Eco-friendly cryptocurrencies leverage blockchain technology to reduce environmental impact by using energy-efficient consensus mechanisms, contrasting sharply with traditional carbon credits that represent a permit to emit a specific amount of carbon dioxide. These digital assets offer enhanced transparency, traceability, and accessibility in carbon offsetting, potentially revolutionizing sustainable investment strategies. Explore how integrating eco-friendly cryptocurrencies can transform your approach to green investing and carbon management.

Why it is important

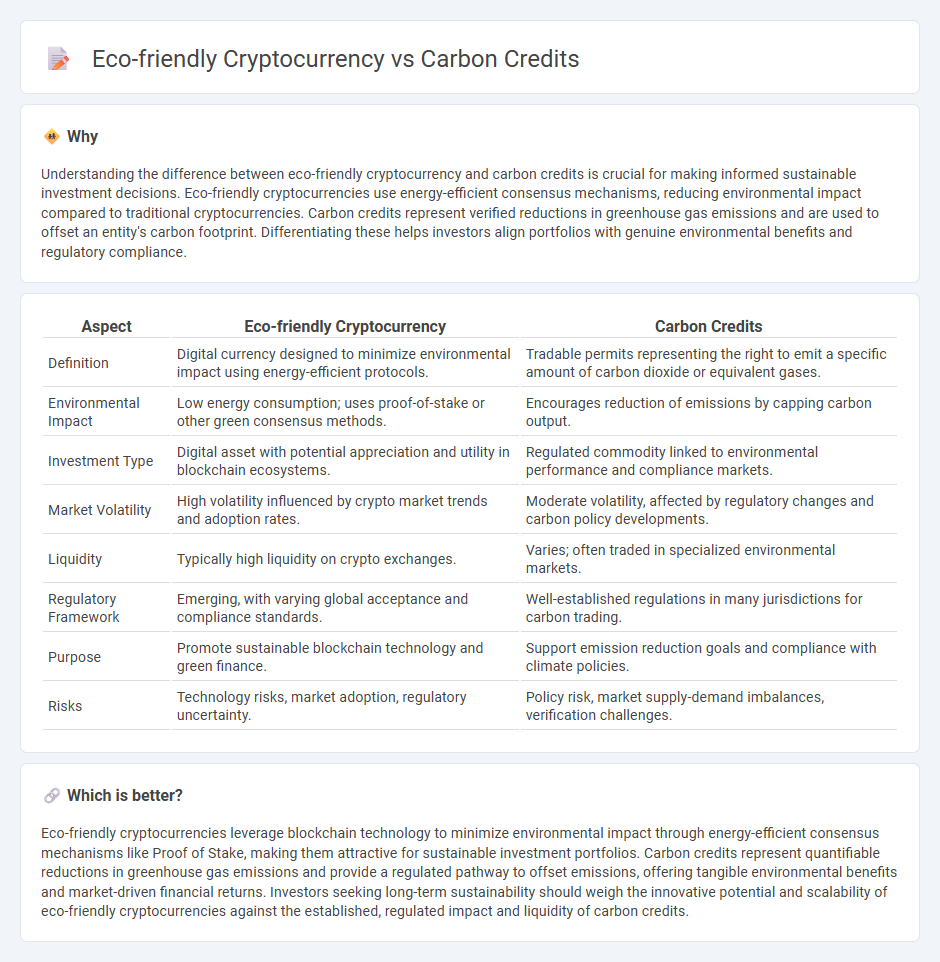

Understanding the difference between eco-friendly cryptocurrency and carbon credits is crucial for making informed sustainable investment decisions. Eco-friendly cryptocurrencies use energy-efficient consensus mechanisms, reducing environmental impact compared to traditional cryptocurrencies. Carbon credits represent verified reductions in greenhouse gas emissions and are used to offset an entity's carbon footprint. Differentiating these helps investors align portfolios with genuine environmental benefits and regulatory compliance.

