Investment communities often consist of individual investors and enthusiasts pooling knowledge and resources to fund startups and projects, focusing on shared interests and collaborative growth. Venture capitalists operate as professional fund managers investing substantial capital in high-potential startups, emphasizing rigorous due diligence and scalable returns. Explore deeper insights into how these different investment approaches shape innovation and financial success.

Why it is important

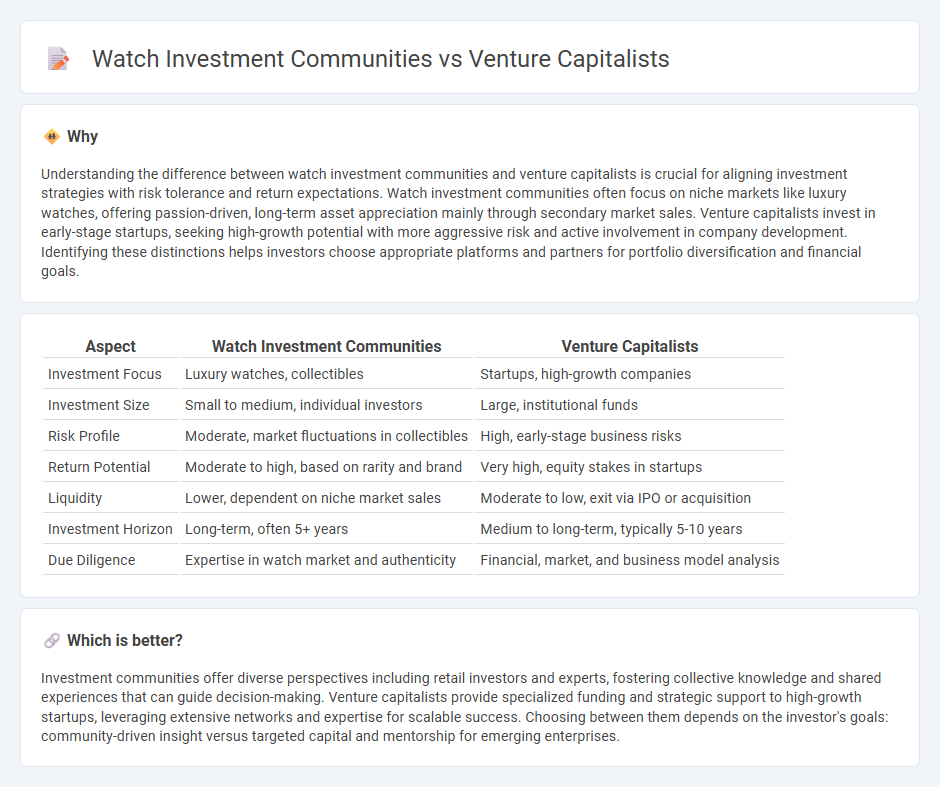

Understanding the difference between watch investment communities and venture capitalists is crucial for aligning investment strategies with risk tolerance and return expectations. Watch investment communities often focus on niche markets like luxury watches, offering passion-driven, long-term asset appreciation mainly through secondary market sales. Venture capitalists invest in early-stage startups, seeking high-growth potential with more aggressive risk and active involvement in company development. Identifying these distinctions helps investors choose appropriate platforms and partners for portfolio diversification and financial goals.

Comparison Table

| Aspect | Watch Investment Communities | Venture Capitalists |

|---|---|---|

| Investment Focus | Luxury watches, collectibles | Startups, high-growth companies |

| Investment Size | Small to medium, individual investors | Large, institutional funds |

| Risk Profile | Moderate, market fluctuations in collectibles | High, early-stage business risks |

| Return Potential | Moderate to high, based on rarity and brand | Very high, equity stakes in startups |

| Liquidity | Lower, dependent on niche market sales | Moderate to low, exit via IPO or acquisition |

| Investment Horizon | Long-term, often 5+ years | Medium to long-term, typically 5-10 years |

| Due Diligence | Expertise in watch market and authenticity | Financial, market, and business model analysis |

Which is better?

Investment communities offer diverse perspectives including retail investors and experts, fostering collective knowledge and shared experiences that can guide decision-making. Venture capitalists provide specialized funding and strategic support to high-growth startups, leveraging extensive networks and expertise for scalable success. Choosing between them depends on the investor's goals: community-driven insight versus targeted capital and mentorship for emerging enterprises.

Connection

Investment communities drive innovation by collaborating with venture capitalists who provide essential funding and strategic guidance to startups. These financiers leverage insights from active investment communities to identify emerging market trends and high-potential ventures. The synergy between investment forums and venture capital accelerates business growth and maximizes returns in competitive industries.

Key Terms

**Venture capitalists:**

Venture capitalists (VCs) specialize in providing high-risk funding to startups and early-stage companies with high growth potential, focusing on equity stakes and strategic mentorship to maximize returns. Their investment decisions rely heavily on market trends, innovation potential, and scalability, contrasting with watch investment communities that prioritize market rarity, brand heritage, and intrinsic value of luxury timepieces. Explore the distinct approaches and benefits of venture capital investing to deepen your financial strategy understanding.

Equity

Venture capitalists primarily invest in early-stage startups, acquiring equity stakes to fuel innovation and growth potential. Watch investment communities focus on rare and luxury timepieces, acquiring shares or partial ownership in high-value watches to capitalize on appreciation in value. Discover how these contrasting equity-focused investments operate and their unique market dynamics.

Startup

Venture capitalists prioritize high-growth startups with scalable business models and significant market disruption potential, often investing early to maximize equity stakes. Watch investment communities concentrate on niche luxury timepieces, focusing on value appreciation, brand heritage, and market trends for investment returns. Explore detailed insights into both investment strategies to understand their unique approaches and opportunities.

Source and External Links

Venture capital - Wikipedia - Venture capitalists finance startups in exchange for equity, providing funding, expertise, mentoring, and networks to help high-growth companies succeed, typically looking for strong management teams and large market potential with the expectation of a profitable exit within 8-12 years.

Fund your business | U.S. Small Business Administration - Venture capital involves investors providing equity funding to high-growth businesses, often requiring board seats and participation in governance, with funding rounds tied to milestones and an extensive due diligence process before investment.

15 Top Venture Capital Firms in the World (2025 Updated) - Venture capital firms receive numerous startup applications, filter candidate companies through screening processes, and invest in the most promising ideas to generate returns for investors, founders, and society, with industry leaders like Tiger Global Management and Sequoia Capital dominating.

dowidth.com

dowidth.com