Collectibles investment involves acquiring rare items like art, coins, or vintage cars that can appreciate in value over time, while peer-to-peer lending connects individual borrowers with investors seeking direct loans for competitive returns. Collectibles require specialized knowledge and carry risks related to authenticity and market demand, whereas peer-to-peer lending offers diversified portfolios with relatively predictable cash flows but potential default risks. Explore the benefits and challenges of both to determine the best fit for your investment goals.

Why it is important

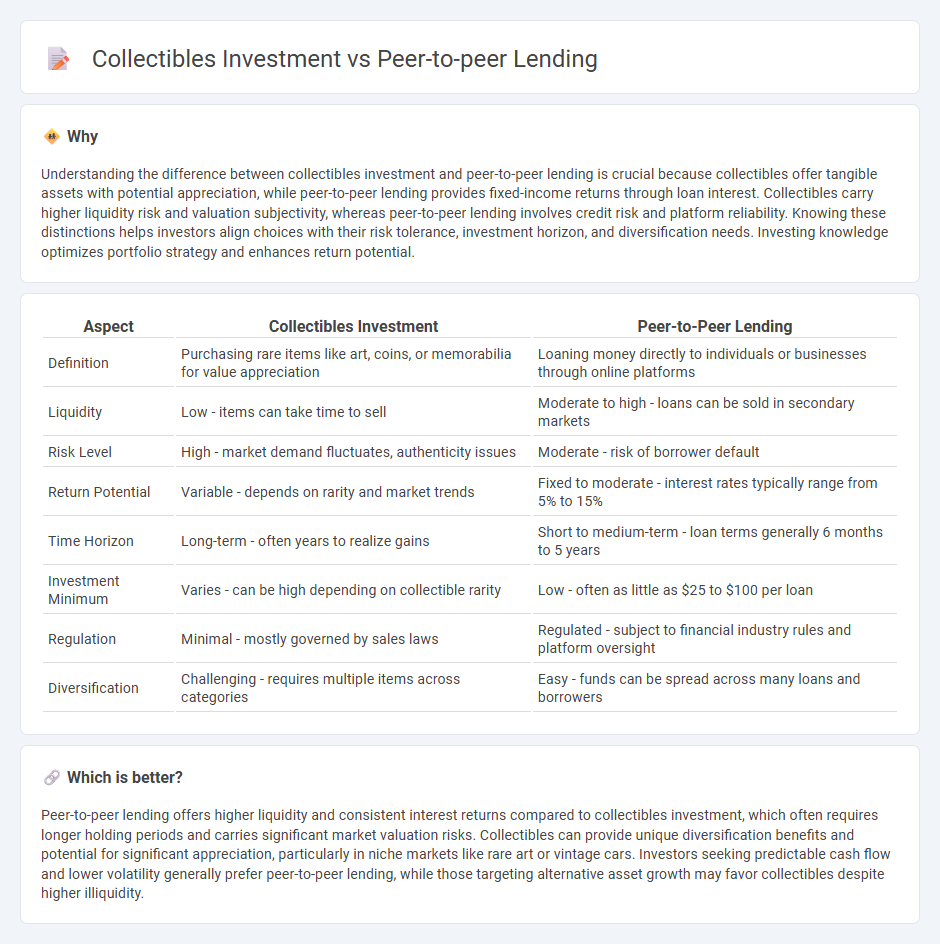

Understanding the difference between collectibles investment and peer-to-peer lending is crucial because collectibles offer tangible assets with potential appreciation, while peer-to-peer lending provides fixed-income returns through loan interest. Collectibles carry higher liquidity risk and valuation subjectivity, whereas peer-to-peer lending involves credit risk and platform reliability. Knowing these distinctions helps investors align choices with their risk tolerance, investment horizon, and diversification needs. Investing knowledge optimizes portfolio strategy and enhances return potential.

