Whiskey cask investment offers unique advantages such as tangible asset ownership, potential for aging value appreciation, and diversification away from traditional markets, contrasting with real estate investment's stability, rental income generation, and long-term capital growth. Both investment types carry differing liquidity levels, market volatility, and regulatory considerations that influence portfolio strategy. Explore the detailed benefits and risks of whiskey cask versus real estate investments to optimize your asset allocation.

Why it is important

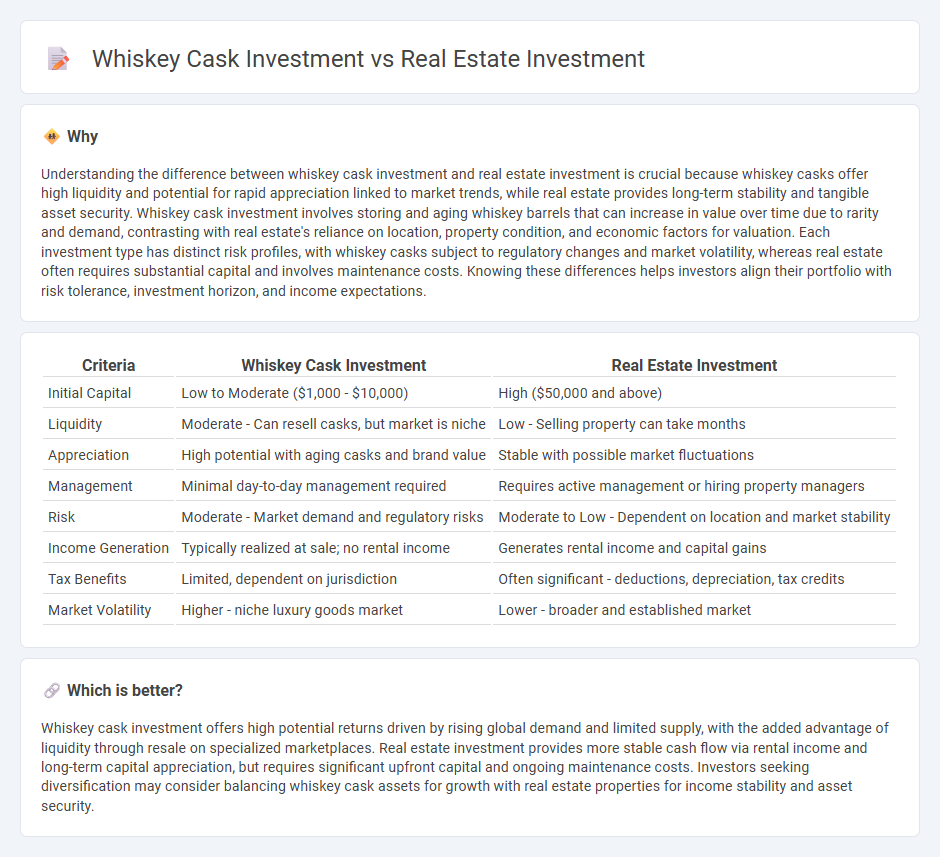

Understanding the difference between whiskey cask investment and real estate investment is crucial because whiskey casks offer high liquidity and potential for rapid appreciation linked to market trends, while real estate provides long-term stability and tangible asset security. Whiskey cask investment involves storing and aging whiskey barrels that can increase in value over time due to rarity and demand, contrasting with real estate's reliance on location, property condition, and economic factors for valuation. Each investment type has distinct risk profiles, with whiskey casks subject to regulatory changes and market volatility, whereas real estate often requires substantial capital and involves maintenance costs. Knowing these differences helps investors align their portfolio with risk tolerance, investment horizon, and income expectations.

Comparison Table

| Criteria | Whiskey Cask Investment | Real Estate Investment |

|---|---|---|

| Initial Capital | Low to Moderate ($1,000 - $10,000) | High ($50,000 and above) |

| Liquidity | Moderate - Can resell casks, but market is niche | Low - Selling property can take months |

| Appreciation | High potential with aging casks and brand value | Stable with possible market fluctuations |

| Management | Minimal day-to-day management required | Requires active management or hiring property managers |

| Risk | Moderate - Market demand and regulatory risks | Moderate to Low - Dependent on location and market stability |

| Income Generation | Typically realized at sale; no rental income | Generates rental income and capital gains |

| Tax Benefits | Limited, dependent on jurisdiction | Often significant - deductions, depreciation, tax credits |

| Market Volatility | Higher - niche luxury goods market | Lower - broader and established market |

Which is better?

Whiskey cask investment offers high potential returns driven by rising global demand and limited supply, with the added advantage of liquidity through resale on specialized marketplaces. Real estate investment provides more stable cash flow via rental income and long-term capital appreciation, but requires significant upfront capital and ongoing maintenance costs. Investors seeking diversification may consider balancing whiskey cask assets for growth with real estate properties for income stability and asset security.

Connection

Whiskey cask investment and real estate investment both offer tangible asset-backed opportunities that typically hedge against inflation and market volatility. Both asset classes tend to appreciate over time through scarcity, quality, and historical value, attracting investors seeking portfolio diversification and passive income streams. The increasing global demand for rare whiskey casks parallels real estate's steady appreciation, creating synergistic potential for wealth preservation and growth.

Key Terms

Real estate investment:

Real estate investment offers stable long-term capital appreciation and consistent rental income, with tangible assets that provide security against market volatility. Investors benefit from tax advantages such as depreciation and mortgage interest deductions, while property values tend to rise over time in growing markets. Discover detailed strategies and compare returns to make informed decisions about real estate investments.

Property appreciation

Real estate investment typically offers steady property appreciation driven by market demand, location, and economic growth, often resulting in predictable long-term value increases. Whiskey cask investment, while less traditional, can yield significant returns through the aging process, rarity, and brand reputation, although it carries higher market volatility and liquidity risks. Explore detailed comparisons and potential returns of these asset classes to make an informed investment decision.

Rental income

Real estate investment generates consistent rental income through tenant leases, offering predictable cash flow and potential property appreciation. Whiskey cask investment provides income via the sale or leasing of matured casks, which can appreciate over time depending on aging and market demand. Explore the detailed comparison of rental income benefits between these two investment options to determine the best fit for your portfolio.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - This article provides five methods for investing in real estate, including REITs, real estate investing platforms, rental properties, and flipping investment properties, offering a range of options from low to high maintenance.

4 Ways to Invest in Real Estate - This guide outlines four ways to invest in real estate: purchasing a home, investing in REITs, using mutual funds, and becoming a landlord, highlighting various strategies for wealth building.

Real Estate Investing Made Easy - Yieldstreet offers real estate investment opportunities with diversified exposure and direct access to private markets, starting with a minimum investment of $10,000.

dowidth.com

dowidth.com