Wine funds offer investors exposure to fine wine as an alternative asset, often yielding returns through appreciation and rarity, while exchange-traded funds (ETFs) provide diversified equity or bond portfolios that are easily traded on stock exchanges. Wine funds typically appeal to those seeking portfolio diversification with lower market correlation and tangible asset backing, contrasting with ETFs' liquidity and broad market accessibility. Explore the distinct advantages and risks of wine funds versus ETFs to determine the optimal investment strategy for your financial goals.

Why it is important

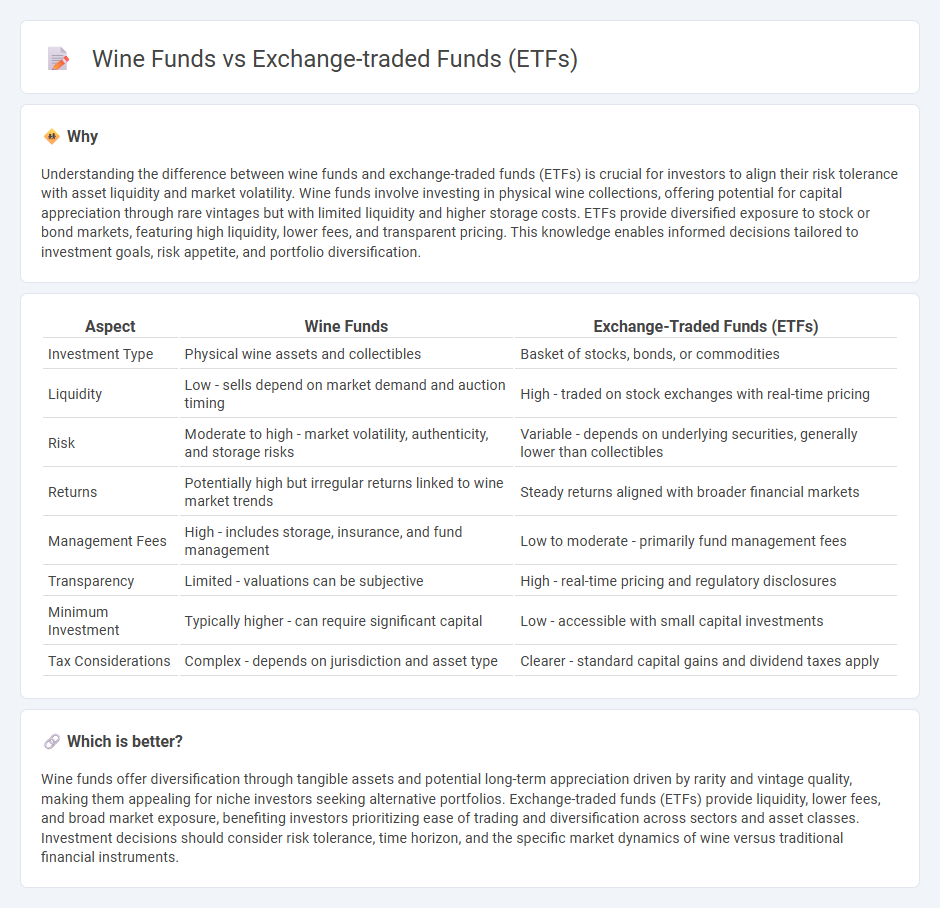

Understanding the difference between wine funds and exchange-traded funds (ETFs) is crucial for investors to align their risk tolerance with asset liquidity and market volatility. Wine funds involve investing in physical wine collections, offering potential for capital appreciation through rare vintages but with limited liquidity and higher storage costs. ETFs provide diversified exposure to stock or bond markets, featuring high liquidity, lower fees, and transparent pricing. This knowledge enables informed decisions tailored to investment goals, risk appetite, and portfolio diversification.

Comparison Table

| Aspect | Wine Funds | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Investment Type | Physical wine assets and collectibles | Basket of stocks, bonds, or commodities |

| Liquidity | Low - sells depend on market demand and auction timing | High - traded on stock exchanges with real-time pricing |

| Risk | Moderate to high - market volatility, authenticity, and storage risks | Variable - depends on underlying securities, generally lower than collectibles |

| Returns | Potentially high but irregular returns linked to wine market trends | Steady returns aligned with broader financial markets |

| Management Fees | High - includes storage, insurance, and fund management | Low to moderate - primarily fund management fees |

| Transparency | Limited - valuations can be subjective | High - real-time pricing and regulatory disclosures |

| Minimum Investment | Typically higher - can require significant capital | Low - accessible with small capital investments |

| Tax Considerations | Complex - depends on jurisdiction and asset type | Clearer - standard capital gains and dividend taxes apply |

Which is better?

Wine funds offer diversification through tangible assets and potential long-term appreciation driven by rarity and vintage quality, making them appealing for niche investors seeking alternative portfolios. Exchange-traded funds (ETFs) provide liquidity, lower fees, and broad market exposure, benefiting investors prioritizing ease of trading and diversification across sectors and asset classes. Investment decisions should consider risk tolerance, time horizon, and the specific market dynamics of wine versus traditional financial instruments.

Connection

Wine funds and exchange-traded funds (ETFs) are connected through their role as alternative investment vehicles that offer portfolio diversification. Wine funds invest directly in collectible wines, leveraging the rare wine market's historical appreciation, while wine-related ETFs provide exposure by tracking companies engaged in wine production and distribution. Both investment types allow investors to gain exposure to the wine industry's growth potential without owning physical bottles.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity with shares traded on major stock exchanges, allowing investors to buy or sell instantly at market prices during trading hours. Wine funds, by contrast, generally have lower liquidity due to the niche market and longer investment horizons, often requiring extended holding periods before realizing returns. Explore more about liquidity differences and investment suitability between ETFs and wine funds to make informed decisions.

Diversification

Exchange-traded funds (ETFs) offer broad market diversification by pooling assets from various sectors, industries, and geographic regions, minimizing individual investment risk. Wine funds, while providing exposure to an alternative asset class, tend to be less diversified, focusing on specific vintages, regions, or producers, which can increase risk but offer unique portfolio benefits. Explore more about how diversification strategies differ between ETFs and wine funds to optimize your investment portfolio.

Valuation

Exchange-traded funds (ETFs) are typically valued based on real-time market prices that reflect the current value of their underlying assets, providing high liquidity and transparency. Wine funds, in contrast, rely on less frequent appraisals and market valuations of physical wine collections, which can be influenced by factors such as vintage rarity, provenance, and storage conditions, resulting in more subjective valuations. Explore further to understand the risks and opportunities in valuing ETFs versus wine funds.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are investment funds traded on stock exchanges, pooling investors' money to buy stocks, bonds, or other assets, with each share representing part ownership of the underlying portfolio.

What is an ETF (Exchange-Traded Fund)? - Schwab - ETFs combine stock-like trading flexibility with mutual fund diversification, offering broad exposure to asset classes at typically lower costs than actively managed mutual funds.

Exchange-Traded Funds and Products - FINRA - ETFs are traded throughout the day like stocks, use authorized participants for share creation/redemption, and can be passively indexed or actively managed.

dowidth.com

dowidth.com