Crowdlending platforms enable individual investors to fund specific projects or small businesses directly, offering higher transparency and accessibility compared to hedge funds, which pool capital to execute complex strategies across diverse financial instruments. Hedge funds typically require substantial minimum investments and charge higher fees, whereas crowdlending platforms provide lower entry barriers and more predictable returns through fixed interest payments. Explore the advantages and risks of both investment options to make informed decisions.

Why it is important

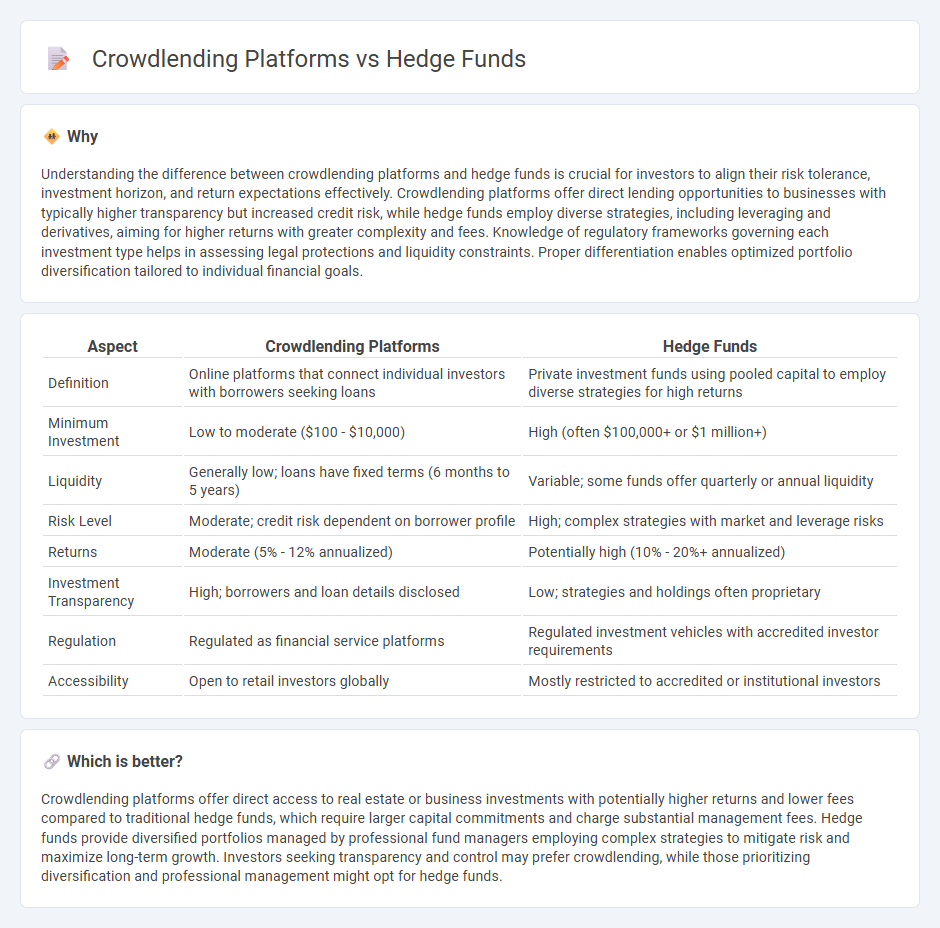

Understanding the difference between crowdlending platforms and hedge funds is crucial for investors to align their risk tolerance, investment horizon, and return expectations effectively. Crowdlending platforms offer direct lending opportunities to businesses with typically higher transparency but increased credit risk, while hedge funds employ diverse strategies, including leveraging and derivatives, aiming for higher returns with greater complexity and fees. Knowledge of regulatory frameworks governing each investment type helps in assessing legal protections and liquidity constraints. Proper differentiation enables optimized portfolio diversification tailored to individual financial goals.

Comparison Table

| Aspect | Crowdlending Platforms | Hedge Funds |

|---|---|---|

| Definition | Online platforms that connect individual investors with borrowers seeking loans | Private investment funds using pooled capital to employ diverse strategies for high returns |

| Minimum Investment | Low to moderate ($100 - $10,000) | High (often $100,000+ or $1 million+) |

| Liquidity | Generally low; loans have fixed terms (6 months to 5 years) | Variable; some funds offer quarterly or annual liquidity |

| Risk Level | Moderate; credit risk dependent on borrower profile | High; complex strategies with market and leverage risks |

| Returns | Moderate (5% - 12% annualized) | Potentially high (10% - 20%+ annualized) |

| Investment Transparency | High; borrowers and loan details disclosed | Low; strategies and holdings often proprietary |

| Regulation | Regulated as financial service platforms | Regulated investment vehicles with accredited investor requirements |

| Accessibility | Open to retail investors globally | Mostly restricted to accredited or institutional investors |

Which is better?

Crowdlending platforms offer direct access to real estate or business investments with potentially higher returns and lower fees compared to traditional hedge funds, which require larger capital commitments and charge substantial management fees. Hedge funds provide diversified portfolios managed by professional fund managers employing complex strategies to mitigate risk and maximize long-term growth. Investors seeking transparency and control may prefer crowdlending, while those prioritizing diversification and professional management might opt for hedge funds.

Connection

Crowdlending platforms and hedge funds are connected through their shared interest in alternative investment opportunities that diversify portfolios beyond traditional assets. Hedge funds often allocate capital to crowdlending ventures to capture higher yields from peer-to-peer loans, benefiting from direct exposure to consumer and small business credit markets. This synergy enhances liquidity and risk-adjusted returns while expanding the investment universe with data-driven credit analysis.

Key Terms

Leverage

Hedge funds employ significant leverage by borrowing capital to amplify investment positions, often utilizing complex financial instruments to maximize returns while managing risk exposure. Crowdlending platforms offer individual investors access to diversified loan portfolios with relatively lower leverage, focusing on direct peer-to-peer lending and fixed income generation. Explore how leverage strategies differ fundamentally between hedge funds and crowdlending platforms for optimized portfolio management.

Diversification

Hedge funds offer diversification through a variety of asset classes, including equities, derivatives, and alternative investments, enabling risk mitigation and potential for higher returns. Crowdlending platforms provide diversification by allowing investors to spread capital across numerous small business loans or consumer credits, reducing exposure to any single borrower default. Discover how these investment avenues can complement your portfolio's diversification strategy.

Risk profile

Hedge funds typically involve higher risk exposure due to leveraged investment strategies and market volatility, targeting sophisticated investors seeking substantial returns. Crowdlending platforms offer relatively lower risk by providing diversified, fixed-income loans to small businesses or individuals, attracting retail investors prioritizing steady cash flow. Explore more to understand how risk profiles vary and which investment suits your financial goals.

Source and External Links

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment vehicles that pool money from accredited and institutional investors to pursue flexible, often high-risk strategies not available to traditional mutual funds or ETFs.

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds aim to generate absolute returns using diverse, alternative investment strategies--such as short-selling, derivatives, and event-driven trades--regardless of overall market performance.

Hedge fund - Wikipedia - Hedge funds employ complex trading and risk management techniques, charge both management and performance fees, and while historically focused on hedging risk, now often pursue a wide variety of speculative strategies.

dowidth.com

dowidth.com