Vintage luxury handbags funds offer investors unique exposure to the appreciating market of designer accessories, capitalizing on limited-edition releases and brand heritage. Rare book funds focus on acquiring historically significant, scarce literary works with proven long-term value appreciation in the collectibles market. Explore the distinct benefits and potential returns of each asset class to determine the best fit for your investment portfolio.

Why it is important

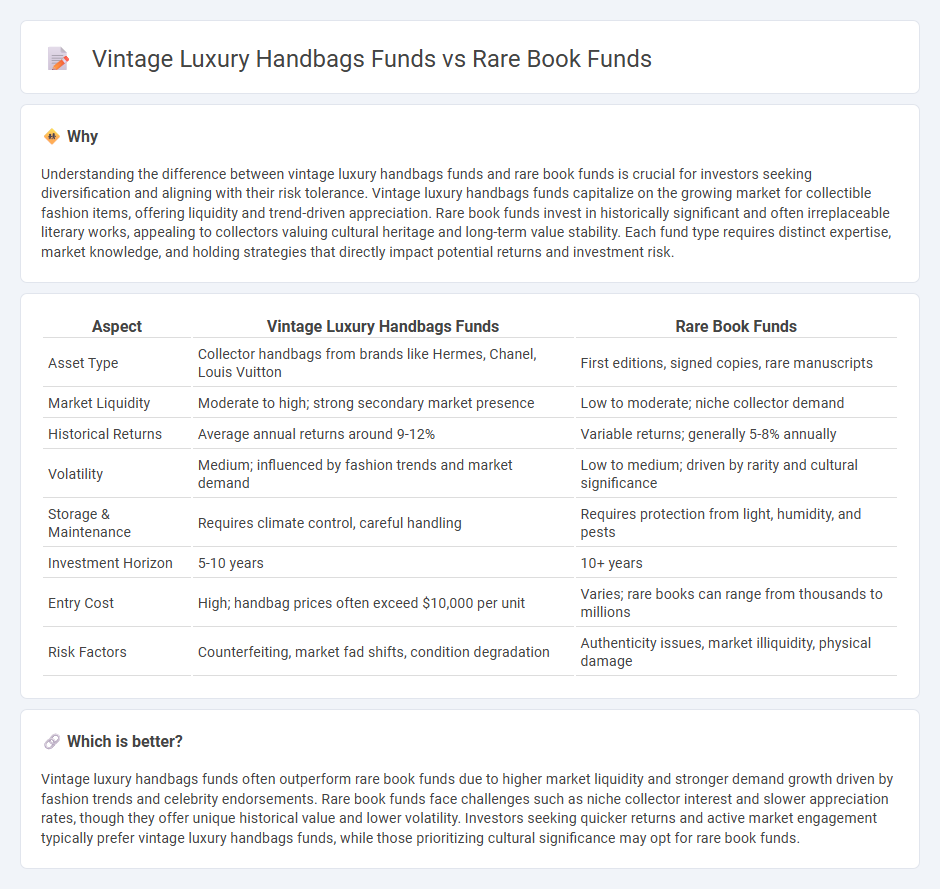

Understanding the difference between vintage luxury handbags funds and rare book funds is crucial for investors seeking diversification and aligning with their risk tolerance. Vintage luxury handbags funds capitalize on the growing market for collectible fashion items, offering liquidity and trend-driven appreciation. Rare book funds invest in historically significant and often irreplaceable literary works, appealing to collectors valuing cultural heritage and long-term value stability. Each fund type requires distinct expertise, market knowledge, and holding strategies that directly impact potential returns and investment risk.

Comparison Table

| Aspect | Vintage Luxury Handbags Funds | Rare Book Funds |

|---|---|---|

| Asset Type | Collector handbags from brands like Hermes, Chanel, Louis Vuitton | First editions, signed copies, rare manuscripts |

| Market Liquidity | Moderate to high; strong secondary market presence | Low to moderate; niche collector demand |

| Historical Returns | Average annual returns around 9-12% | Variable returns; generally 5-8% annually |

| Volatility | Medium; influenced by fashion trends and market demand | Low to medium; driven by rarity and cultural significance |

| Storage & Maintenance | Requires climate control, careful handling | Requires protection from light, humidity, and pests |

| Investment Horizon | 5-10 years | 10+ years |

| Entry Cost | High; handbag prices often exceed $10,000 per unit | Varies; rare books can range from thousands to millions |

| Risk Factors | Counterfeiting, market fad shifts, condition degradation | Authenticity issues, market illiquidity, physical damage |

Which is better?

Vintage luxury handbags funds often outperform rare book funds due to higher market liquidity and stronger demand growth driven by fashion trends and celebrity endorsements. Rare book funds face challenges such as niche collector interest and slower appreciation rates, though they offer unique historical value and lower volatility. Investors seeking quicker returns and active market engagement typically prefer vintage luxury handbags funds, while those prioritizing cultural significance may opt for rare book funds.

Connection

Vintage luxury handbag funds and rare book funds are connected through their shared focus on investing in tangible, culturally significant assets that appreciate over time. Both types of funds leverage scarcity, provenance, and historical value to generate returns, attracting collectors and investors seeking niche alternative investments. The market dynamics of rarity, condition, and authenticity play a crucial role in determining the value and performance of investments in these specialized asset classes.

Key Terms

Provenance

Rare book funds capitalize on the unique historical provenance of first editions and manuscripts, enhancing value through documented ownership and rarity, often appealing to collectors and historians. Vintage luxury handbag funds emphasize provenance through brand heritage and limited production, with iconic pieces linked to exclusive fashion houses like Hermes or Chanel commanding premium prices due to verified authenticity and celebrity associations. Explore more to understand how provenance drives investment potential in these niche asset classes.

Authentication

Rare book funds employ rigorous authentication techniques such as paper analysis, provenance verification, and expert appraisal to ensure the originality and historical value of each book. Vintage luxury handbag funds prioritize authentication methods like serial number checks, material examination, and brand expert validation to confirm genuine craftsmanship and market authenticity. Explore how advanced authentication standards impact investment security and value in both rare book and vintage handbag funds.

Market Liquidity

Rare book funds offer niche market liquidity characterized by limited but dedicated collectors, often resulting in slower transaction speeds and higher price volatility. Vintage luxury handbag funds benefit from broader market appeal, with more frequent trades and robust resale platforms enhancing liquidity and price transparency. Explore the nuances of market liquidity in alternative asset investments to make informed portfolio decisions.

Source and External Links

Rare Book and Collectible Funds: Preserving History While Building Wealth - These funds allow investors to pool capital to acquire and manage rare books and collectibles, combining cultural preservation with potential financial returns through expert management and asset appreciation.

Acquisitions Sources and Endowed Funds - Rare Books Collection - Several endowed or special funds exist for acquiring rare books in specific categories or disciplines, often supporting libraries or collections through donations and ethical market purchases.

Investing in rare books and manuscripts - The Beacon Newspaper - Investing in rare books offers portfolio diversification and cultural engagement but involves risks such as market illiquidity, niche size, and maintenance costs.

dowidth.com

dowidth.com