Wine funds and classic car funds offer alternative investment opportunities, each with distinct market dynamics and asset appreciation patterns. Wine funds capitalize on the growing global demand for rare vintages and historically stable price increases, while classic car funds leverage the increasing value of collectible automobiles driven by scarcity and cultural significance. Explore the advantages and risks of these niche asset classes to make informed investment decisions.

Why it is important

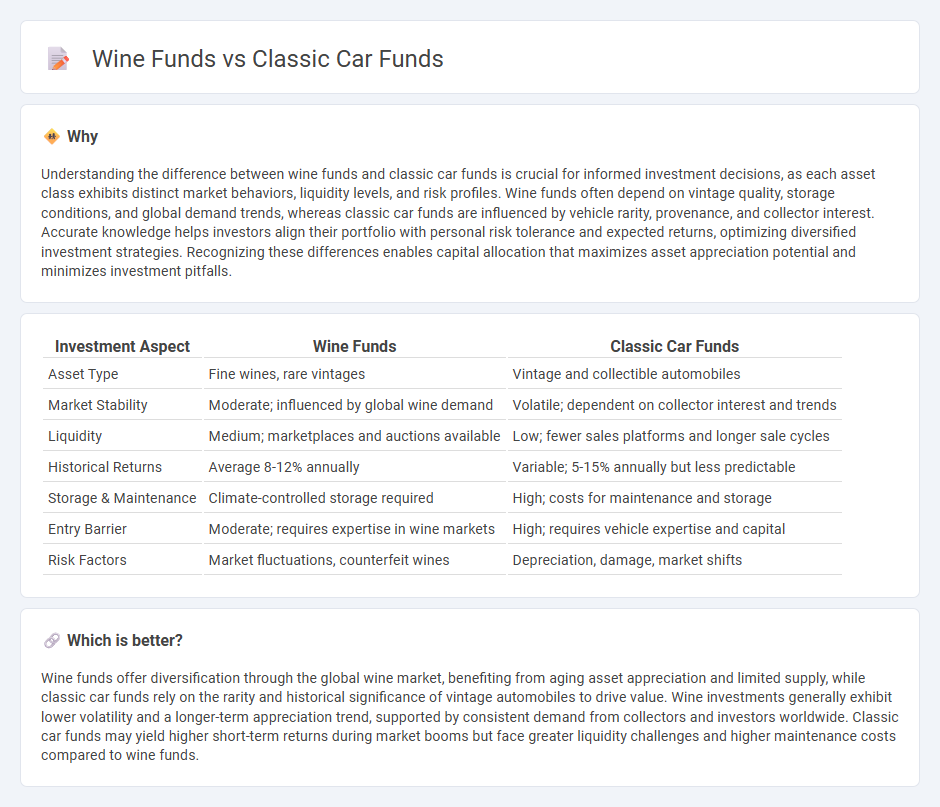

Understanding the difference between wine funds and classic car funds is crucial for informed investment decisions, as each asset class exhibits distinct market behaviors, liquidity levels, and risk profiles. Wine funds often depend on vintage quality, storage conditions, and global demand trends, whereas classic car funds are influenced by vehicle rarity, provenance, and collector interest. Accurate knowledge helps investors align their portfolio with personal risk tolerance and expected returns, optimizing diversified investment strategies. Recognizing these differences enables capital allocation that maximizes asset appreciation potential and minimizes investment pitfalls.

Comparison Table

| Investment Aspect | Wine Funds | Classic Car Funds |

|---|---|---|

| Asset Type | Fine wines, rare vintages | Vintage and collectible automobiles |

| Market Stability | Moderate; influenced by global wine demand | Volatile; dependent on collector interest and trends |

| Liquidity | Medium; marketplaces and auctions available | Low; fewer sales platforms and longer sale cycles |

| Historical Returns | Average 8-12% annually | Variable; 5-15% annually but less predictable |

| Storage & Maintenance | Climate-controlled storage required | High; costs for maintenance and storage |

| Entry Barrier | Moderate; requires expertise in wine markets | High; requires vehicle expertise and capital |

| Risk Factors | Market fluctuations, counterfeit wines | Depreciation, damage, market shifts |

Which is better?

Wine funds offer diversification through the global wine market, benefiting from aging asset appreciation and limited supply, while classic car funds rely on the rarity and historical significance of vintage automobiles to drive value. Wine investments generally exhibit lower volatility and a longer-term appreciation trend, supported by consistent demand from collectors and investors worldwide. Classic car funds may yield higher short-term returns during market booms but face greater liquidity challenges and higher maintenance costs compared to wine funds.

Connection

Wine funds and classic car funds both serve as alternative investment vehicles that diversify portfolios beyond traditional stocks and bonds, leveraging the appreciation potential of tangible luxury assets. These funds capitalize on the scarcity, historical value, and cultural significance of rare wines and vintage automobiles, often yielding higher returns aligned with market demand trends and collector interest. Their performance is influenced by factors such as provenance, condition, rarity, and global economic shifts impacting luxury asset markets.

Key Terms

**Classic Car Funds:**

Classic car funds invest in rare and vintage automobiles, leveraging historical appreciation trends and market demand for collectible vehicles. These funds offer diversification through tangible assets with potential value growth tied to iconic car models and limited production runs. Explore more about how classic car funds can enhance your investment portfolio.

Provenance

Classic car funds emphasize detailed provenance records, tracking ownership history, maintenance, and restoration to enhance asset value and authenticity. Wine funds prioritize provenance through meticulous documentation of vineyard origin, vintage, and storage conditions, ensuring quality and investment reliability. Explore how provenance impacts investment security and value in classic car and wine funds.

Restoration Quality

Classic car funds prioritize restoration quality by investing in vehicles that maintain original specifications and use authentic parts, ensuring high resale value and collector interest. Wine funds focus on the provenance and vintage integrity, emphasizing controlled storage conditions and minimal intervention to preserve the wine's value over time. Explore the distinct investment strategies behind restoration quality in classic car and wine funds to make informed decisions.

Source and External Links

Classic Car Investment Funds: Do These Portfolios Pay Off? - Classic car funds operate by acquiring fleets of appreciating vehicles and allowing investors to buy shares; profits come from selling cars after value growth, often using a hedge-fund structure with typical fees of 2% management and 20% of profits.

How To Invest in Collectible and Vintage Cars - There are various classic car funds like TheCarCrowd and The Inspira Classic Car Fund that enable investors to own shares in cars or collections, combining financial returns with lifestyle benefits and requiring due diligence on platform credibility.

Classic Car Fund - FalconCo - FalconCo's Classic Car Fund offers fractional ownership for portfolio diversification, professional management, and access to rare vintage cars, aiming to deliver historical appreciation with liquidity and enjoyment benefits.

dowidth.com

dowidth.com