable harvesting revenue. Explore the distinct advantages and risks of each fund type to determine the best fit for your investment portfolio.

Why it is important

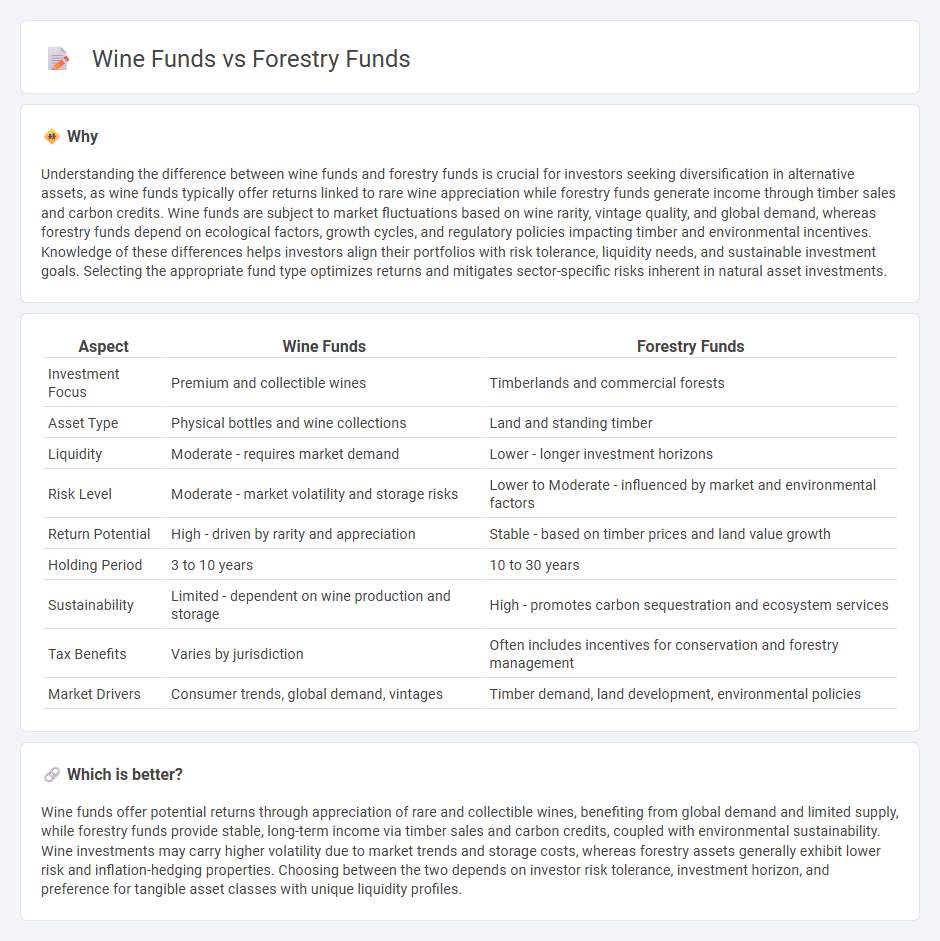

Understanding the difference between wine funds and forestry funds is crucial for investors seeking diversification in alternative assets, as wine funds typically offer returns linked to rare wine appreciation while forestry funds generate income through timber sales and carbon credits. Wine funds are subject to market fluctuations based on wine rarity, vintage quality, and global demand, whereas forestry funds depend on ecological factors, growth cycles, and regulatory policies impacting timber and environmental incentives. Knowledge of these differences helps investors align their portfolios with risk tolerance, liquidity needs, and sustainable investment goals. Selecting the appropriate fund type optimizes returns and mitigates sector-specific risks inherent in natural asset investments.

Comparison Table

| Aspect | Wine Funds | Forestry Funds |

|---|---|---|

| Investment Focus | Premium and collectible wines | Timberlands and commercial forests |

| Asset Type | Physical bottles and wine collections | Land and standing timber |

| Liquidity | Moderate - requires market demand | Lower - longer investment horizons |

| Risk Level | Moderate - market volatility and storage risks | Lower to Moderate - influenced by market and environmental factors |

| Return Potential | High - driven by rarity and appreciation | Stable - based on timber prices and land value growth |

| Holding Period | 3 to 10 years | 10 to 30 years |

| Sustainability | Limited - dependent on wine production and storage | High - promotes carbon sequestration and ecosystem services |

| Tax Benefits | Varies by jurisdiction | Often includes incentives for conservation and forestry management |

| Market Drivers | Consumer trends, global demand, vintages | Timber demand, land development, environmental policies |

Which is better?

Wine funds offer potential returns through appreciation of rare and collectible wines, benefiting from global demand and limited supply, while forestry funds provide stable, long-term income via timber sales and carbon credits, coupled with environmental sustainability. Wine investments may carry higher volatility due to market trends and storage costs, whereas forestry assets generally exhibit lower risk and inflation-hedging properties. Choosing between the two depends on investor risk tolerance, investment horizon, and preference for tangible asset classes with unique liquidity profiles.

Connection

Wine funds and forestry funds both represent alternative investment vehicles focused on tangible assets with potential for long-term capital appreciation. These funds leverage the natural growth cycles of vineyards and forests, offering investors exposure to agricultural commodities and sustainable resource management. Their connection lies in shared characteristics such as asset longevity, inflation hedging potential, and participation in niche markets driven by environmental and luxury consumption trends.

Key Terms

**Forestry Funds:**

Forestry funds invest in sustainable timberland management, offering benefits like carbon sequestration, biodiversity conservation, and steady long-term returns through timber sales and land appreciation. These funds appeal to environmentally conscious investors seeking portfolio diversification and inflation hedging through natural asset exposure. Explore how forestry funds can align with your investment goals and ecological values for a resilient financial future.

Timberland

Timberland investments within forestry funds offer long-term capital appreciation driven by sustainable timber harvesting and land value appreciation, contrasting with wine funds that rely on vintage quality and market demand for rare wines. Forestry funds provide diversification benefits, steady cash flow through timber sales, and environmental impact advantages such as carbon sequestration. Explore detailed insights on how timberland assets contribute to portfolio resilience and ecological sustainability.

Carbon Credits

Forestry funds generate revenue through carbon credit trading by preserving and expanding forested areas that absorb CO2, while wine funds primarily rely on vineyard appreciation with limited direct involvement in carbon markets. The global carbon credit market is expected to exceed $100 billion by 2030, highlighting forestry funds' potential in sustainable investment and climate impact. Discover how integrating carbon credits can enhance your portfolio's environmental and financial returns.

Source and External Links

Exemplary Forestry Investment Fund - The Exemplary Forestry Investment Fund (EFIF) is a for-profit, long-term timber investment vehicle that blends public, private, and philanthropic capital to acquire and sustainably manage large forest tracts in Maine, aiming for climate mitigation, high-quality timber production, and investor returns through conservation easements and carbon credits.

Forestry Funds: The Emerging Star of Alternative Investments - Forestry funds, also known as timber funds, are alternative investment vehicles that provide exposure to forested land and timber assets, managed by specialists to generate returns through sustainable harvesting and sale of wood products, while offering long-term growth and climate benefits.

The best Forestry ETFs - Investors can gain exposure to the forestry sector through exchange-traded funds (ETFs) that track global timber and forestry indexes, offering a liquid and diversified way to invest in companies involved in forest management and wood production.

dowidth.com

dowidth.com