Vintage sneaker portfolios offer unique investment opportunities driven by limited editions, brand collaborations, and cultural significance, often yielding high returns in a short timeframe. Wine collections build value through aging, provenance, and rarity, appealing to connoisseurs and investors seeking long-term appreciation. Discover how these alternative asset classes compare and which suits your investment goals best.

Why it is important

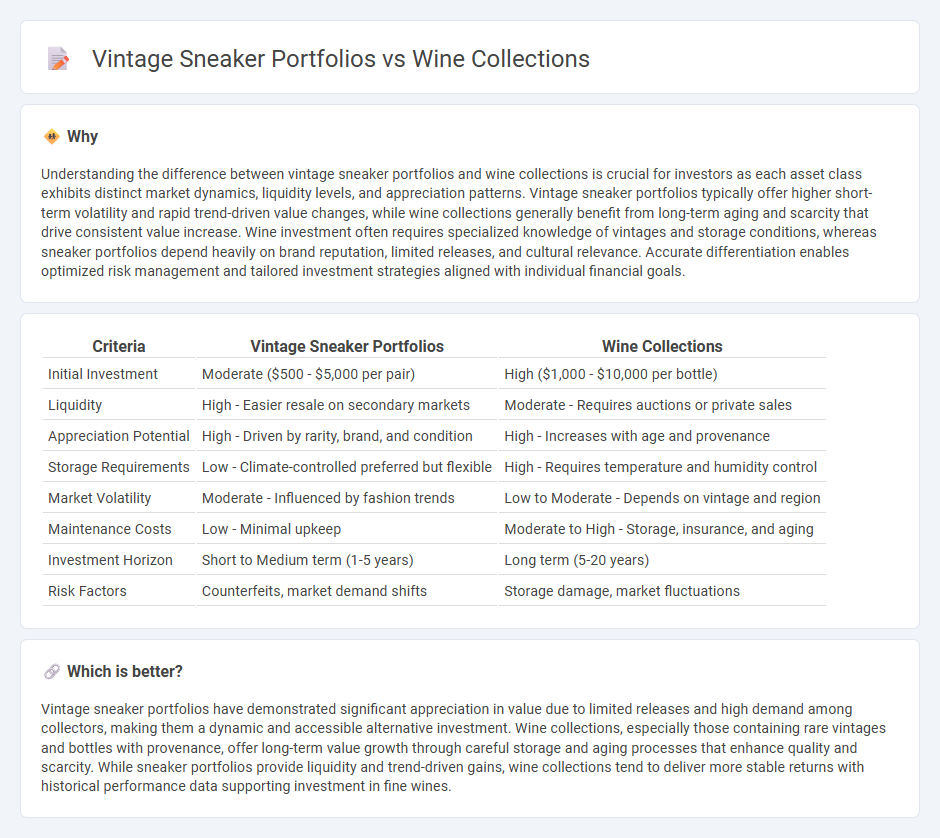

Understanding the difference between vintage sneaker portfolios and wine collections is crucial for investors as each asset class exhibits distinct market dynamics, liquidity levels, and appreciation patterns. Vintage sneaker portfolios typically offer higher short-term volatility and rapid trend-driven value changes, while wine collections generally benefit from long-term aging and scarcity that drive consistent value increase. Wine investment often requires specialized knowledge of vintages and storage conditions, whereas sneaker portfolios depend heavily on brand reputation, limited releases, and cultural relevance. Accurate differentiation enables optimized risk management and tailored investment strategies aligned with individual financial goals.

Comparison Table

| Criteria | Vintage Sneaker Portfolios | Wine Collections |

|---|---|---|

| Initial Investment | Moderate ($500 - $5,000 per pair) | High ($1,000 - $10,000 per bottle) |

| Liquidity | High - Easier resale on secondary markets | Moderate - Requires auctions or private sales |

| Appreciation Potential | High - Driven by rarity, brand, and condition | High - Increases with age and provenance |

| Storage Requirements | Low - Climate-controlled preferred but flexible | High - Requires temperature and humidity control |

| Market Volatility | Moderate - Influenced by fashion trends | Low to Moderate - Depends on vintage and region |

| Maintenance Costs | Low - Minimal upkeep | Moderate to High - Storage, insurance, and aging |

| Investment Horizon | Short to Medium term (1-5 years) | Long term (5-20 years) |

| Risk Factors | Counterfeits, market demand shifts | Storage damage, market fluctuations |

Which is better?

Vintage sneaker portfolios have demonstrated significant appreciation in value due to limited releases and high demand among collectors, making them a dynamic and accessible alternative investment. Wine collections, especially those containing rare vintages and bottles with provenance, offer long-term value growth through careful storage and aging processes that enhance quality and scarcity. While sneaker portfolios provide liquidity and trend-driven gains, wine collections tend to deliver more stable returns with historical performance data supporting investment in fine wines.

Connection

Vintage sneaker portfolios and wine collections share a unique investment appeal through their combination of scarcity, cultural significance, and potential for high returns. Both asset classes benefit from limited supply, increasing demand driven by passionate collectors, and careful preservation that enhances value over time. Market trends demonstrate that these tangible collectibles often outperform traditional investments due to their strong community engagement and iconic status.

Key Terms

Provenance

Provenance plays a crucial role in both wine collections and vintage sneaker portfolios, determining authenticity, value, and historical significance. In wine, detailed records of vineyard origin, production year, and storage conditions directly impact investment worth, while sneaker portfolios rely on verifiable history, original packaging, and limited-edition releases to ensure legitimacy. Explore how provenance shapes the market and security of these prized assets to deepen your understanding.

Authentication

Authentication in wine collections centers on provenance verification through serial numbers, detailed labels, and expert appraisals to ensure the vintage's origin and quality. In vintage sneaker portfolios, authentication relies heavily on physical examination of stitching, materials, and unique identifiers like serial codes and original packaging to confirm legitimacy. Explore further to understand the specialized techniques that safeguard value in both collectible markets.

Market Liquidity

Wine collections often exhibit lower market liquidity due to the specialized knowledge required for valuation and preservation, while vintage sneaker portfolios benefit from faster turnover driven by high demand and consumer trends. Auction platforms and online marketplaces have significantly enhanced liquidity for sneakers, contrasting with the more traditional, slower wine auction circuits. Explore deeper insights into how market liquidity impacts investment strategies in both asset classes.

Source and External Links

Building a Wine Collection? Choose the Road Less Traveled - Collecting wines from both renowned regions like Bordeaux and Burgundy as well as lesser-known appellations offers diversity, investment potential, and surprising discoveries for enthusiasts.

10 Tips for Starting a Wine Collection - Successful wine collecting requires disposable income, organized inventory management, and regular appraisals to protect and track value.

Our Napa Wine Collections - Charles Krug offers curated selections of limited-edition Napa wines, including vintages from family estates and historical references, available for direct purchase and gifting.

dowidth.com

dowidth.com