Royalty rights investing offers unique income streams derived from intellectual property, natural resources, or mineral rights, providing investors with steady, often inflation-resistant cash flows. Exchange-traded funds (ETFs) represent diversified portfolios of stocks or bonds that trade on stock exchanges, delivering liquidity and convenience with broad market exposure. Explore the distinct advantages and risk profiles of both to determine the ideal investment strategy for your portfolio.

Why it is important

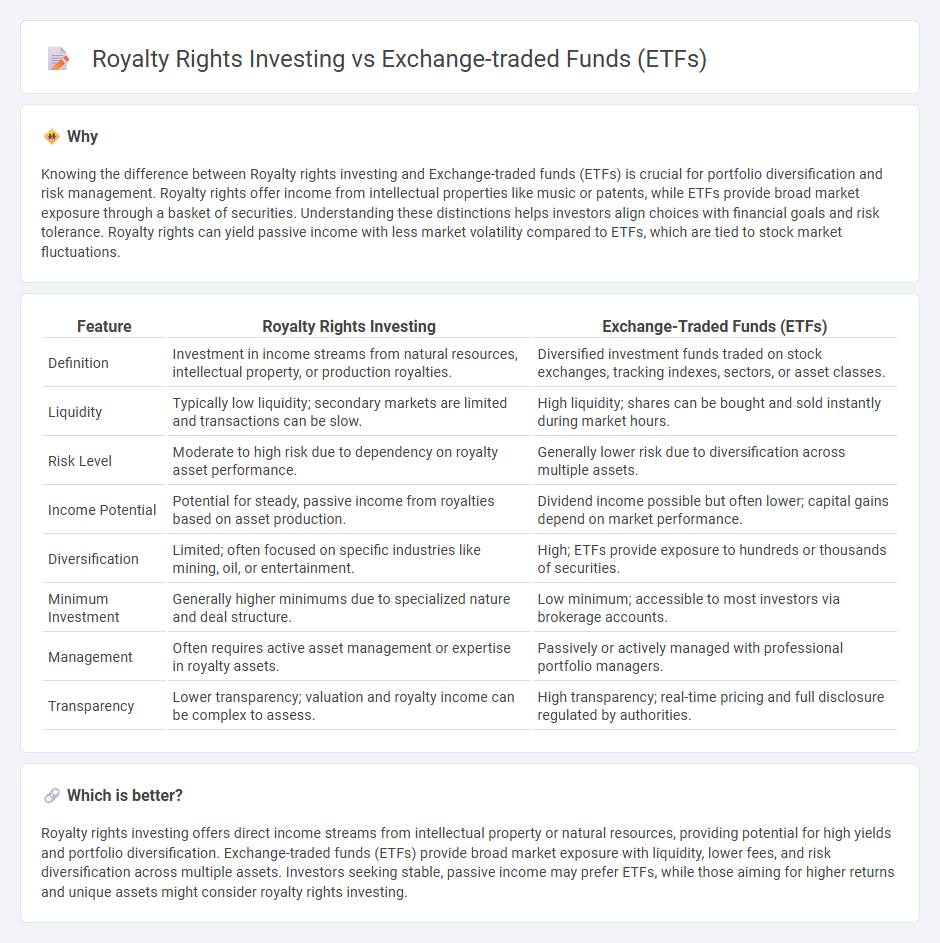

Knowing the difference between Royalty rights investing and Exchange-traded funds (ETFs) is crucial for portfolio diversification and risk management. Royalty rights offer income from intellectual properties like music or patents, while ETFs provide broad market exposure through a basket of securities. Understanding these distinctions helps investors align choices with financial goals and risk tolerance. Royalty rights can yield passive income with less market volatility compared to ETFs, which are tied to stock market fluctuations.

Comparison Table

| Feature | Royalty Rights Investing | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Investment in income streams from natural resources, intellectual property, or production royalties. | Diversified investment funds traded on stock exchanges, tracking indexes, sectors, or asset classes. |

| Liquidity | Typically low liquidity; secondary markets are limited and transactions can be slow. | High liquidity; shares can be bought and sold instantly during market hours. |

| Risk Level | Moderate to high risk due to dependency on royalty asset performance. | Generally lower risk due to diversification across multiple assets. |

| Income Potential | Potential for steady, passive income from royalties based on asset production. | Dividend income possible but often lower; capital gains depend on market performance. |

| Diversification | Limited; often focused on specific industries like mining, oil, or entertainment. | High; ETFs provide exposure to hundreds or thousands of securities. |

| Minimum Investment | Generally higher minimums due to specialized nature and deal structure. | Low minimum; accessible to most investors via brokerage accounts. |

| Management | Often requires active asset management or expertise in royalty assets. | Passively or actively managed with professional portfolio managers. |

| Transparency | Lower transparency; valuation and royalty income can be complex to assess. | High transparency; real-time pricing and full disclosure regulated by authorities. |

Which is better?

Royalty rights investing offers direct income streams from intellectual property or natural resources, providing potential for high yields and portfolio diversification. Exchange-traded funds (ETFs) provide broad market exposure with liquidity, lower fees, and risk diversification across multiple assets. Investors seeking stable, passive income may prefer ETFs, while those aiming for higher returns and unique assets might consider royalty rights investing.

Connection

Royalty rights investing provides investors with passive income streams derived from intellectual property or natural resources, while Exchange-traded funds (ETFs) offer diversified exposure to royalty assets by pooling multiple royalty companies or funds into a single tradable product. ETFs focused on royalty rights enable investors to access a broad portfolio of royalty income sources, reducing risk compared to direct investment in individual royalties. This integration allows for liquid, transparent, and cost-efficient participation in royalty income markets through stock exchanges.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity due to their listing on major stock exchanges, enabling investors to buy and sell shares throughout the trading day with minimal bid-ask spreads. Royalty rights investing tends to have lower liquidity as these assets are typically traded in private transactions or specialized marketplaces, often requiring longer hold periods and complex valuation processes. Explore more about liquidity differences and strategic benefits between ETFs and royalty rights investing to optimize your portfolio.

Diversification

Exchange-traded funds (ETFs) offer broad diversification by pooling multiple assets across various sectors, reducing risk through exposure to a wide market index. Royalty rights investing provides diversification by generating income from different royalty streams across industries like music, oil, or pharmaceuticals, which often exhibit low correlation with traditional markets. Explore deeper insights into how each investment type enhances portfolio diversification strategies.

Income generation

Exchange-traded funds (ETFs) offer diversified income generation through dividends across multiple sectors and asset classes, enhancing portfolio stability. Royalty rights investing provides steady, often inflation-protected cash flow from intellectual property or natural resources, appealing to investors seeking passive income with lower market correlation. Explore how income-focused ETFs and royalty rights can optimize your financial strategy.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are exchange-traded investment products that pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets, and can be bought or sold on stock exchanges like individual stocks.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification benefits of mutual funds, offering affordable access to a wide range of asset classes and typically featuring lower costs and greater tax efficiency than actively managed mutual funds.

Exchange-Traded Funds and Products - FINRA.org - ETFs are pooled investments traded on exchanges, usually tracking an index or benchmark, and utilize a unique creation/redemption process involving authorized participants to maintain liquidity and alignment with the underlying assets.

dowidth.com

dowidth.com