Music royalties platforms provide investors access to income generated from song rights, offering steady cash flow tied to popular tracks and artist catalogs. Farmland investment platforms allow individuals to invest in agricultural land, benefiting from land appreciation and revenue from crop production or leasing. Explore more to understand which investment aligns with your financial goals and risk appetite.

Why it is important

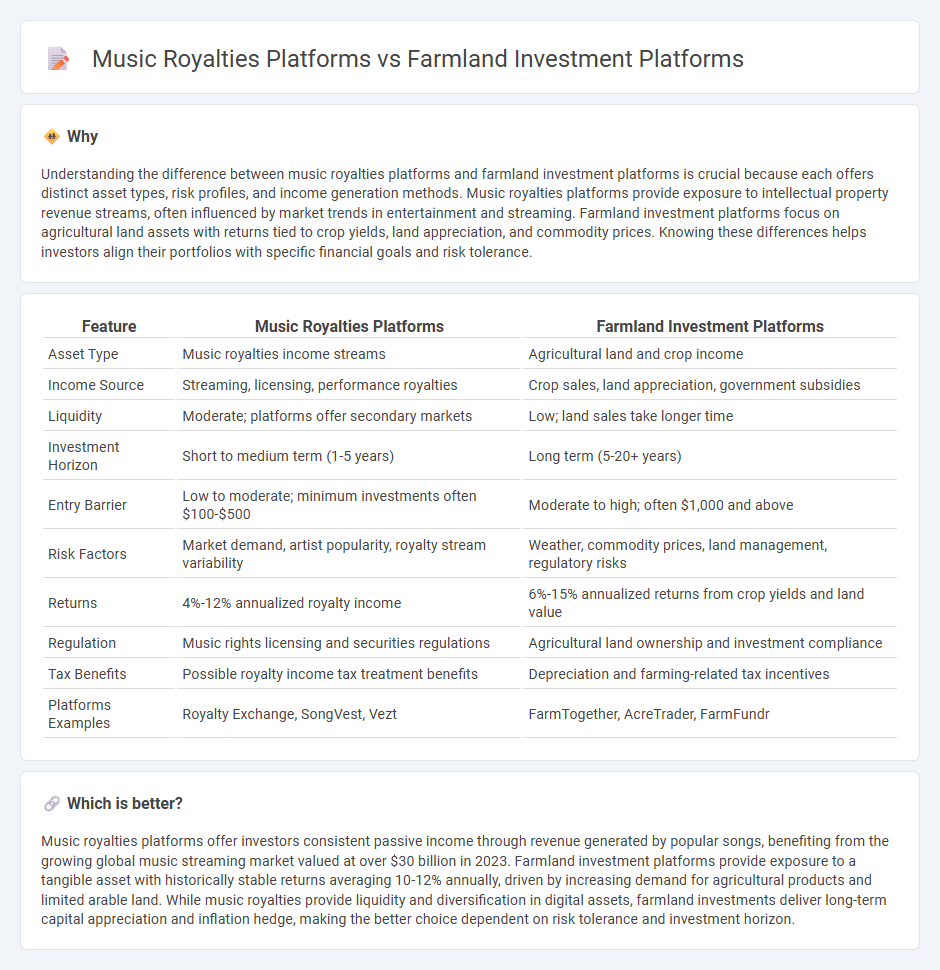

Understanding the difference between music royalties platforms and farmland investment platforms is crucial because each offers distinct asset types, risk profiles, and income generation methods. Music royalties platforms provide exposure to intellectual property revenue streams, often influenced by market trends in entertainment and streaming. Farmland investment platforms focus on agricultural land assets with returns tied to crop yields, land appreciation, and commodity prices. Knowing these differences helps investors align their portfolios with specific financial goals and risk tolerance.

