Vintage luxury handbags funds offer niche investment opportunities characterized by strong demand in fashion-driven markets and consistent appreciation potential due to rarity and brand prestige. Classic car funds provide exposure to appreciating automotive assets, often driven by historical significance, limited production, and collector enthusiasm, which can yield substantial long-term returns. Explore the distinct advantages and risk profiles of these alternative asset classes to make an informed investment decision.

Why it is important

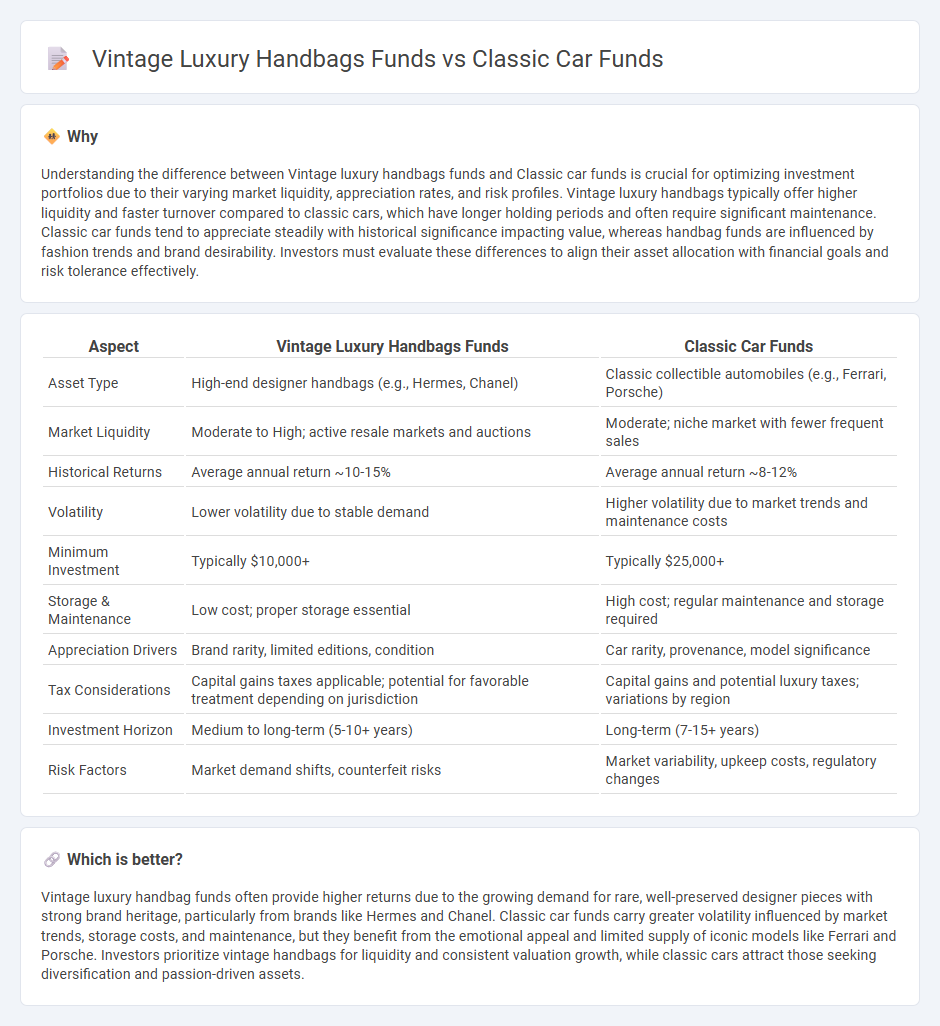

Understanding the difference between Vintage luxury handbags funds and Classic car funds is crucial for optimizing investment portfolios due to their varying market liquidity, appreciation rates, and risk profiles. Vintage luxury handbags typically offer higher liquidity and faster turnover compared to classic cars, which have longer holding periods and often require significant maintenance. Classic car funds tend to appreciate steadily with historical significance impacting value, whereas handbag funds are influenced by fashion trends and brand desirability. Investors must evaluate these differences to align their asset allocation with financial goals and risk tolerance effectively.

