Secondaries in venture capital allow investors to purchase existing stakes in startups or funds, providing liquidity and portfolio diversification without the risks of early-stage investment. Co-investments involve directly partnering with lead investors to invest alongside them in new ventures, often gaining better terms and deeper involvement in the company's growth. Explore the benefits and distinctions between these investment strategies to enhance your portfolio management.

Why it is important

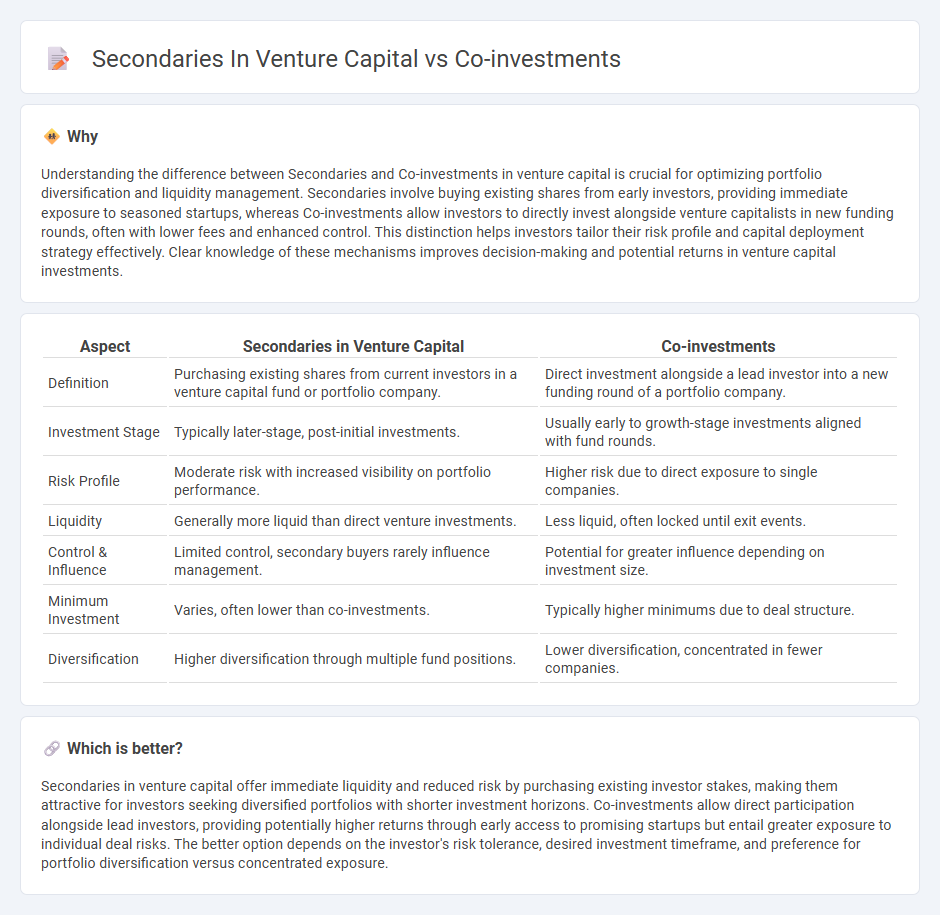

Understanding the difference between Secondaries and Co-investments in venture capital is crucial for optimizing portfolio diversification and liquidity management. Secondaries involve buying existing shares from early investors, providing immediate exposure to seasoned startups, whereas Co-investments allow investors to directly invest alongside venture capitalists in new funding rounds, often with lower fees and enhanced control. This distinction helps investors tailor their risk profile and capital deployment strategy effectively. Clear knowledge of these mechanisms improves decision-making and potential returns in venture capital investments.

Comparison Table

| Aspect | Secondaries in Venture Capital | Co-investments |

|---|---|---|

| Definition | Purchasing existing shares from current investors in a venture capital fund or portfolio company. | Direct investment alongside a lead investor into a new funding round of a portfolio company. |

| Investment Stage | Typically later-stage, post-initial investments. | Usually early to growth-stage investments aligned with fund rounds. |

| Risk Profile | Moderate risk with increased visibility on portfolio performance. | Higher risk due to direct exposure to single companies. |

| Liquidity | Generally more liquid than direct venture investments. | Less liquid, often locked until exit events. |

| Control & Influence | Limited control, secondary buyers rarely influence management. | Potential for greater influence depending on investment size. |

| Minimum Investment | Varies, often lower than co-investments. | Typically higher minimums due to deal structure. |

| Diversification | Higher diversification through multiple fund positions. | Lower diversification, concentrated in fewer companies. |

Which is better?

Secondaries in venture capital offer immediate liquidity and reduced risk by purchasing existing investor stakes, making them attractive for investors seeking diversified portfolios with shorter investment horizons. Co-investments allow direct participation alongside lead investors, providing potentially higher returns through early access to promising startups but entail greater exposure to individual deal risks. The better option depends on the investor's risk tolerance, desired investment timeframe, and preference for portfolio diversification versus concentrated exposure.

Connection

Secondaries in venture capital involve the purchase of existing investor stakes in startups, providing liquidity while maintaining exposure to high-growth companies, which closely relates to co-investments where investors directly invest alongside lead venture capital funds. Both strategies allow participants to access venture capital opportunities with differing risk profiles and entry points, complementing portfolio diversification and capital deployment timing. Utilizing secondaries and co-investments can optimize investment returns by balancing liquidity, control, and exposure to promising startups.

Key Terms

Deal Flow

Co-investments in venture capital offer direct exposure to high-potential startups by investing alongside lead investors, enhancing deal flow with targeted opportunities and lower fees. Secondaries provide liquidity access to pre-existing venture fund stakes, improving portfolio diversification but potentially involving higher premiums and less control over individual deals. Explore deeper insights into optimizing venture capital strategies through co-investments and secondaries for superior deal flow management.

Liquidity

Co-investments in venture capital offer investors direct stakes alongside lead investors, providing potential for higher returns but often with longer liquidity horizons due to startup growth cycles. Secondaries involve purchasing existing stakes from current investors, typically delivering faster liquidity by acquiring shares closer to exit events or more mature companies. Explore the nuances of liquidity profiles in co-investments versus secondaries to optimize your venture capital strategy.

Alignment of Interests

Co-investments in venture capital align interests by allowing limited partners to invest directly alongside fund managers, ensuring shared risk and potentially higher returns. Secondaries provide liquidity by enabling investors to buy existing stakes, which may dilute alignment but offer immediate portfolio diversification. Discover deeper insights into how each strategy impacts investor alignment and portfolio outcomes.

Source and External Links

Equity Co-investment - Equity co-investment involves a minority investment alongside a financial sponsor in a leveraged buyout or growth capital transaction, allowing for targeted risk and potential returns.

The Growing Opportunity in Private Equity Secondaries and Co-investments - This article highlights co-investments as providing targeted exposure and an attractive risk/reward profile, particularly in sectors like healthcare and technology.

The Case for Co-Investments - Co-investing is a strategy that allows investors to make direct, passive investments into companies alongside a manager, offering greater control and potential returns.

dowidth.com

dowidth.com