Farmland crowdfunding allows investors to participate in agricultural real estate with lower capital and diversified risk by pooling resources through online platforms. Direct farmland ownership involves purchasing and managing land personally, offering full control and potential tax benefits but requiring significant expertise and capital. Explore the advantages and challenges of each approach to decide the best investment strategy for your agricultural portfolio.

Why it is important

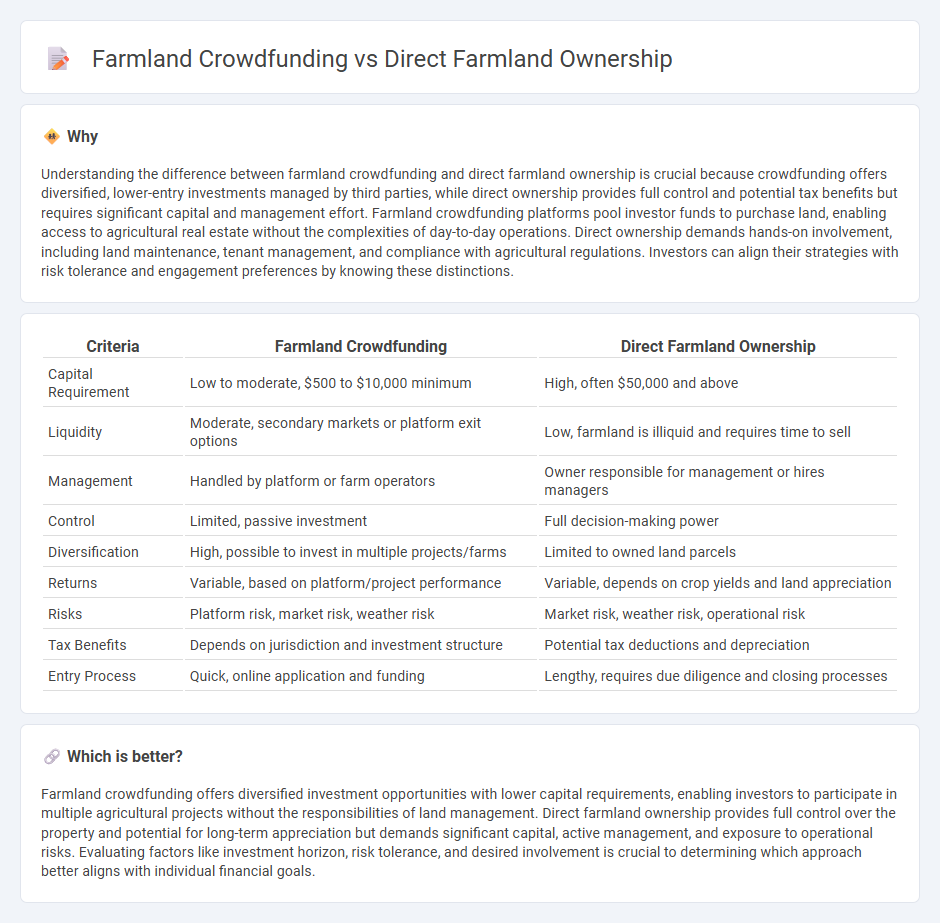

Understanding the difference between farmland crowdfunding and direct farmland ownership is crucial because crowdfunding offers diversified, lower-entry investments managed by third parties, while direct ownership provides full control and potential tax benefits but requires significant capital and management effort. Farmland crowdfunding platforms pool investor funds to purchase land, enabling access to agricultural real estate without the complexities of day-to-day operations. Direct ownership demands hands-on involvement, including land maintenance, tenant management, and compliance with agricultural regulations. Investors can align their strategies with risk tolerance and engagement preferences by knowing these distinctions.

Comparison Table

| Criteria | Farmland Crowdfunding | Direct Farmland Ownership |

|---|---|---|

| Capital Requirement | Low to moderate, $500 to $10,000 minimum | High, often $50,000 and above |

| Liquidity | Moderate, secondary markets or platform exit options | Low, farmland is illiquid and requires time to sell |

| Management | Handled by platform or farm operators | Owner responsible for management or hires managers |

| Control | Limited, passive investment | Full decision-making power |

| Diversification | High, possible to invest in multiple projects/farms | Limited to owned land parcels |

| Returns | Variable, based on platform/project performance | Variable, depends on crop yields and land appreciation |

| Risks | Platform risk, market risk, weather risk | Market risk, weather risk, operational risk |

| Tax Benefits | Depends on jurisdiction and investment structure | Potential tax deductions and depreciation |

| Entry Process | Quick, online application and funding | Lengthy, requires due diligence and closing processes |

Which is better?

Farmland crowdfunding offers diversified investment opportunities with lower capital requirements, enabling investors to participate in multiple agricultural projects without the responsibilities of land management. Direct farmland ownership provides full control over the property and potential for long-term appreciation but demands significant capital, active management, and exposure to operational risks. Evaluating factors like investment horizon, risk tolerance, and desired involvement is crucial to determining which approach better aligns with individual financial goals.

Connection

Farmland crowdfunding and direct farmland ownership both enable investors to access agricultural real estate, but differ in scale and involvement. Crowdfunding platforms pool capital from multiple investors to purchase or manage farmland, offering fractional ownership and reduced entry barriers. Direct farmland ownership typically requires significant capital and hands-on management but provides full control and potential for long-term asset appreciation.

Key Terms

Title Deed

Direct farmland ownership grants the buyer a registered title deed, ensuring full legal rights and control over the property, including the ability to sell, lease, or develop the land. Farmland crowdfunding offers fractional ownership without individual title deeds, pooling investor capital to collectively hold a title managed by a fund or platform, reducing entry barriers but limiting direct asset control. Explore the distinctions in ownership security and operational control to decide which investment suits your agricultural portfolio.

Fractional Ownership

Direct farmland ownership offers investors full control and long-term equity in agricultural land, providing potential for rental income and capital appreciation. Farmland crowdfunding, especially through fractional ownership models, allows individuals to invest smaller amounts in diversified agricultural projects without managing the land directly, enhancing liquidity and risk distribution. Explore the benefits and risks of both approaches to determine the best fit for your investment portfolio.

Liquidity

Direct farmland ownership often involves significant capital and lower liquidity due to the time required to sell land, making it less flexible for investors seeking quick access to funds. Farmland crowdfunding platforms offer higher liquidity by allowing investors to buy and sell shares in agricultural assets more easily, thus providing quicker access to their investments. Explore the differences in liquidity options to determine the best approach for your farmland investment strategy.

Source and External Links

Investing in farmland | Nuveen - Direct farmland ownership involves actively operating the farm and providing machinery, personnel, and crop inputs directly, which offers the highest return potential but comes with the highest risk among farmland investment strategies.

Farm Ownership Loans - The USDA's Farm Service Agency offers Direct Farm Ownership Loans that finance the purchase and development of farmland with competitive interest rates and terms up to 40 years, supporting farmers aiming to own farmland directly.

How to Buy Farm Land As a Beginning Farmer - FBN - Direct Farm Ownership Joint Financing Loans from the FSA can cover up to 50% of farm purchase costs and can be combined with other lenders, helping beginning farmers buy or scale farmland ownership.

dowidth.com

dowidth.com