Farmland crowdfunding and peer-to-peer lending represent innovative investment strategies offering diverse opportunities for portfolio diversification. Farmland crowdfunding enables investors to directly fund agricultural projects, benefiting from land appreciation and crop yields, while peer-to-peer lending connects borrowers with individual lenders, generating income through interest payments. Explore the comparative advantages and risks of these investment methods to enhance your financial decision-making.

Why it is important

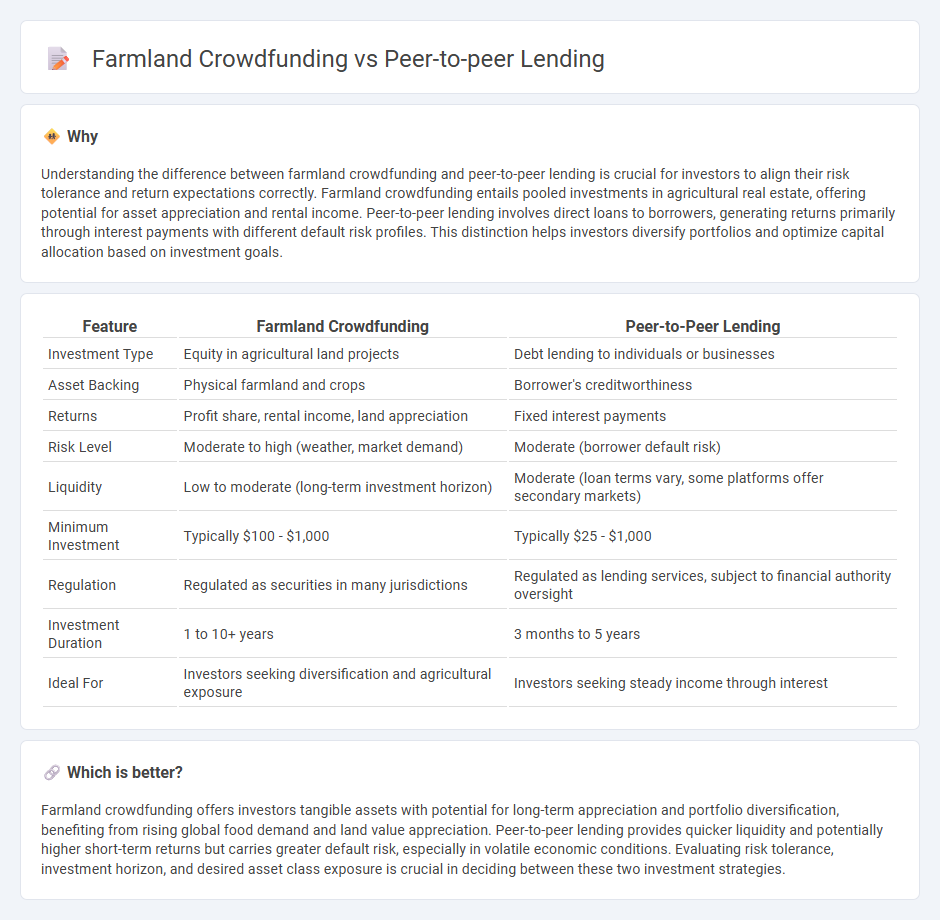

Understanding the difference between farmland crowdfunding and peer-to-peer lending is crucial for investors to align their risk tolerance and return expectations correctly. Farmland crowdfunding entails pooled investments in agricultural real estate, offering potential for asset appreciation and rental income. Peer-to-peer lending involves direct loans to borrowers, generating returns primarily through interest payments with different default risk profiles. This distinction helps investors diversify portfolios and optimize capital allocation based on investment goals.

Comparison Table

| Feature | Farmland Crowdfunding | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Equity in agricultural land projects | Debt lending to individuals or businesses |

| Asset Backing | Physical farmland and crops | Borrower's creditworthiness |

| Returns | Profit share, rental income, land appreciation | Fixed interest payments |

| Risk Level | Moderate to high (weather, market demand) | Moderate (borrower default risk) |

| Liquidity | Low to moderate (long-term investment horizon) | Moderate (loan terms vary, some platforms offer secondary markets) |

| Minimum Investment | Typically $100 - $1,000 | Typically $25 - $1,000 |

| Regulation | Regulated as securities in many jurisdictions | Regulated as lending services, subject to financial authority oversight |

| Investment Duration | 1 to 10+ years | 3 months to 5 years |

| Ideal For | Investors seeking diversification and agricultural exposure | Investors seeking steady income through interest |

Which is better?

Farmland crowdfunding offers investors tangible assets with potential for long-term appreciation and portfolio diversification, benefiting from rising global food demand and land value appreciation. Peer-to-peer lending provides quicker liquidity and potentially higher short-term returns but carries greater default risk, especially in volatile economic conditions. Evaluating risk tolerance, investment horizon, and desired asset class exposure is crucial in deciding between these two investment strategies.

Connection

Farmland crowdfunding and peer-to-peer lending intersect by enabling individual investors to directly fund agricultural projects, bypassing traditional financial institutions. Both platforms leverage digital technology to democratize funding, providing accessible investment opportunities with potential returns tied to farmland productivity and loan repayments. This synergy allows diversified portfolios, combining the tangible asset appeal of farmland with the credit-driven income from peer-to-peer loans.

Key Terms

Platform (Intermediary)

Peer-to-peer lending platforms connect individual borrowers directly with lenders, offering streamlined loan services with lower overhead costs and personalized risk assessment models. Farmland crowdfunding platforms serve as intermediaries that pool funds from multiple investors to finance agricultural projects, leveraging specialized knowledge in agriculture to manage land acquisition and farm operations. Explore how these platforms uniquely facilitate investment opportunities and risk management in alternative financing markets.

Risk Assessment

Peer-to-peer lending platforms assess risk by analyzing borrower credit scores, repayment history, and loan purpose, offering a diversified portfolio to mitigate defaults. Farmland crowdfunding evaluates agricultural land value, crop yield potential, and market conditions, with risk tied closely to environmental factors and commodity prices. Explore comprehensive risk assessment strategies to make informed decisions in alternative investment opportunities.

Asset Type

Peer-to-peer lending primarily involves financial assets where individuals lend money directly to borrowers, focusing on debt instruments with relatively short-term returns and interest payments. In contrast, farmland crowdfunding targets tangible real estate assets, allowing investors to participate in agricultural land ownership and benefit from land appreciation and farm income. Explore how these asset types impact risk, liquidity, and returns to make informed investment decisions.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending allows borrowers to obtain loans directly from individual investors through specialized websites, bypassing banks, offering potentially lower eligibility requirements and competitive interest rates, while lenders can earn interest on their investments with varying risk levels.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an online financial service connecting lenders and borrowers via platforms that manage credit evaluation, payment processing, and legal compliance, providing an alternative to traditional financial institutions with unsecured or secured loans that typically lack government insurance protection.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending websites act as marketplaces matching people or businesses wanting to lend money with borrowers, offering higher interest rates than savings accounts but with greater risk, sometimes allowing lenders to choose borrowers or spreading their money across many loans to diversify risk.

dowidth.com

dowidth.com