Sports team ownership shares provide investors with a unique blend of passion and portfolio diversification, often involving long-term value appreciation tied to franchise success and fan engagement. Angel investing allows early-stage supporters to fund innovative startups, potentially yielding high returns through equity stakes in emerging companies. Explore the distinct benefits and risks of these investment avenues to determine which aligns best with your financial goals and interests.

Why it is important

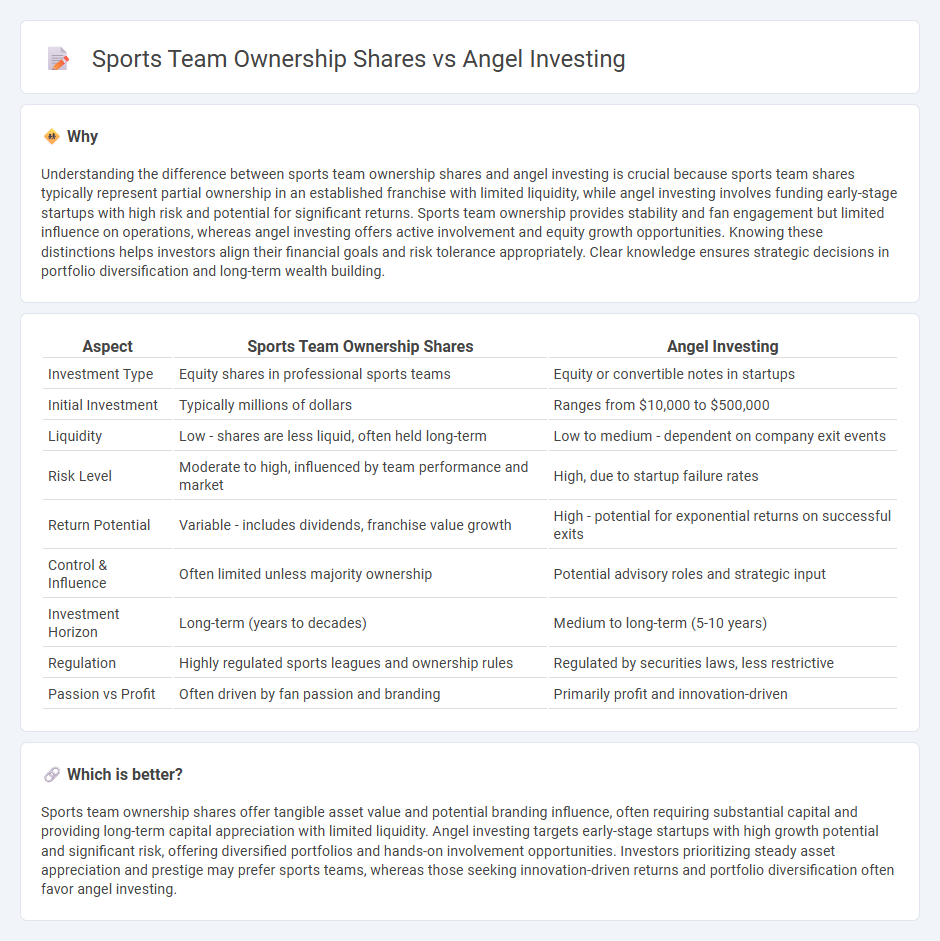

Understanding the difference between sports team ownership shares and angel investing is crucial because sports team shares typically represent partial ownership in an established franchise with limited liquidity, while angel investing involves funding early-stage startups with high risk and potential for significant returns. Sports team ownership provides stability and fan engagement but limited influence on operations, whereas angel investing offers active involvement and equity growth opportunities. Knowing these distinctions helps investors align their financial goals and risk tolerance appropriately. Clear knowledge ensures strategic decisions in portfolio diversification and long-term wealth building.

Comparison Table

| Aspect | Sports Team Ownership Shares | Angel Investing |

|---|---|---|

| Investment Type | Equity shares in professional sports teams | Equity or convertible notes in startups |

| Initial Investment | Typically millions of dollars | Ranges from $10,000 to $500,000 |

| Liquidity | Low - shares are less liquid, often held long-term | Low to medium - dependent on company exit events |

| Risk Level | Moderate to high, influenced by team performance and market | High, due to startup failure rates |

| Return Potential | Variable - includes dividends, franchise value growth | High - potential for exponential returns on successful exits |

| Control & Influence | Often limited unless majority ownership | Potential advisory roles and strategic input |

| Investment Horizon | Long-term (years to decades) | Medium to long-term (5-10 years) |

| Regulation | Highly regulated sports leagues and ownership rules | Regulated by securities laws, less restrictive |

| Passion vs Profit | Often driven by fan passion and branding | Primarily profit and innovation-driven |

Which is better?

Sports team ownership shares offer tangible asset value and potential branding influence, often requiring substantial capital and providing long-term capital appreciation with limited liquidity. Angel investing targets early-stage startups with high growth potential and significant risk, offering diversified portfolios and hands-on involvement opportunities. Investors prioritizing steady asset appreciation and prestige may prefer sports teams, whereas those seeking innovation-driven returns and portfolio diversification often favor angel investing.

Connection

Sports team ownership shares represent a unique asset class attracting angel investors who seek high-growth opportunities in passion-driven markets. Angel investing in sports teams often involves acquiring equity stakes, offering both financial returns and exclusive access to the sports industry's revenue streams, including broadcasting rights, merchandising, and ticket sales. This intersection allows early-stage investors to leverage sports franchises as scalable investments with potential for substantial appreciation.

Key Terms

Equity

Angel investing involves providing early-stage capital to startups in exchange for equity, often resulting in high-growth potential ownership stakes. Sports team ownership shares represent equity in an established franchise, typically offering financial stability but limited liquidity and slower appreciation. Explore the differences in equity structure and risk profiles to determine which investment aligns with your financial goals.

Valuation

Angel investing involves acquiring equity in early-stage startups, with valuation often based on future growth potential and market disruption, typically valuated through methods like discounted cash flow or comparable startup rounds. Sports team ownership shares are valued based on current revenue streams, brand strength, and league-wide financial performance, often influenced by broadcast rights, merchandise sales, and ticket revenues. Explore detailed valuation metrics and strategic considerations for both investment types to make informed decisions.

Due diligence

Due diligence in angel investing involves thorough evaluation of startup business models, market potential, financial health, and the founding team's track record to mitigate risks and maximize ROI. In contrast, due diligence for sports team ownership shares emphasizes franchise valuation, revenue streams from broadcasting rights, sponsorship deals, and league regulations. Explore deeper insights on due diligence strategies to make informed investment decisions in both domains.

Source and External Links

Understanding angel financing and investing - Angel investors are individuals who provide capital to startups in exchange for equity or convertible debt, typically stepping in after initial "friends and family" funding and before professional venture capital, often offering mentorship and industry connections to help founders progress toward key milestones and prepare for institutional investment.

Demystifying Angel Investing - Angel investing allows individuals to back early-stage companies for financial returns, community impact, and possible tax benefits, with angel groups supporting startup ecosystems and providing resources for new investors to learn and participate in deals.

Angel Investors - Angel investors are affluent individuals who fund startups in exchange for ownership shares, using their personal wealth rather than pooled funds, and often provide hands-on support, while seeking eventual profitable exits through acquisitions or public offerings.

dowidth.com

dowidth.com