Whiskey barrel investment offers unique growth potential by capitalizing on the aging process that enhances whiskey's value over time, appealing to connoisseurs and collectors seeking alternative assets. Fine jewelry investment provides stability and liquidity, with intrinsic value derived from precious metals and gemstones, often benefiting from global demand and market trends. Explore the distinct advantages and risks of whiskey barrel versus fine jewelry investment to determine the best fit for your portfolio.

Why it is important

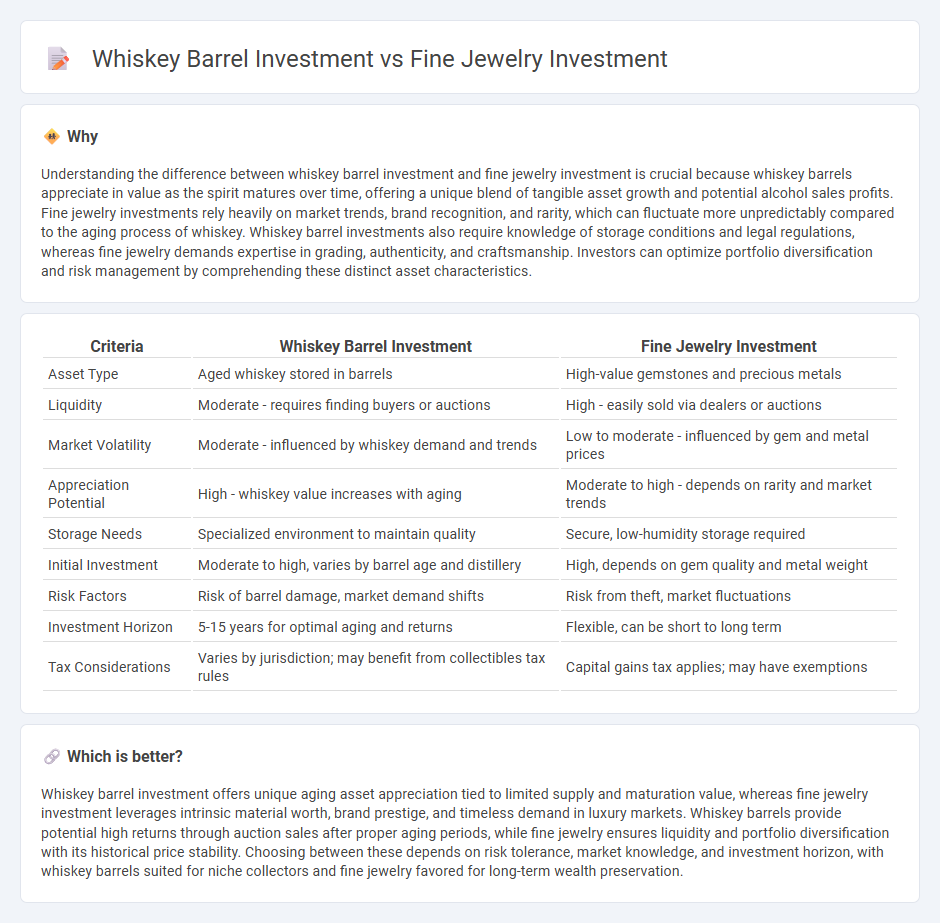

Understanding the difference between whiskey barrel investment and fine jewelry investment is crucial because whiskey barrels appreciate in value as the spirit matures over time, offering a unique blend of tangible asset growth and potential alcohol sales profits. Fine jewelry investments rely heavily on market trends, brand recognition, and rarity, which can fluctuate more unpredictably compared to the aging process of whiskey. Whiskey barrel investments also require knowledge of storage conditions and legal regulations, whereas fine jewelry demands expertise in grading, authenticity, and craftsmanship. Investors can optimize portfolio diversification and risk management by comprehending these distinct asset characteristics.

Comparison Table

| Criteria | Whiskey Barrel Investment | Fine Jewelry Investment |

|---|---|---|

| Asset Type | Aged whiskey stored in barrels | High-value gemstones and precious metals |

| Liquidity | Moderate - requires finding buyers or auctions | High - easily sold via dealers or auctions |

| Market Volatility | Moderate - influenced by whiskey demand and trends | Low to moderate - influenced by gem and metal prices |

| Appreciation Potential | High - whiskey value increases with aging | Moderate to high - depends on rarity and market trends |

| Storage Needs | Specialized environment to maintain quality | Secure, low-humidity storage required |

| Initial Investment | Moderate to high, varies by barrel age and distillery | High, depends on gem quality and metal weight |

| Risk Factors | Risk of barrel damage, market demand shifts | Risk from theft, market fluctuations |

| Investment Horizon | 5-15 years for optimal aging and returns | Flexible, can be short to long term |

| Tax Considerations | Varies by jurisdiction; may benefit from collectibles tax rules | Capital gains tax applies; may have exemptions |

Which is better?

Whiskey barrel investment offers unique aging asset appreciation tied to limited supply and maturation value, whereas fine jewelry investment leverages intrinsic material worth, brand prestige, and timeless demand in luxury markets. Whiskey barrels provide potential high returns through auction sales after proper aging periods, while fine jewelry ensures liquidity and portfolio diversification with its historical price stability. Choosing between these depends on risk tolerance, market knowledge, and investment horizon, with whiskey barrels suited for niche collectors and fine jewelry favored for long-term wealth preservation.

Connection

Whiskey barrel investment and fine jewelry investment both serve as alternative asset classes that diversify traditional portfolios and hedge against market volatility. Both rely on tangible, high-value commodities with historical appreciation trends, making them attractive for wealth preservation. Their illiquidity and niche markets require specialized knowledge, but they offer unique opportunities for long-term capital growth and tangible asset ownership.

Key Terms

Fine Jewelry Investment:

Fine jewelry investment offers the advantage of tangible assets with intrinsic value, often appreciating due to rarity, craftsmanship, and brand prestige. High-quality diamonds, rare gemstones, and vintage pieces tend to hold or increase their worth, benefiting from a global market demand. Discover how fine jewelry can diversify your portfolio and provide lasting value.

Gemstone Quality

Investing in fine jewelry centers around the quality of gemstones, including factors such as clarity, cut, color, and carat weight, which significantly influence the piece's value and market demand. Whiskey barrel investments depend more on the aging process, brand reputation, and provenance, with less emphasis on physical attributes compared to gemstone grading criteria. Explore the nuanced differences in asset valuation and market trends to understand which investment aligns better with your goals.

Hallmark Authentication

Fine jewelry investment benefits from Hallmark Authentication, which certifies the metal quality and maker's mark, ensuring the piece's authenticity and value retention. Whiskey barrel investment lacks standardized authentication like hallmarks, relying more on brand reputation and aging processes. Explore the importance of Hallmark Authentication in safeguarding your fine jewelry investment portfolio.

Source and External Links

Is Fine Jewelry a Good Investment? - Fine jewelry can be a valuable investment due to its high-quality materials, craftsmanship, and the potential for long-term value appreciation, especially with precious metals and gemstones.

The Best Jewelry Investment Pieces - This article highlights diamond engagement rings as a prime example of jewelry that retains or increases in value over time, making them a smart investment choice.

Vintage & Antique Gold Jewelry - The Safest Investment - Investing in vintage and antique gold jewelry offers both aesthetic appeal and financial value, as these pieces often appreciate due to their rarity and historical significance.

dowidth.com

dowidth.com