Farmland funds invest in agricultural land, generating returns through crop production and land appreciation, while ESG funds focus on companies meeting environmental, social, and governance criteria to promote sustainable investing. Investors seeking tangible asset diversification and inflation protection may prefer farmland funds, whereas those prioritizing ethical impact often gravitate towards ESG funds aligned with responsible business practices. Explore in-depth comparisons to determine which investment strategy aligns with your financial goals and values.

Why it is important

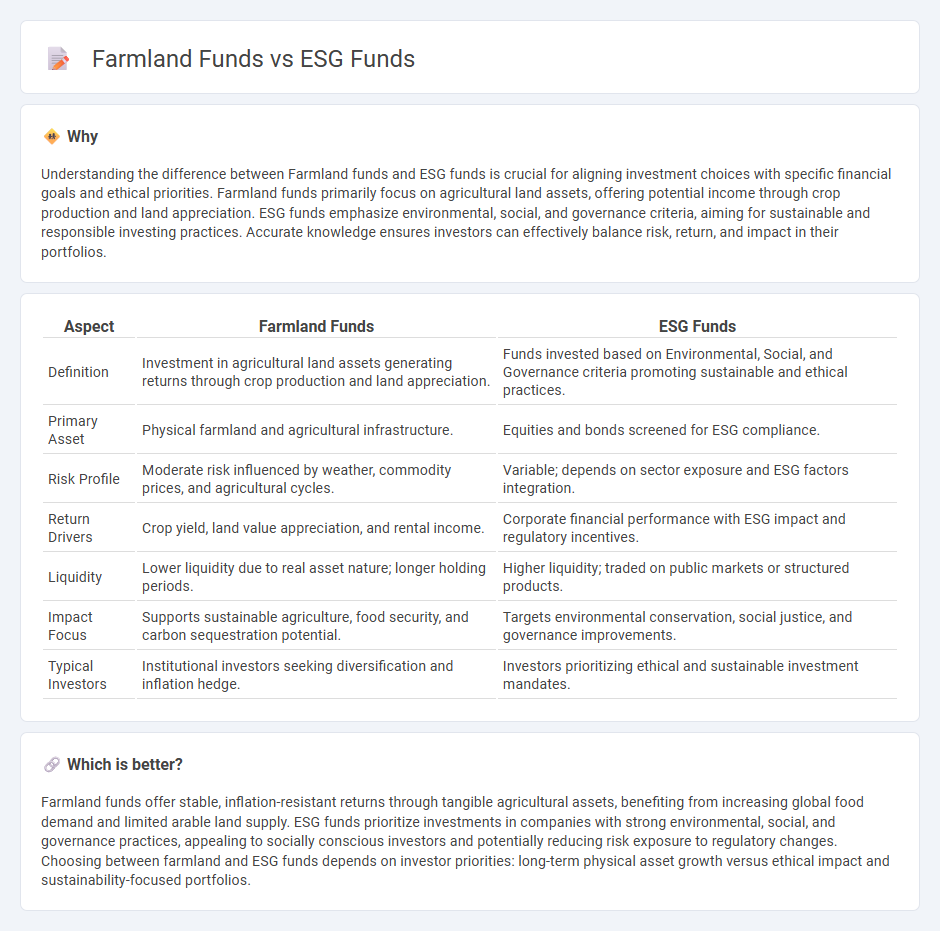

Understanding the difference between Farmland funds and ESG funds is crucial for aligning investment choices with specific financial goals and ethical priorities. Farmland funds primarily focus on agricultural land assets, offering potential income through crop production and land appreciation. ESG funds emphasize environmental, social, and governance criteria, aiming for sustainable and responsible investing practices. Accurate knowledge ensures investors can effectively balance risk, return, and impact in their portfolios.

Comparison Table

| Aspect | Farmland Funds | ESG Funds |

|---|---|---|

| Definition | Investment in agricultural land assets generating returns through crop production and land appreciation. | Funds invested based on Environmental, Social, and Governance criteria promoting sustainable and ethical practices. |

| Primary Asset | Physical farmland and agricultural infrastructure. | Equities and bonds screened for ESG compliance. |

| Risk Profile | Moderate risk influenced by weather, commodity prices, and agricultural cycles. | Variable; depends on sector exposure and ESG factors integration. |

| Return Drivers | Crop yield, land value appreciation, and rental income. | Corporate financial performance with ESG impact and regulatory incentives. |

| Liquidity | Lower liquidity due to real asset nature; longer holding periods. | Higher liquidity; traded on public markets or structured products. |

| Impact Focus | Supports sustainable agriculture, food security, and carbon sequestration potential. | Targets environmental conservation, social justice, and governance improvements. |

| Typical Investors | Institutional investors seeking diversification and inflation hedge. | Investors prioritizing ethical and sustainable investment mandates. |

Which is better?

Farmland funds offer stable, inflation-resistant returns through tangible agricultural assets, benefiting from increasing global food demand and limited arable land supply. ESG funds prioritize investments in companies with strong environmental, social, and governance practices, appealing to socially conscious investors and potentially reducing risk exposure to regulatory changes. Choosing between farmland and ESG funds depends on investor priorities: long-term physical asset growth versus ethical impact and sustainability-focused portfolios.

Connection

Farmland funds and ESG funds are increasingly interconnected through their shared focus on sustainable and responsible investment practices. Farmland funds emphasize carbon sequestration, biodiversity preservation, and water conservation, aligning with ESG criteria that prioritize environmental stewardship and social impact. Investors leverage this synergy to achieve long-term financial returns while promoting sustainable agriculture and climate resilience.

Key Terms

Sustainability

ESG funds prioritize investments in companies with strong environmental, social, and governance practices, targeting sustainable growth and ethical business models. Farmland funds focus on acquiring and managing agricultural land to generate returns while promoting sustainable farming practices and carbon sequestration. Explore the benefits and differences of ESG and farmland funds to enhance your sustainable investment strategy.

Diversification

ESG funds prioritize investments aligned with environmental, social, and governance criteria, promoting sustainability across diverse industries to mitigate risks and enhance long-term returns. Farmland funds offer diversification through tangible agricultural assets, providing a hedge against inflation and market volatility due to their stable income from crop yields and land appreciation. Explore how combining ESG and farmland funds can optimize portfolio diversification and resilience.

Yield

ESG funds prioritize sustainable and ethical investments, often yielding moderate returns aligned with long-term environmental and social goals. Farmland funds offer potentially higher yields driven by agricultural production and land appreciation, making them attractive for income-focused investors. Explore the comparative performance and risk profiles of ESG and farmland funds to make informed yield-oriented investment decisions.

Source and External Links

7 Best-Performing ESG ETFs and 7 Cheapest ESG ETFs for July 2025 - Lists top ESG ETFs by recent performance and cost, highlighting funds that invest in companies meeting environmental, social, and governance criteria, with some funds yielding over 70% annual returns as of June 2025.

Investing in ESG Funds: Reflect What Matters Most | Vanguard - Outlines Vanguard's ESG fund lineup, including indexed and actively managed options covering U.S. and international stocks and bonds, all designed to exclude companies that don't meet specified ESG standards while emphasizing diversification and low costs.

Mars Launches $250 Million Sustainability Solutions Fund - Details Mars' new $250 million fund targeting investments in innovative solutions for sustainable agriculture, ingredient sourcing, health, and packaging to reduce emissions and improve circularity across its value chain.

dowidth.com

dowidth.com