Collectible sneakers and fine wine both offer unique investment opportunities driven by rarity, market demand, and cultural trends. Sneakers gain value through limited releases and brand collaborations, appealing to younger generations and streetwear enthusiasts, while wine investments rely on vintage quality, aging potential, and provenance, attracting connoisseurs and traditional investors. Explore the distinct advantages and risks of these alternative assets to enhance your investment strategy.

Why it is important

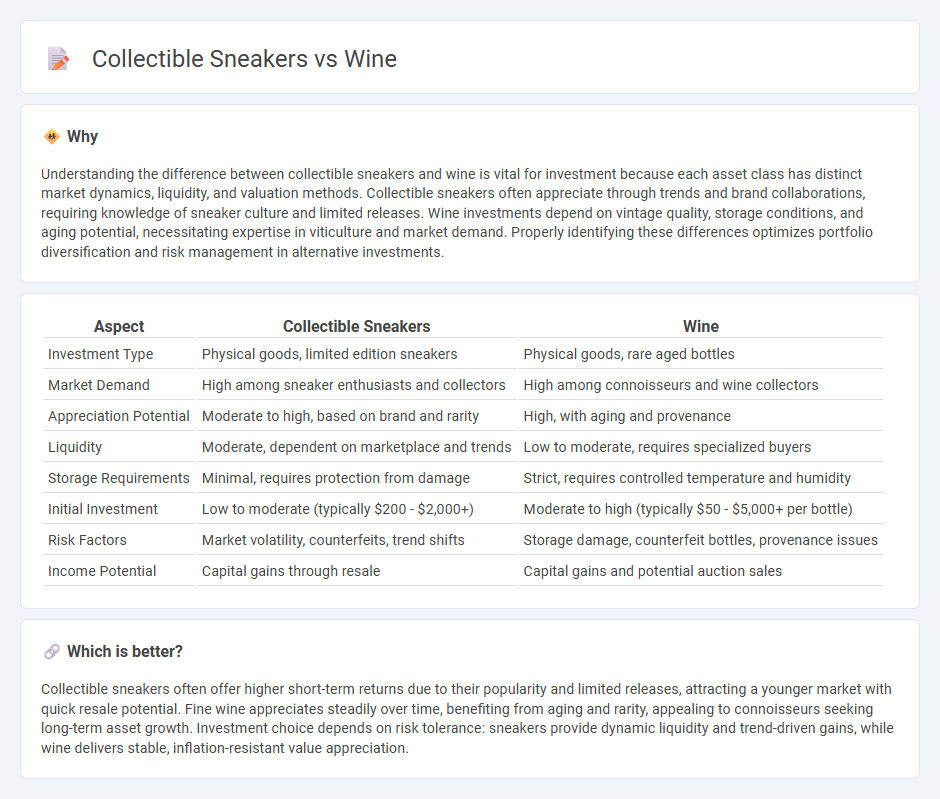

Understanding the difference between collectible sneakers and wine is vital for investment because each asset class has distinct market dynamics, liquidity, and valuation methods. Collectible sneakers often appreciate through trends and brand collaborations, requiring knowledge of sneaker culture and limited releases. Wine investments depend on vintage quality, storage conditions, and aging potential, necessitating expertise in viticulture and market demand. Properly identifying these differences optimizes portfolio diversification and risk management in alternative investments.

Comparison Table

| Aspect | Collectible Sneakers | Wine |

|---|---|---|

| Investment Type | Physical goods, limited edition sneakers | Physical goods, rare aged bottles |

| Market Demand | High among sneaker enthusiasts and collectors | High among connoisseurs and wine collectors |

| Appreciation Potential | Moderate to high, based on brand and rarity | High, with aging and provenance |

| Liquidity | Moderate, dependent on marketplace and trends | Low to moderate, requires specialized buyers |

| Storage Requirements | Minimal, requires protection from damage | Strict, requires controlled temperature and humidity |

| Initial Investment | Low to moderate (typically $200 - $2,000+) | Moderate to high (typically $50 - $5,000+ per bottle) |

| Risk Factors | Market volatility, counterfeits, trend shifts | Storage damage, counterfeit bottles, provenance issues |

| Income Potential | Capital gains through resale | Capital gains and potential auction sales |

Which is better?

Collectible sneakers often offer higher short-term returns due to their popularity and limited releases, attracting a younger market with quick resale potential. Fine wine appreciates steadily over time, benefiting from aging and rarity, appealing to connoisseurs seeking long-term asset growth. Investment choice depends on risk tolerance: sneakers provide dynamic liquidity and trend-driven gains, while wine delivers stable, inflation-resistant value appreciation.

Connection

Collectible sneakers and fine wine both serve as alternative investment assets that appreciate over time due to rarity, brand prestige, and cultural significance. The sneaker market is driven by limited-edition drops and collaborations, while wine investment relies on vintage quality and aging potential, creating opportunities for diversification in investment portfolios. Both markets use authentication and provenance tracking to ensure value retention and reduce counterfeiting risks.

Key Terms

Authenticity

Authenticity is paramount when investing in wine or collectible sneakers, with provenance and certification serving as critical indicators of genuineness. In the wine industry, detailed vintner records and professional appraisals verify origin and quality, while collectible sneakers rely heavily on serial numbers, holograms, and expert authentication services to prevent counterfeits. Discover more about ensuring authenticity and maximizing the value of your investments.

Market Liquidity

Market liquidity in the wine sector remains robust due to a stable demand for rare vintages and established auction platforms that facilitate quick transactions. Collectible sneakers experience higher volatility, with liquidity fluctuating based on trends, brand collaborations, and limited releases that drive short-term spikes. Explore detailed insights on how liquidity dynamics affect investment returns in both markets.

Provenance

Provenance plays a crucial role in establishing the value of both wine and collectible sneakers, with documented history and authenticity significantly impacting market demand. Wine provenance includes detailed records of vineyard origin, vintage, storage conditions, and ownership, while collectible sneakers rely on limited edition releases, original packaging, and verified transaction history. Discover how provenance influences investment potential and authenticity verification in these two dynamic markets.

Source and External Links

Wine - Wikipedia - Wine is an alcoholic drink made from fermented grapes, produced worldwide in many styles influenced by grape varieties, growing conditions, and production methods, with a rich history dating back to 6000 BCE and significant cultural and religious roles.

Wine - Walmart.com - Walmart offers a wide range of wines including red, white, sparkling, and boxed wines in various flavor profiles and styles, suitable for all occasions and budgets.

Premium Wine Delivery | Fine Wine for Sale - WTSO - WTSO curates monthly selections of premium wines spanning all types and tastes, available for online purchase and delivery, ideal for special occasions and gifting.

dowidth.com

dowidth.com