Comparison Table

| Feature | Music Royalties Platforms | Farmland Investment Platforms |

|---|---|---|

| Asset Type | Music royalties income streams | Agricultural land and crop income |

| Income Source | Streaming, licensing, performance royalties | Crop sales, land appreciation, government subsidies |

| Liquidity | Moderate; platforms offer secondary markets | Low; land sales take longer time |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5-20+ years) |

| Entry Barrier | Low to moderate; minimum investments often $100-$500 | Moderate to high; often $1,000 and above |

| Risk Factors | Market demand, artist popularity, royalty stream variability | Weather, commodity prices, land management, regulatory risks |

| Returns | 4%-12% annualized royalty income | 6%-15% annualized returns from crop yields and land value |

| Regulation | Music rights licensing and securities regulations | Agricultural land ownership and investment compliance |

| Tax Benefits | Possible royalty income tax treatment benefits | Depreciation and farming-related tax incentives |

| Platforms Examples | Royalty Exchange, SongVest, Vezt | FarmTogether, AcreTrader, FarmFundr |

Which is better?

Music royalties platforms offer investors consistent passive income through revenue generated by popular songs, benefiting from the growing global music streaming market valued at over $30 billion in 2023. Farmland investment platforms provide exposure to a tangible asset with historically stable returns averaging 10-12% annually, driven by increasing demand for agricultural products and limited arable land. While music royalties provide liquidity and diversification in digital assets, farmland investments deliver long-term capital appreciation and inflation hedge, making the better choice dependent on risk tolerance and investment horizon.

Connection

Music royalties platforms and farmland investment platforms both offer alternative asset classes that generate passive income through revenue-sharing models. These platforms enable investors to diversify portfolios beyond traditional stocks and bonds by acquiring fractional ownership in music rights or agricultural land, respectively. Blockchain technology and digital marketplaces often enhance transparency and liquidity in both sectors, attracting a similar demographic of tech-savvy, income-focused investors.

Key Terms

**Farmland investment platforms:**

Farmland investment platforms offer access to agricultural land assets, providing investors with opportunities for portfolio diversification and potential stable returns through crop yields and land appreciation. These platforms utilize advanced data analytics and satellite imagery to optimize farmland management and increase profitability. Discover how farmland investment platforms can enhance your investment strategy and generate sustainable income streams.

Acreage

Farmland investment platforms offer opportunities to diversify portfolios with assets tied to agricultural land, emphasizing acreage size, soil quality, and crop yield potential to assess value and returns. Music royalties platforms focus on intellectual property rights, where investment depends on the popularity of a song or catalog rather than physical acreage. Explore the unique benefits and risks of each investment type to determine which aligns best with your financial goals.

Crop yield

Farmland investment platforms directly correlate returns with crop yield, making agricultural productivity a critical factor in investor profits. In contrast, music royalties platforms generate revenue based on song performance metrics such as streaming numbers and licensing deals, with no direct link to agricultural output. Explore further to understand how crop yield influences farmland investment outcomes compared to revenue dynamics in music royalties.

Source and External Links

Here Are 5 Interesting Farmland Investing Platforms For 2025 - This article lists top farmland investment platforms like FarmTogether, Steward, and others, detailing their minimum investments, accessibility, types of investments, and fees; for example, FarmTogether offers various investment products focused mainly on permanent crops with a minimum investment starting at $15K, while Steward offers loan-based investments accessible to all investors starting from $100.

FarmTogether vs Acretrader | Which Farm Crowdfunding Platform is ... - A comparison of two popular farmland crowdfunding platforms targeting accredited investors with minimum investments between $10,000 and $15,000, highlighting that FarmTogether provides multiple investment types including crowdfunded farmland and institutional-grade funds, ideal for long-term, high-income investors.

FarmFundr | Agriculture Crowdfunding Investment Farms - FarmFundr is a farmer-owned equity crowdfunding platform focusing on specialty crop operations, offering fractional farmland ownership to members, handling farm operations, and distributing profits from crop sales to investors.

dowidth.com

dowidth.com