Wine futures offer a unique investment avenue with potential high returns tied to vintage quality and market demand, while REITs provide diversified exposure to real estate markets with regular income through dividends. Both options present different risk profiles and liquidity levels, catering to investors seeking portfolio diversification beyond traditional stocks and bonds. Explore the advantages and risks of wine futures versus REITs to determine the investment strategy that suits your financial goals.

Why it is important

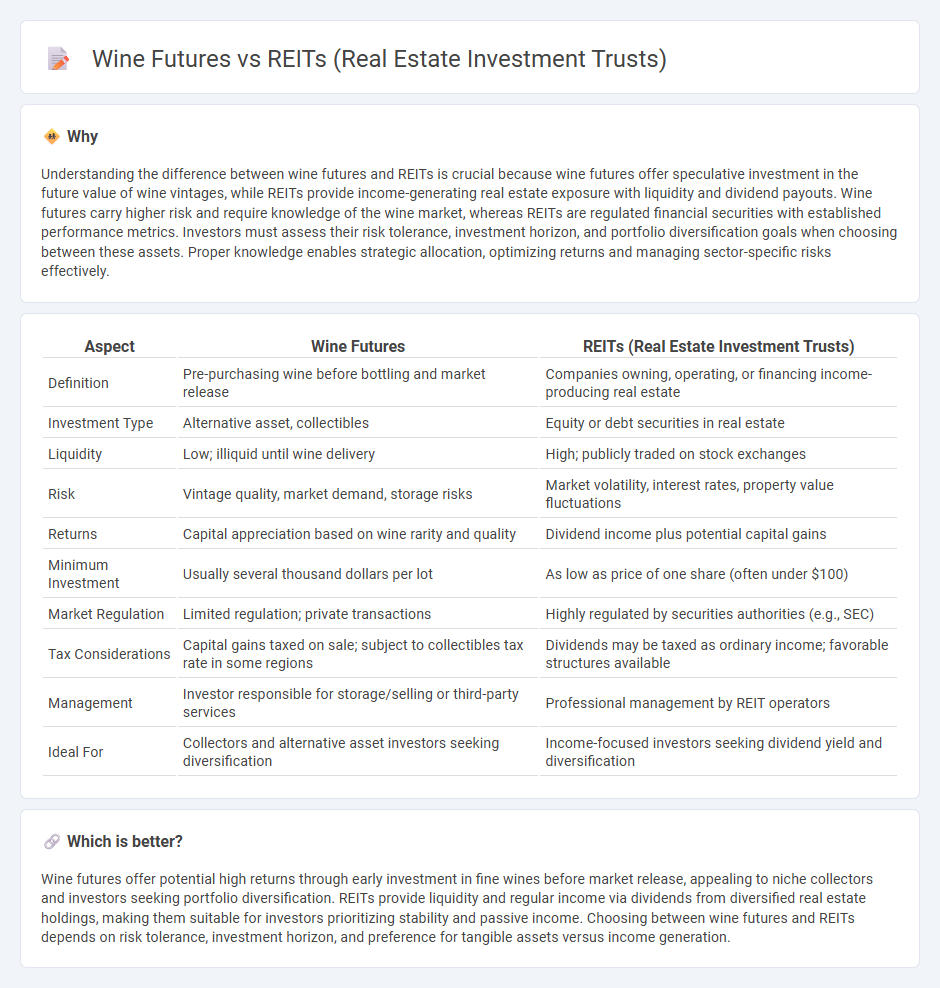

Understanding the difference between wine futures and REITs is crucial because wine futures offer speculative investment in the future value of wine vintages, while REITs provide income-generating real estate exposure with liquidity and dividend payouts. Wine futures carry higher risk and require knowledge of the wine market, whereas REITs are regulated financial securities with established performance metrics. Investors must assess their risk tolerance, investment horizon, and portfolio diversification goals when choosing between these assets. Proper knowledge enables strategic allocation, optimizing returns and managing sector-specific risks effectively.

Comparison Table

| Aspect | Wine Futures | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Definition | Pre-purchasing wine before bottling and market release | Companies owning, operating, or financing income-producing real estate |

| Investment Type | Alternative asset, collectibles | Equity or debt securities in real estate |

| Liquidity | Low; illiquid until wine delivery | High; publicly traded on stock exchanges |

| Risk | Vintage quality, market demand, storage risks | Market volatility, interest rates, property value fluctuations |

| Returns | Capital appreciation based on wine rarity and quality | Dividend income plus potential capital gains |

| Minimum Investment | Usually several thousand dollars per lot | As low as price of one share (often under $100) |

| Market Regulation | Limited regulation; private transactions | Highly regulated by securities authorities (e.g., SEC) |

| Tax Considerations | Capital gains taxed on sale; subject to collectibles tax rate in some regions | Dividends may be taxed as ordinary income; favorable structures available |

| Management | Investor responsible for storage/selling or third-party services | Professional management by REIT operators |

| Ideal For | Collectors and alternative asset investors seeking diversification | Income-focused investors seeking dividend yield and diversification |

Which is better?

Wine futures offer potential high returns through early investment in fine wines before market release, appealing to niche collectors and investors seeking portfolio diversification. REITs provide liquidity and regular income via dividends from diversified real estate holdings, making them suitable for investors prioritizing stability and passive income. Choosing between wine futures and REITs depends on risk tolerance, investment horizon, and preference for tangible assets versus income generation.

Connection

Wine futures and Real Estate Investment Trusts (REITs) both represent alternative investment avenues appealing to diversification-focused portfolios. Wine futures provide exposure to tangible assets with potential appreciation tied to vintage quality and market demand, while REITs offer liquidity and dividend income through real estate holdings. Combined, they enable investors to balance risk and return by merging the asset-backed characteristics of collectibles with the steady cash flow and growth potential of real estate.

Key Terms

Liquidity

REITs offer high liquidity by trading shares on major stock exchanges, allowing investors to easily buy or sell positions anytime during market hours. Wine futures involve purchasing wine before it is bottled, requiring long-term commitment and limited market access, resulting in significantly lower liquidity compared to REITs. Explore detailed comparisons of REITs and wine futures to understand which investment aligns with your liquidity needs.

Asset Class

REITs (Real Estate Investment Trusts) represent a liquid, income-generating asset class tied to commercial and residential properties, offering exposure to real estate markets through dividend yields and capital appreciation. Wine futures involve investing in barrels of wine prior to bottling, representing a tangible asset with potential for significant value appreciation due to scarcity and aging but higher risk and less liquidity. Explore the unique risks and rewards of these asset classes to determine which fits your investment strategy best.

Yield

REITs typically offer annual dividend yields averaging between 4% and 7%, providing consistent income streams through property rent collections. Wine futures involve purchasing wine before bottling, with potential returns driven by market appreciation, historically averaging 8% to 12% over several years but with higher volatility and risk. Explore detailed yield comparisons and investment strategies to determine which aligns with your portfolio goals.

Source and External Links

Real estate investment trust - Wikipedia - REITs are companies that own and operate income-producing real estate such as offices, apartments, and shopping centers, and are categorized into equity and mortgage REITs, offering tax advantages and regular dividends to investors.

What is a REIT? - Fidelity Investments - REITs pool money from investors to buy and manage real estate portfolios, distribute most of their taxable income as dividends, and provide accessible real estate investment opportunities without requiring direct property ownership.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing properties like malls, hotels, and warehouses, offering a share of rental income and capital appreciation without the need to buy or manage properties directly.

dowidth.com

dowidth.com