Comparison Table

| Aspect | Collectibles Investment | Peer-to-Peer Lending |

|---|---|---|

| Definition | Purchasing rare items like art, coins, or memorabilia for value appreciation | Loaning money directly to individuals or businesses through online platforms |

| Liquidity | Low - items can take time to sell | Moderate to high - loans can be sold in secondary markets |

| Risk Level | High - market demand fluctuates, authenticity issues | Moderate - risk of borrower default |

| Return Potential | Variable - depends on rarity and market trends | Fixed to moderate - interest rates typically range from 5% to 15% |

| Time Horizon | Long-term - often years to realize gains | Short to medium-term - loan terms generally 6 months to 5 years |

| Investment Minimum | Varies - can be high depending on collectible rarity | Low - often as little as $25 to $100 per loan |

| Regulation | Minimal - mostly governed by sales laws | Regulated - subject to financial industry rules and platform oversight |

| Diversification | Challenging - requires multiple items across categories | Easy - funds can be spread across many loans and borrowers |

Which is better?

Peer-to-peer lending offers higher liquidity and consistent interest returns compared to collectibles investment, which often requires longer holding periods and carries significant market valuation risks. Collectibles can provide unique diversification benefits and potential for significant appreciation, particularly in niche markets like rare art or vintage cars. Investors seeking predictable cash flow and lower volatility generally prefer peer-to-peer lending, while those targeting alternative asset growth may favor collectibles despite higher illiquidity.

Connection

Collectibles investment and peer-to-peer lending both represent alternative asset classes that diversify traditional portfolios by offering unique risk and return profiles. Collectibles involve tangible assets such as art and rare items whose value appreciates based on rarity and demand, while peer-to-peer lending connects individual borrowers with investors through online platforms, generating returns from interest payments. Both investment types emphasize decentralized market participation and can hedge against volatility in equities and bonds, appealing to investors seeking diversification beyond conventional financial instruments.

Key Terms

**Peer-to-Peer Lending:**

Peer-to-peer lending offers investors access to diversified loan portfolios with potential returns higher than traditional savings accounts, leveraging platforms that connect borrowers directly with individual lenders while mitigating risks through credit assessments and automated repayment schedules. This form of investment provides monthly income streams and is less impacted by market volatility compared to collectibles, which often require extensive knowledge to value accurately and can be illiquid. Explore the benefits and risks of peer-to-peer lending to determine if it aligns with your investment goals.

Default Risk

Peer-to-peer (P2P) lending exposes investors to default risk, which occurs when borrowers fail to repay loans, often influenced by creditworthiness and economic conditions; platforms may mitigate this through credit checks and diversified loan portfolios. Collectibles investment, such as art, rare coins, or vintage items, generally carries lower default risk but faces market volatility, authenticity issues, and liquidity challenges that can impact returns. Explore deeper insights into managing default risk across these investment types for informed decision-making.

Interest Rate

Peer-to-peer lending typically offers interest rates ranging from 5% to 12%, depending on the borrower's credit profile and loan term, providing predictable income streams. Collectibles investment, such as rare coins or art, lacks fixed interest rates and relies on asset appreciation, which can be highly volatile and less predictable. Explore detailed comparisons on interest rate performance between peer-to-peer lending and collectibles investment to make informed financial decisions.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending is a method where borrowers apply for loans directly from individual investors through specialized websites, bypassing traditional banks, often with lower eligibility requirements and flexible terms, but also with higher risk due to lack of institutional backing.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an online practice where platforms match lenders and borrowers directly, allowing lenders to choose borrowers, with loans that may be secured or unsecured but are not usually backed by government insurance, and the platforms provide credit checks, loan servicing, and legal compliance.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending platforms operate as marketplaces connecting lenders and borrowers, where lenders earn interest on loans repaid over time, but this investment can carry higher risks compared to traditional savings accounts due to the potential for borrower default.

dowidth.com

dowidth.com