Comparison Table

| Aspect | Vintage Luxury Handbags Funds | Classic Car Funds |

|---|---|---|

| Asset Type | High-end designer handbags (e.g., Hermes, Chanel) | Classic collectible automobiles (e.g., Ferrari, Porsche) |

| Market Liquidity | Moderate to High; active resale markets and auctions | Moderate; niche market with fewer frequent sales |

| Historical Returns | Average annual return ~10-15% | Average annual return ~8-12% |

| Volatility | Lower volatility due to stable demand | Higher volatility due to market trends and maintenance costs |

| Minimum Investment | Typically $10,000+ | Typically $25,000+ |

| Storage & Maintenance | Low cost; proper storage essential | High cost; regular maintenance and storage required |

| Appreciation Drivers | Brand rarity, limited editions, condition | Car rarity, provenance, model significance |

| Tax Considerations | Capital gains taxes applicable; potential for favorable treatment depending on jurisdiction | Capital gains and potential luxury taxes; variations by region |

| Investment Horizon | Medium to long-term (5-10+ years) | Long-term (7-15+ years) |

| Risk Factors | Market demand shifts, counterfeit risks | Market variability, upkeep costs, regulatory changes |

Which is better?

Vintage luxury handbag funds often provide higher returns due to the growing demand for rare, well-preserved designer pieces with strong brand heritage, particularly from brands like Hermes and Chanel. Classic car funds carry greater volatility influenced by market trends, storage costs, and maintenance, but they benefit from the emotional appeal and limited supply of iconic models like Ferrari and Porsche. Investors prioritize vintage handbags for liquidity and consistent valuation growth, while classic cars attract those seeking diversification and passion-driven assets.

Connection

Vintage luxury handbags funds and classic car funds are connected through their shared strategy of alternative investment in tangible assets with historical value and limited supply. Both asset classes appeal to collectors and investors seeking portfolio diversification, inflation hedging, and long-term capital appreciation. Market performance of these funds often correlates with trends in luxury goods demand, rarity, and provenance authenticity, driving unique investment returns.

Key Terms

Asset Valuation

Classic car funds and vintage luxury handbag funds both hinge on precise asset valuation, which directly influences investment returns and portfolio stability. While classic cars are appraised based on factors like historical significance, rarity, restoration condition, and market trends, vintage luxury handbags value is driven by brand heritage, limited editions, provenance, and condition grading. Explore how these unique valuation methodologies impact fund performance and investor confidence by learning more about their distinct asset appraisal frameworks.

Liquidity

Classic car funds typically offer lower liquidity due to the niche market and longer sale process for high-value vehicles, often requiring months to liquidate assets. Vintage luxury handbag funds, leveraging a more active secondary market and broader consumer base, usually provide higher liquidity and faster turnaround times for investors. Explore further to understand which investment aligns with your liquidity preferences and financial goals.

Provenance

Classic car funds emphasize provenance through documented ownership history, detailed maintenance records, and authenticity certifications, ensuring each vehicle's heritage is preserved and valued. Vintage luxury handbag funds highlight provenance via original purchase receipts, brand authentication, and traceable previous owners, which drive premium valuations in the market. Explore how provenance impacts investment stability and returns in these unique asset classes.

Source and External Links

Classic Car Investment Funds: Do These Portfolios Pay Off? - Classic car funds operate by acquiring rare vehicles expected to appreciate over time, offering investors fractional ownership with typical management fees of 2% annually and 20% on profits, focusing mainly on "blue chip" cars with strong price history to generate returns through sales after appreciation.

Classic Car Fund - FalconCo - FalconCo's Classic Car Fund provides fractional ownership in vintage cars, offering portfolio diversification, professional management, historical appreciation, and more liquidity than whole car ownership, allowing investors to enjoy prestige and potential financial gains with reduced risk.

How To Invest in Collectible and Vintage Cars - Various classic car funds and platforms like TheCarCrowd and Inspira Classic Car Fund let investors buy shares in individual cars or collections, often structured as limited companies, combining investment with lifestyle benefits, with emphasis on due diligence regarding fees, track record, and management expertise.

dowidth.com

dowidth.com