Royalty rights investing involves purchasing rights to future income from intellectual property such as music, films, or patents, offering a steady revenue stream linked to the asset's performance. Collectibles investing focuses on acquiring rare items like art, vintage cars, or coins, relying on market demand and scarcity for value appreciation. Explore the benefits and risks of these distinct investment strategies to make informed portfolio decisions.

Why it is important

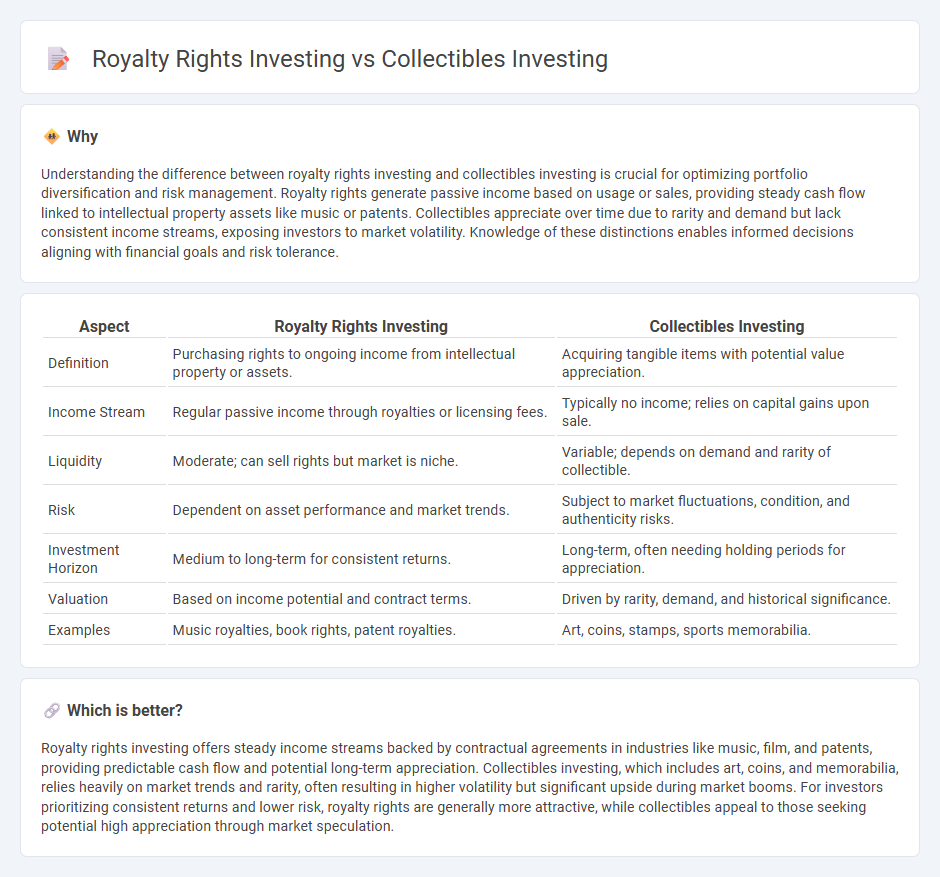

Understanding the difference between royalty rights investing and collectibles investing is crucial for optimizing portfolio diversification and risk management. Royalty rights generate passive income based on usage or sales, providing steady cash flow linked to intellectual property assets like music or patents. Collectibles appreciate over time due to rarity and demand but lack consistent income streams, exposing investors to market volatility. Knowledge of these distinctions enables informed decisions aligning with financial goals and risk tolerance.

Comparison Table

| Aspect | Royalty Rights Investing | Collectibles Investing |

|---|---|---|

| Definition | Purchasing rights to ongoing income from intellectual property or assets. | Acquiring tangible items with potential value appreciation. |

| Income Stream | Regular passive income through royalties or licensing fees. | Typically no income; relies on capital gains upon sale. |

| Liquidity | Moderate; can sell rights but market is niche. | Variable; depends on demand and rarity of collectible. |

| Risk | Dependent on asset performance and market trends. | Subject to market fluctuations, condition, and authenticity risks. |

| Investment Horizon | Medium to long-term for consistent returns. | Long-term, often needing holding periods for appreciation. |

| Valuation | Based on income potential and contract terms. | Driven by rarity, demand, and historical significance. |

| Examples | Music royalties, book rights, patent royalties. | Art, coins, stamps, sports memorabilia. |

Which is better?

Royalty rights investing offers steady income streams backed by contractual agreements in industries like music, film, and patents, providing predictable cash flow and potential long-term appreciation. Collectibles investing, which includes art, coins, and memorabilia, relies heavily on market trends and rarity, often resulting in higher volatility but significant upside during market booms. For investors prioritizing consistent returns and lower risk, royalty rights are generally more attractive, while collectibles appeal to those seeking potential high appreciation through market speculation.

Connection

Royalty rights investing and collectibles investing both offer alternative asset classes that diversify traditional portfolios by generating unique income streams and potential asset appreciation. Investors in royalty rights earn passive income through royalties from intellectual properties such as music, patents, or trademarks, while collectibles investing involves acquiring tangible, rare items like art, coins, or vintage memorabilia that may appreciate over time. Both methods require understanding market trends, valuation intricacies, and liquidity considerations to optimize returns and manage risks effectively.

Key Terms

Collectibles investing:

Collectibles investing involves acquiring rare items such as art, vintage toys, coins, and sports memorabilia that appreciate in value over time due to scarcity and demand. These tangible assets often provide portfolio diversification and potential inflation hedging, though market liquidity can vary significantly. Explore detailed strategies and market trends to optimize your collectibles investment approach.

Authentication

Authentication plays a crucial role in collectibles investing by verifying the provenance and condition of tangible items, thus directly impacting market value and investor confidence. In royalty rights investing, authentication centers on legal ownership and the legitimacy of revenue streams, confirmed through contracts and intellectual property rights documentation. Explore further to understand how authentication processes differ and influence risk assessment in both investment types.

Provenance

Collectibles investing leverages provenance to authenticate and enhance the historical value of items such as rare coins, art, and vintage cars, often increasing their market desirability and price. Royalty rights investing emphasizes clear provenance through legal documentation and contract history to ensure consistent income streams from intellectual property like music, patents, or literary works. Explore how understanding provenance can optimize your investment strategy in both collectibles and royalty rights.

Source and External Links

Investing In The $500 Billion Collectibles Market: How To Get Started - Investing in collectibles can be done directly by buying items or through platforms like Masterworks and WhiskyInvestDirect, which allow investment in art or spirits with fees and portfolio curation services, but other types require individual effort and market knowledge.

Types of Collectible Investments To Consider - SmartAsset - Collectible investments such as fine art, classic cars, rare coins, and stamps offer portfolio diversification but require careful research, proper storage, and insurance due to liquidity challenges and subjective valuation.

Best Collectibles to Invest In: Guide for 2024 - Benzinga - The best collectibles for investment include fine art, coins, stamps, vintage cars, and investment-grade wine, noted for their rarity and demand which can lead to portfolio diversification and potential financial gain.

dowidth.com

dowidth.com