Music royalties investment offers consistent passive income by acquiring the rights to artists' earnings, ensuring steady cash flow from streaming, radio plays, and licensing deals. Angel investing involves funding early-stage startups with high growth potential, presenting significant risk but the opportunity for substantial returns upon company success. Explore how these two distinct investment avenues can diversify your portfolio and balance risk with reward.

Why it is important

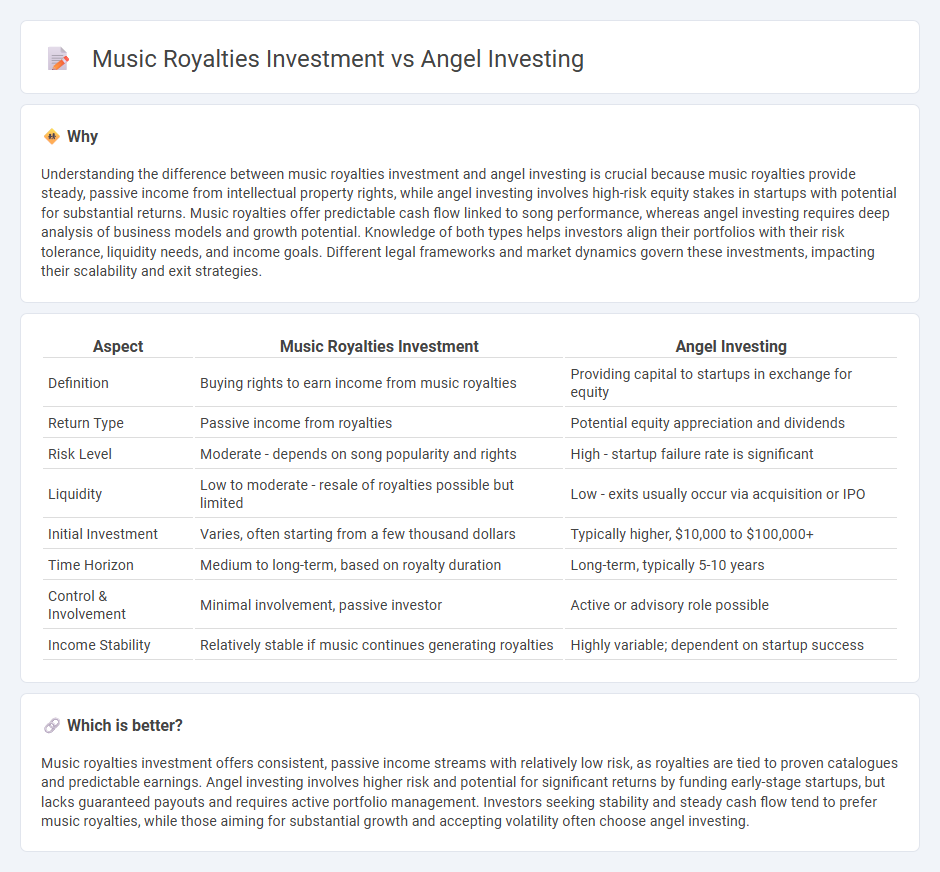

Understanding the difference between music royalties investment and angel investing is crucial because music royalties provide steady, passive income from intellectual property rights, while angel investing involves high-risk equity stakes in startups with potential for substantial returns. Music royalties offer predictable cash flow linked to song performance, whereas angel investing requires deep analysis of business models and growth potential. Knowledge of both types helps investors align their portfolios with their risk tolerance, liquidity needs, and income goals. Different legal frameworks and market dynamics govern these investments, impacting their scalability and exit strategies.

Comparison Table

| Aspect | Music Royalties Investment | Angel Investing |

|---|---|---|

| Definition | Buying rights to earn income from music royalties | Providing capital to startups in exchange for equity |

| Return Type | Passive income from royalties | Potential equity appreciation and dividends |

| Risk Level | Moderate - depends on song popularity and rights | High - startup failure rate is significant |

| Liquidity | Low to moderate - resale of royalties possible but limited | Low - exits usually occur via acquisition or IPO |

| Initial Investment | Varies, often starting from a few thousand dollars | Typically higher, $10,000 to $100,000+ |

| Time Horizon | Medium to long-term, based on royalty duration | Long-term, typically 5-10 years |

| Control & Involvement | Minimal involvement, passive investor | Active or advisory role possible |

| Income Stability | Relatively stable if music continues generating royalties | Highly variable; dependent on startup success |

Which is better?

Music royalties investment offers consistent, passive income streams with relatively low risk, as royalties are tied to proven catalogues and predictable earnings. Angel investing involves higher risk and potential for significant returns by funding early-stage startups, but lacks guaranteed payouts and requires active portfolio management. Investors seeking stability and steady cash flow tend to prefer music royalties, while those aiming for substantial growth and accepting volatility often choose angel investing.

Connection

Music royalties investment offers a unique revenue stream based on intellectual property rights, attracting angel investors seeking diversified portfolios and passive income. Angel investing fuels emerging artists or startups in the music industry, creating growth potential that can enhance royalty returns. Both investment types leverage early-stage opportunities, combining creative industry assets with strategic financial backing for long-term value.

Key Terms

Angel Investing:

Angel investing involves providing early-stage capital to startups in exchange for equity, offering high growth potential but with significant risk. Investors gain strategic influence and the possibility of substantial returns if the startup succeeds, typically within tech, healthcare, or consumer sectors. Explore the advantages and strategies of angel investing to better understand its role in building diversified investment portfolios.

Equity

Angel investing primarily involves providing early-stage capital to startups in exchange for equity ownership, often offering significant growth potential and participation in company decisions. Music royalties investment gives investors a share of revenue generated from music copyrights, providing a steady income stream without ownership in the artist or label. Explore the distinct equity benefits and risk profiles of these investment types to make an informed decision.

Valuation

Angel investing typically involves evaluating startup companies based on projected growth, market potential, and financial metrics such as revenue multiples and EBITDA. Music royalties investment valuation hinges on historical earnings, catalog longevity, and royalty rate agreements, with cash flow consistency being a critical factor. Explore detailed comparisons to understand which asset class aligns best with your investment goals.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investing involves wealthy individuals providing capital to startups in exchange for equity or convertible debt, helping founders develop prototypes and attract further investment while often mentoring and advising the startup founders.

Demystifying Angel Investing - Angel Capital Association - Angel investing offers high-return opportunities and tax advantages by investing in startups, with angel investors also contributing to regional economic growth and providing a network of resources and mentorship.

Angel Investors - The Hartford Insurance - Angel investors, typically wealthy individuals using their own funds, invest in early-stage businesses in exchange for equity, offering patient capital and mentorship while expecting eventual returns through exits like acquisitions or public offerings.

dowidth.com

dowidth.com