Comparison Table

| Aspect | Eco-friendly Cryptocurrency | Carbon Credits |

|---|---|---|

| Definition | Digital currency designed to minimize environmental impact using energy-efficient protocols. | Tradable permits representing the right to emit a specific amount of carbon dioxide or equivalent gases. |

| Environmental Impact | Low energy consumption; uses proof-of-stake or other green consensus methods. | Encourages reduction of emissions by capping carbon output. |

| Investment Type | Digital asset with potential appreciation and utility in blockchain ecosystems. | Regulated commodity linked to environmental performance and compliance markets. |

| Market Volatility | High volatility influenced by crypto market trends and adoption rates. | Moderate volatility, affected by regulatory changes and carbon policy developments. |

| Liquidity | Typically high liquidity on crypto exchanges. | Varies; often traded in specialized environmental markets. |

| Regulatory Framework | Emerging, with varying global acceptance and compliance standards. | Well-established regulations in many jurisdictions for carbon trading. |

| Purpose | Promote sustainable blockchain technology and green finance. | Support emission reduction goals and compliance with climate policies. |

| Risks | Technology risks, market adoption, regulatory uncertainty. | Policy risk, market supply-demand imbalances, verification challenges. |

Which is better?

Eco-friendly cryptocurrencies leverage blockchain technology to minimize environmental impact through energy-efficient consensus mechanisms like Proof of Stake, making them attractive for sustainable investment portfolios. Carbon credits represent quantifiable reductions in greenhouse gas emissions and provide a regulated pathway to offset emissions, offering tangible environmental benefits and market-driven financial returns. Investors seeking long-term sustainability should weigh the innovative potential and scalability of eco-friendly cryptocurrencies against the established, regulated impact and liquidity of carbon credits.

Connection

Eco-friendly cryptocurrencies leverage blockchain technology to reduce energy consumption and lower carbon footprints, aligning with global sustainability goals. Carbon credits serve as tradable certificates that incentivize companies, including those adopting green cryptocurrencies, to offset their emissions by funding renewable energy and reforestation projects. This integration creates a transparent, verifiable system linking digital asset investments with environmental impact mitigation through carbon offset mechanisms.

Key Terms

Emissions Offsetting

Carbon credits represent measurable emission reductions verified by regulatory bodies, offering companies a way to offset their carbon footprint through certified projects. Eco-friendly cryptocurrencies utilize energy-efficient consensus mechanisms, such as proof-of-stake, to minimize environmental impact while enabling carbon offset transactions on decentralized platforms. Explore how these innovative solutions redefine emissions offsetting in the fight against climate change.

Blockchain Verification

Carbon credits represent verified emission reductions tradable on regulated markets, with blockchain verification enhancing transparency and traceability of transactions to prevent double counting. Eco-friendly cryptocurrencies prioritize energy-efficient consensus mechanisms like Proof of Stake, minimizing environmental impact while integrating carbon offset projects on blockchain platforms. Explore how blockchain innovations are revolutionizing sustainable finance by ensuring accountability and green investment integrity.

Sustainability Tokens

Sustainability tokens represent a new wave of eco-friendly cryptocurrencies designed to support and incentivize carbon reduction efforts through blockchain technology. Unlike traditional carbon credits, which are often centralized and subject to regulatory constraints, sustainability tokens provide transparent, verifiable, and tradeable digital assets that promote environmental responsibility. Discover how these innovative tokens are reshaping the sustainability landscape and driving green investment.

Source and External Links

Carbon Credits Explained | Climate Impact Partners - Carbon credits represent one tonne of avoided or removed greenhouse gas emissions and enable businesses to offset emissions by funding vetted decarbonization projects worldwide.

Ask the experts: Carbon credits 101 - Carbon credits operate either within cap-and-trade systems where emissions are capped and credits traded, or as offsets purchased to compensate for emissions by funding reductions elsewhere.

What Are Carbon Credits? | CarbonNeutral - Purchasing a carbon credit authorizes an equivalent carbon emission while funding projects that remove or reduce emissions; these credits are essential financial tools supporting net-zero goals.

dowidth.com

dowidth.com