Sneakers flipping and music memorabilia investing are two popular alternatives in the investment world, each offering unique market dynamics and profit potentials. Sneakers flipping capitalizes on limited edition releases and brand collaborations, driving high demand and rapid turnover, while music memorabilia investing relies on the rarity and emotional value of iconic items linked to famous artists. Explore deeper insights into these investment strategies to determine which aligns best with your financial goals.

Why it is important

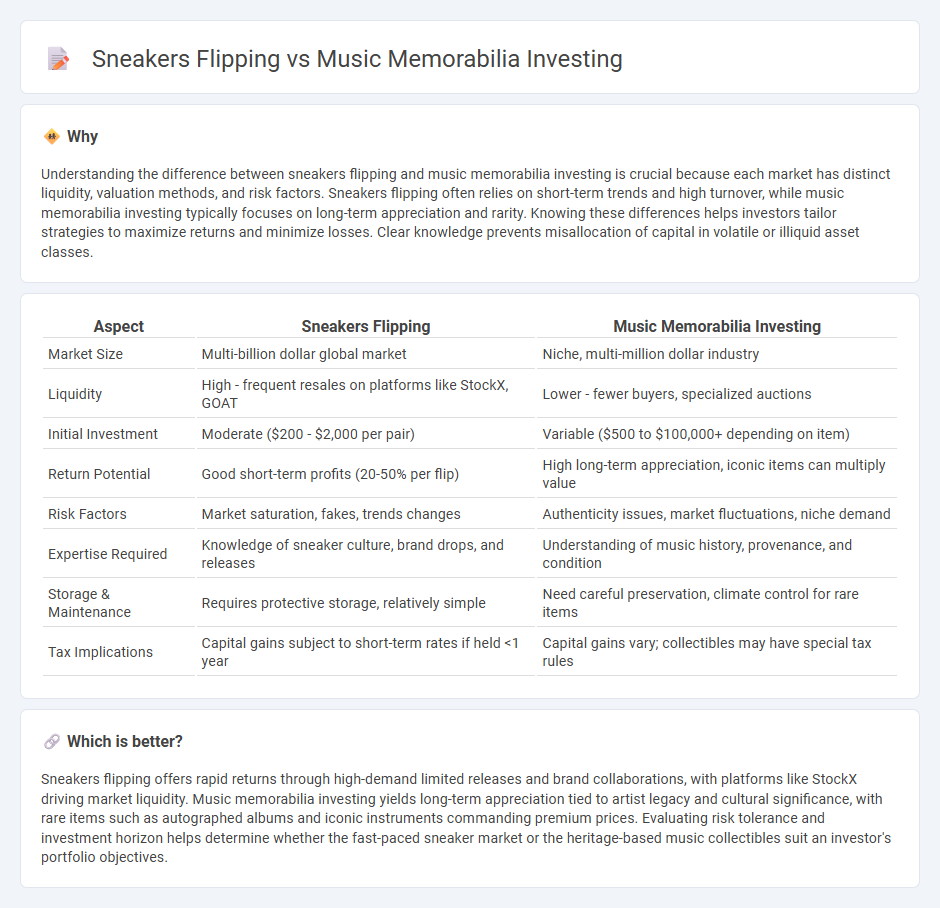

Understanding the difference between sneakers flipping and music memorabilia investing is crucial because each market has distinct liquidity, valuation methods, and risk factors. Sneakers flipping often relies on short-term trends and high turnover, while music memorabilia investing typically focuses on long-term appreciation and rarity. Knowing these differences helps investors tailor strategies to maximize returns and minimize losses. Clear knowledge prevents misallocation of capital in volatile or illiquid asset classes.

Comparison Table

| Aspect | Sneakers Flipping | Music Memorabilia Investing |

|---|---|---|

| Market Size | Multi-billion dollar global market | Niche, multi-million dollar industry |

| Liquidity | High - frequent resales on platforms like StockX, GOAT | Lower - fewer buyers, specialized auctions |

| Initial Investment | Moderate ($200 - $2,000 per pair) | Variable ($500 to $100,000+ depending on item) |

| Return Potential | Good short-term profits (20-50% per flip) | High long-term appreciation, iconic items can multiply value |

| Risk Factors | Market saturation, fakes, trends changes | Authenticity issues, market fluctuations, niche demand |

| Expertise Required | Knowledge of sneaker culture, brand drops, and releases | Understanding of music history, provenance, and condition |

| Storage & Maintenance | Requires protective storage, relatively simple | Need careful preservation, climate control for rare items |

| Tax Implications | Capital gains subject to short-term rates if held <1 year | Capital gains vary; collectibles may have special tax rules |

Which is better?

Sneakers flipping offers rapid returns through high-demand limited releases and brand collaborations, with platforms like StockX driving market liquidity. Music memorabilia investing yields long-term appreciation tied to artist legacy and cultural significance, with rare items such as autographed albums and iconic instruments commanding premium prices. Evaluating risk tolerance and investment horizon helps determine whether the fast-paced sneaker market or the heritage-based music collectibles suit an investor's portfolio objectives.

Connection

Sneakers flipping and music memorabilia investing both thrive on niche markets driven by cultural trends and collector demand, often yielding high returns through limited editions and rare finds. Each market relies on authenticity verification, brand reputation, and timing to capitalize on value appreciation. Digital platforms and social media play critical roles in connecting buyers and sellers, enhancing market liquidity and price transparency.

Key Terms

**Music memorabilia investing:**

Music memorabilia investing involves acquiring rare and historically significant items such as autographed records, vintage concert posters, and iconic instruments, which tend to appreciate steadily due to their cultural value and limited availability. The market for music collectibles is driven by passionate fan bases, artist legacies, and auctions where authenticated items fetch high prices, making it a potentially lucrative long-term investment. Explore in-depth strategies and top collectibles to maximize your returns in music memorabilia investing.

Provenance

Music memorabilia investing offers unique value due to its verified provenance, establishing authenticity and historical significance that drive market demand and price appreciation. Sneakers flipping relies heavily on limited releases and cultural trends, but provenance, such as original packaging and celebrity endorsements, significantly enhances resale value. Explore how provenance impacts these markets to make informed investment decisions.

Authenticity

Music memorabilia investing demands rigorous authentication through provenance, expert verification, and condition assessment to preserve value and avoid counterfeit risks. Sneakers flipping relies heavily on verifying originality via factory markings, receipt proofs, and advanced authentication apps to maintain market credibility. Discover key strategies to ensure authenticity and maximize returns in both markets.

Source and External Links

Why music memorabilia might be a solid investment - Music memorabilia linked to iconic artists has shown strong demand and rising prices, making it a potentially lucrative alternative investment despite higher risks than stocks.

Top 5 Music Memorabilia Investments for Collectors - JERKS(tm) - Vintage band t-shirts, limited edition and tour merchandise, along with rare accessories, are among the best-valued music memorabilia that can appreciate notably over time.

Music Memorabilia--Can It Be Considered an Investment? - The value of music memorabilia depends on artist popularity, rarity, and condition, but investing requires careful research to avoid fakes and scams, while keeping in mind the value can fluctuate.

dowidth.com

dowidth.com