Music royalties provide artists with ongoing income streams generated from the use and distribution of their compositions and recordings, often yielding long-term passive revenue. Annuities, on the other hand, are financial products that deliver guaranteed periodic payments to investors, typically serving as a stable source of retirement income. Explore how these distinct investment options can diversify your portfolio and secure financial growth.

Why it is important

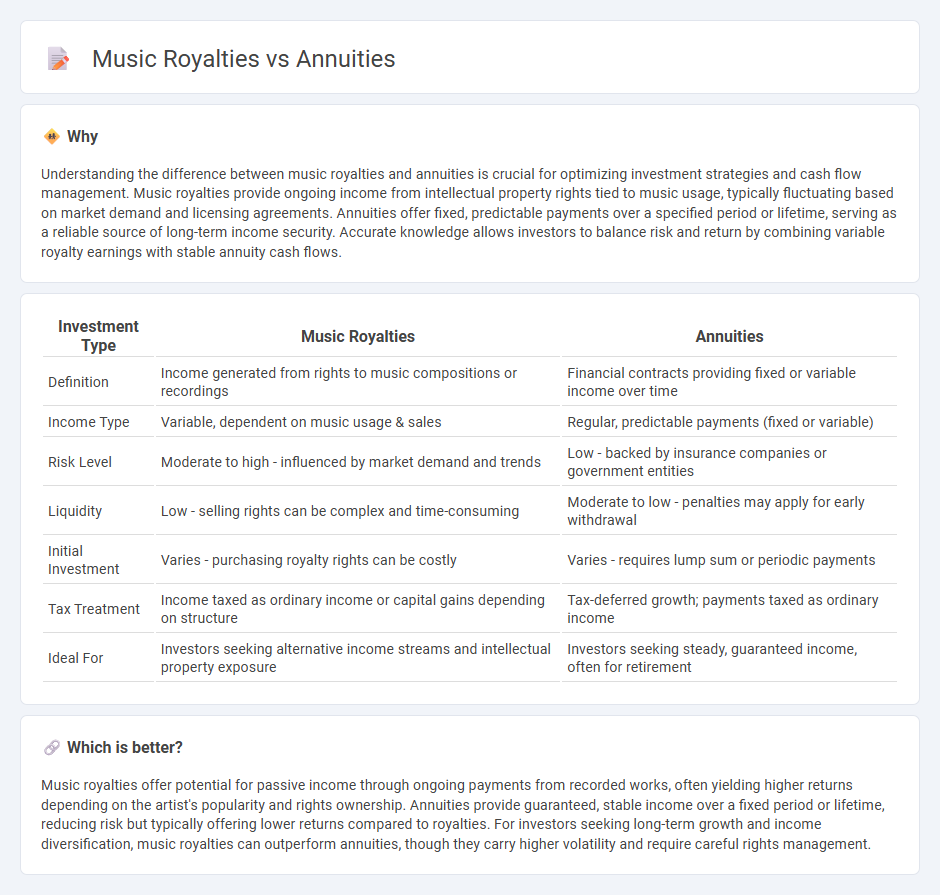

Understanding the difference between music royalties and annuities is crucial for optimizing investment strategies and cash flow management. Music royalties provide ongoing income from intellectual property rights tied to music usage, typically fluctuating based on market demand and licensing agreements. Annuities offer fixed, predictable payments over a specified period or lifetime, serving as a reliable source of long-term income security. Accurate knowledge allows investors to balance risk and return by combining variable royalty earnings with stable annuity cash flows.

Comparison Table

| Investment Type | Music Royalties | Annuities |

|---|---|---|

| Definition | Income generated from rights to music compositions or recordings | Financial contracts providing fixed or variable income over time |

| Income Type | Variable, dependent on music usage & sales | Regular, predictable payments (fixed or variable) |

| Risk Level | Moderate to high - influenced by market demand and trends | Low - backed by insurance companies or government entities |

| Liquidity | Low - selling rights can be complex and time-consuming | Moderate to low - penalties may apply for early withdrawal |

| Initial Investment | Varies - purchasing royalty rights can be costly | Varies - requires lump sum or periodic payments |

| Tax Treatment | Income taxed as ordinary income or capital gains depending on structure | Tax-deferred growth; payments taxed as ordinary income |

| Ideal For | Investors seeking alternative income streams and intellectual property exposure | Investors seeking steady, guaranteed income, often for retirement |

Which is better?

Music royalties offer potential for passive income through ongoing payments from recorded works, often yielding higher returns depending on the artist's popularity and rights ownership. Annuities provide guaranteed, stable income over a fixed period or lifetime, reducing risk but typically offering lower returns compared to royalties. For investors seeking long-term growth and income diversification, music royalties can outperform annuities, though they carry higher volatility and require careful rights management.

Connection

Music royalties generate consistent income streams for rights holders, serving as a form of annuity with predictable cash flows over time. These royalties are contractual payments derived from the ongoing commercial use of music assets, aligning with the investment principle of steady returns. Investors often consider music royalties as intangible assets that diversify portfolios and hedge against market volatility due to their long-term payment structure similar to annuities.

Key Terms

Cash Flow

Annuities provide predictable, steady cash flow through fixed payments over time, making them a reliable income source for long-term financial planning. Music royalties generate variable cash flow dependent on factors such as song popularity, streaming numbers, and licensing deals, often resulting in fluctuating income streams. Explore the nuances of cash flow from annuities versus music royalties to optimize your financial strategy.

Duration

Annuities provide guaranteed income over a fixed or lifetime period, ensuring predictable cash flow that can span decades or until death, depending on the contract terms. Music royalties offer potentially indefinite revenue streams tied to the ongoing use of intellectual property, with income fluctuating based on the asset's popularity and market demand. Explore more about how these income sources vary in duration and stability to optimize your financial planning.

Residual Income

Annuities provide steady, predictable residual income through fixed payments over time, serving as a reliable financial instrument for long-term stability. Music royalties generate ongoing residual income based on the usage and popularity of songs, offering potential for higher returns but with variable income flows influenced by market demand. Explore the key differences between annuities and music royalties to determine which residual income source aligns best with your financial goals.

Source and External Links

Guide to Annuities: Types, Payouts and Expert Q&A - An annuity is a contract with an insurance company providing fixed or variable income, involving accumulation and payout phases, offering tax-deferred growth and protection from market and longevity risks, often used for retirement income.

Learn how annuities work | Office of the Insurance Commissioner - Annuities offer tax-deferred growth and can provide steady, guaranteed lifetime income, death benefits, and are usually purchased for significant savings or retirement planning.

Consumer's Guide to Understanding Annuities - An annuity is a contract with a life insurance company that pays a series of regular payments for retirement income, distinguishing roles of owner, annuitant, and beneficiary in the contract.

dowidth.com

dowidth.com