Sports team ownership shares offer dynamic growth potential tied to team performance and marketability, often yielding lucrative returns through merchandising, broadcasting rights, and ticket sales. Farmland investment provides a stable, long-term asset with consistent income from crop production and rising land values influenced by food demand and sustainable agriculture trends. Explore detailed comparisons to determine which investment aligns best with your financial goals and risk tolerance.

Why it is important

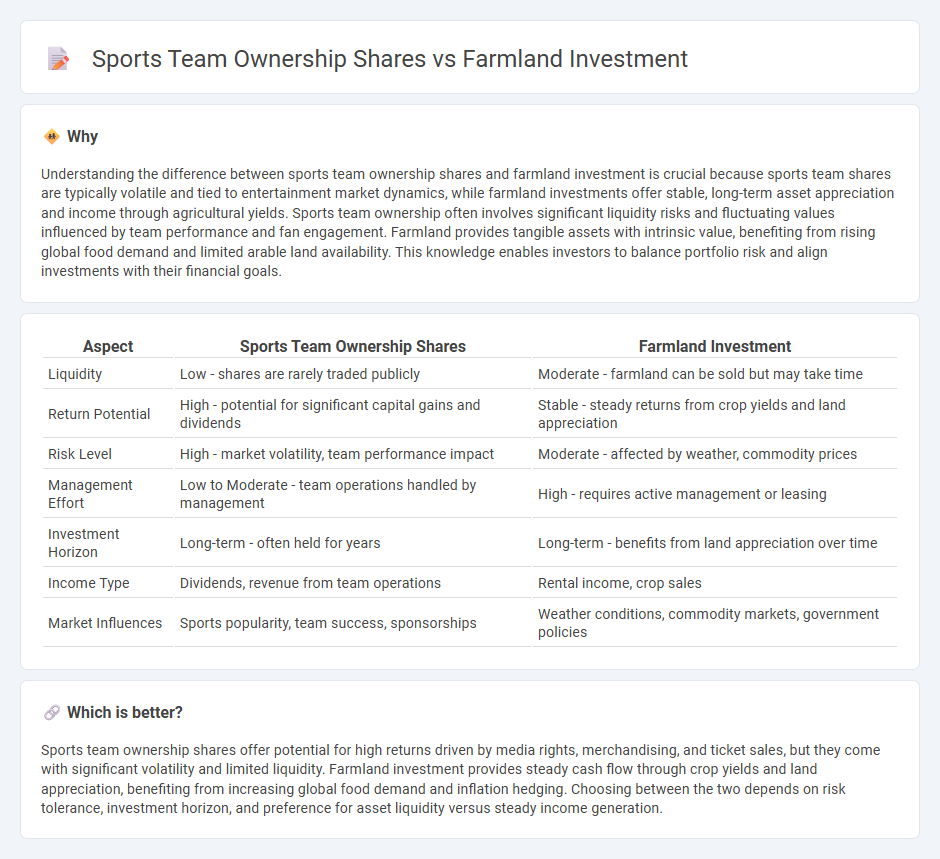

Understanding the difference between sports team ownership shares and farmland investment is crucial because sports team shares are typically volatile and tied to entertainment market dynamics, while farmland investments offer stable, long-term asset appreciation and income through agricultural yields. Sports team ownership often involves significant liquidity risks and fluctuating values influenced by team performance and fan engagement. Farmland provides tangible assets with intrinsic value, benefiting from rising global food demand and limited arable land availability. This knowledge enables investors to balance portfolio risk and align investments with their financial goals.

Comparison Table

| Aspect | Sports Team Ownership Shares | Farmland Investment |

|---|---|---|

| Liquidity | Low - shares are rarely traded publicly | Moderate - farmland can be sold but may take time |

| Return Potential | High - potential for significant capital gains and dividends | Stable - steady returns from crop yields and land appreciation |

| Risk Level | High - market volatility, team performance impact | Moderate - affected by weather, commodity prices |

| Management Effort | Low to Moderate - team operations handled by management | High - requires active management or leasing |

| Investment Horizon | Long-term - often held for years | Long-term - benefits from land appreciation over time |

| Income Type | Dividends, revenue from team operations | Rental income, crop sales |

| Market Influences | Sports popularity, team success, sponsorships | Weather conditions, commodity markets, government policies |

Which is better?

Sports team ownership shares offer potential for high returns driven by media rights, merchandising, and ticket sales, but they come with significant volatility and limited liquidity. Farmland investment provides steady cash flow through crop yields and land appreciation, benefiting from increasing global food demand and inflation hedging. Choosing between the two depends on risk tolerance, investment horizon, and preference for asset liquidity versus steady income generation.

Connection

Sports team ownership shares and farmland investment are connected through their role as alternative assets that diversify investment portfolios and provide stable long-term returns. Both asset classes appeal to investors seeking tangible, inflation-resistant holdings outside traditional stocks and bonds, leveraging unique revenue streams from media rights and agricultural production. Institutional investors increasingly allocate capital to these sectors for portfolio resilience and potential capital appreciation amid market volatility.

Key Terms

**Farmland Investment:**

Farmland investment offers a stable, inflation-resistant asset with consistent rental income and long-term appreciation driven by global food demand and limited arable land supply. Unlike sports team ownership shares, farmland investments benefit from tangible land value and reduced market volatility, providing diversified portfolio advantages. Explore the benefits and strategies of farmland investment to enhance your financial portfolio today.

Land Appreciation

Farmland investment offers stable land appreciation driven by increasing global food demand and limited arable land availability, making it a resilient asset class with predictable long-term growth. In contrast, sports team ownership shares often reflect franchise value, revenue streams, and market popularity, resulting in more volatile appreciation tied to team performance and league dynamics. Explore detailed analyses comparing farmland land appreciation potential and sports franchise equity growth to optimize your investment portfolio.

Crop Yield

Farmland investment offers stable returns driven by consistent crop yields, with average annual yields for key staples like corn and wheat increasing by 1-2% due to advancements in agricultural technology. In contrast, sports team ownership shares are influenced by fluctuating market valuations, ticket sales, and merchandise revenue, which bear less direct correlation to predictable agricultural productivity. Explore deeper insights into how crop yield metrics compare to financial performance indicators in sports team investments.

Source and External Links

Investing in farmland - Farmland investment offers diversification, inflation protection, and stable returns driven by growing global food demand and finite land resources, making it a compelling long-term option.

6 Easy Ways to Invest in Farmland in 2025 - Key considerations for farmland investment include land valuation, farm income potential, local market liquidity, extra assets like irrigation, and opportunities for passive income from leases or renewable energy projects.

Farmland LP: Home - Farmland LP specializes in organic and regenerative farming investments, focusing on sustainability and higher returns through improved soil health and converting conventional farmland to organic.

dowidth.com

dowidth.com