Farmland crowdfunding allows individual investors to collectively fund agricultural projects with relatively low minimum investments, offering exposure to farmland assets that historically provide stable returns and inflation protection. Real estate syndication pools capital from multiple investors to acquire larger commercial or residential properties, typically requiring higher minimum investments and providing potential for substantial income through rental yields and property appreciation. Explore deeper insights to determine the optimal investment strategy for your portfolio.

Why it is important

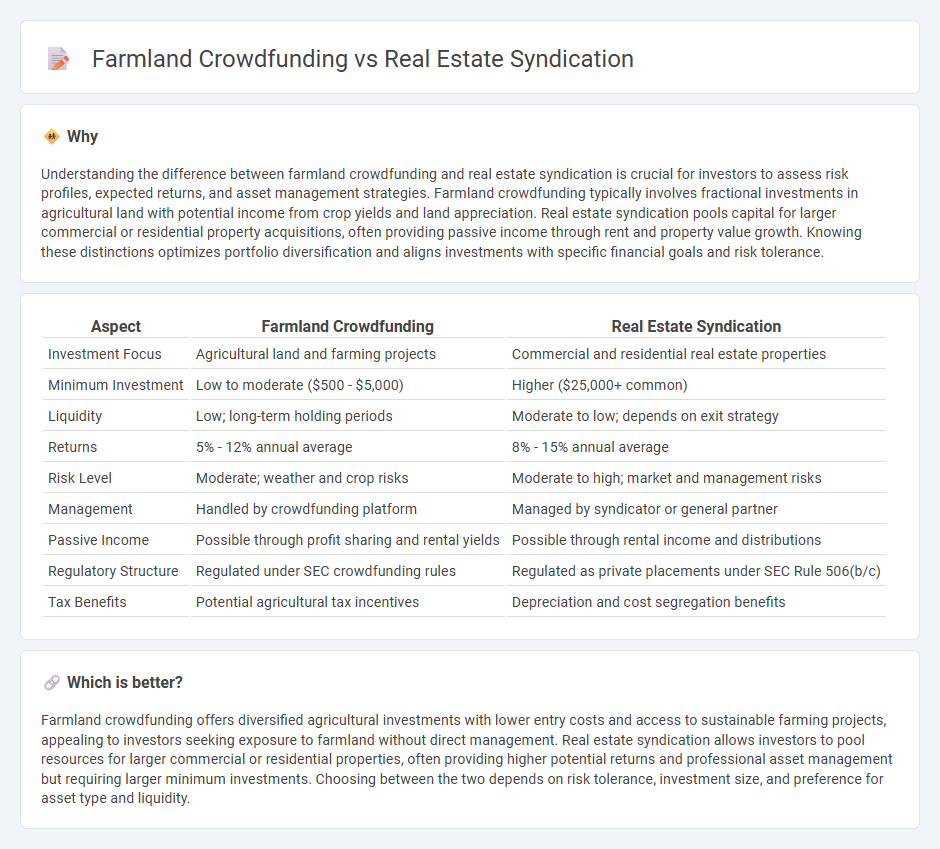

Understanding the difference between farmland crowdfunding and real estate syndication is crucial for investors to assess risk profiles, expected returns, and asset management strategies. Farmland crowdfunding typically involves fractional investments in agricultural land with potential income from crop yields and land appreciation. Real estate syndication pools capital for larger commercial or residential property acquisitions, often providing passive income through rent and property value growth. Knowing these distinctions optimizes portfolio diversification and aligns investments with specific financial goals and risk tolerance.

Comparison Table

| Aspect | Farmland Crowdfunding | Real Estate Syndication |

|---|---|---|

| Investment Focus | Agricultural land and farming projects | Commercial and residential real estate properties |

| Minimum Investment | Low to moderate ($500 - $5,000) | Higher ($25,000+ common) |

| Liquidity | Low; long-term holding periods | Moderate to low; depends on exit strategy |

| Returns | 5% - 12% annual average | 8% - 15% annual average |

| Risk Level | Moderate; weather and crop risks | Moderate to high; market and management risks |

| Management | Handled by crowdfunding platform | Managed by syndicator or general partner |

| Passive Income | Possible through profit sharing and rental yields | Possible through rental income and distributions |

| Regulatory Structure | Regulated under SEC crowdfunding rules | Regulated as private placements under SEC Rule 506(b/c) |

| Tax Benefits | Potential agricultural tax incentives | Depreciation and cost segregation benefits |

Which is better?

Farmland crowdfunding offers diversified agricultural investments with lower entry costs and access to sustainable farming projects, appealing to investors seeking exposure to farmland without direct management. Real estate syndication allows investors to pool resources for larger commercial or residential properties, often providing higher potential returns and professional asset management but requiring larger minimum investments. Choosing between the two depends on risk tolerance, investment size, and preference for asset type and liquidity.

Connection

Farmland crowdfunding and real estate syndication both enable multiple investors to pool capital for acquiring income-generating properties, leveraging collective buying power to access larger, diversified assets. These investment models utilize online platforms to efficiently connect investors with agricultural land or commercial real estate projects, offering passive income opportunities and potential appreciation. The shared structure of fractional ownership and professional management aligns both as scalable, accessible alternatives to traditional direct property investment.

Key Terms

Ownership structure

Real estate syndication typically involves a group of investors pooling capital to acquire or develop properties, often structured as a limited partnership where a sponsor manages the investment. Farmland crowdfunding allows individual investors to buy shares in agricultural land projects through online platforms, offering fractional ownership without direct management responsibilities. Explore the distinct ownership models and benefits of each to determine which aligns with your investment goals.

Capital pooling

Real estate syndication and farmland crowdfunding both enable capital pooling from multiple investors to access larger, often institutional-grade assets. Real estate syndication typically involves fewer, accredited investors contributing significant capital to acquire commercial properties, whereas farmland crowdfunding allows a broader range of smaller investors to collectively fund agricultural land projects. Explore detailed comparisons to understand the benefits and risks of each capital pooling model.

Asset management

Real estate syndication offers active asset management where investors collaborate closely with sponsors to oversee property operations, enhance value, and maximize returns. Farmland crowdfunding typically involves passive asset management, with professional farm operators handling day-to-day agricultural activities and investors receiving periodic updates. Discover the nuances of managing your investments effectively in both models to optimize your portfolio performance.

Source and External Links

An Introduction to Real Estate Syndication - Real estate syndication is a structure where multiple investors pool capital to invest collaboratively in specific property opportunities, managed by a sponsor who handles acquisition and operations, allowing investors access to larger investments than they could afford individually.

Real Estate Syndication - RealtyMogul - Real estate syndication involves a sponsor or syndicator acquiring and managing property on behalf of investor limited partners who provide capital but remain passive, sharing ownership benefits without day-to-day management responsibilities.

Real Estate Syndications vs. REITs for Investors - SmartAsset - Syndications pool investor funds for direct property ownership, typically in larger assets, with a sponsor managing the investment, offering investors exposure to real estate through partnership interests different from publicly traded REIT shares.

dowidth.com

dowidth.com